You cant be forced to repay forgiven student loans unless this happens – You can’t be forced to repay forgiven student loans unless specific circumstances apply. This in-depth exploration delves into the intricate world of student loan forgiveness programs, examining the conditions under which repayment might be required. We’ll cover everything from the different types of forgiveness programs to the legal precedents and practical implications for borrowers.

Understanding the rules surrounding forgiven student loans is crucial. This post Artikels the general rule of non-repayment, the exceptions to that rule, and the legal protections available to borrowers. By examining real-world case studies and hypothetical scenarios, we’ll clarify the complexities and potential pitfalls involved.

Understanding Forgiven Student Loans

Student loan forgiveness programs offer a lifeline to borrowers struggling with substantial debt. These programs, often sponsored by the government or employers, can completely or partially eliminate student loan balances under specific conditions. Understanding the different types of programs, eligibility requirements, and application processes is crucial for borrowers considering this option.

Student Loan Forgiveness Programs Overview

Student loan forgiveness programs are designed to encourage individuals to pursue careers in specific fields, often considered vital to society. These programs incentivize individuals to work in public service or education by offering a pathway to reduce or eliminate their student loan debt. These programs vary significantly in their criteria, benefits, and complexities.

You can’t be forced to repay forgiven student loans unless there’s a specific legal agreement, like a signed contract, or if you defrauded the program. Speaking of financial stuff, have you checked out the new Pandora Podcasts app? It’s now available on both the website and desktop, making it easier than ever to listen to your favorite podcasts on the go.

This means you can stay up-to-date on all things finance, including the latest on student loan forgiveness and repayment, directly on your computer or phone. So, while you can’t be forced to repay forgiven loans without a specific agreement, keep an eye on those legal details! pandora podcasts now available website desktop app

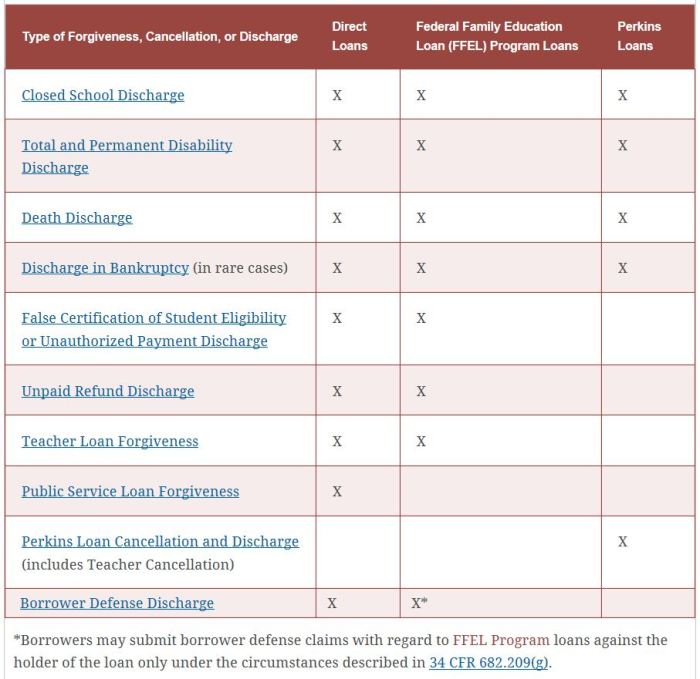

Types of Student Loan Forgiveness Programs

Several programs offer student loan forgiveness. Public Service Loan Forgiveness (PSLF) is a popular option for individuals working in public service jobs. Teacher Loan Forgiveness programs help teachers in underserved schools reduce their loan burden. Other programs might target specific professions or industries.

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program is a federal initiative that forgives the remaining balance of eligible student loans after 10 years of qualifying payments made while working full-time for a qualifying employer. Borrowers must maintain employment in a qualifying public service job and make on-time payments for a qualifying period to qualify for the program.

Teacher Loan Forgiveness

Teacher Loan Forgiveness programs, often offered at the state or federal level, provide financial relief to teachers, especially those working in high-need schools. These programs typically require a certain number of years of teaching experience in a designated subject or grade level in a qualifying school.

Eligibility Criteria for Forgiveness Programs

Common eligibility criteria for various forgiveness programs include:

- Employment in a qualifying field: The job must meet specific requirements defined by the program. For example, PSLF requires employment in a qualifying public service job, while Teacher Loan Forgiveness programs often specify teaching in a high-need school or subject.

- Making qualifying payments: Consistent and timely payments on the student loans are essential. Late or missed payments can jeopardize eligibility for forgiveness.

- Meeting specific service requirements: Some programs require a specific number of years of service, while others might stipulate working in particular areas or communities.

Application Process for Student Loan Forgiveness

The application process for student loan forgiveness programs can be complex and time-consuming. Borrowers must meticulously track their payments, employment history, and maintain proper documentation. Detailed information on the application process, required forms, and deadlines should be obtained directly from the program’s official website.

Comparison of Forgiveness Programs

| Program | Eligibility Criteria | Qualifying Employment | Payment Requirements |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Full-time employment in a qualifying public service job for 10 years. | Federal, state, local government, or non-profit organization. | Consistent and on-time payments for 10 years. |

| Teacher Loan Forgiveness | Teaching experience in a high-need school or subject. | Public schools, sometimes private schools. | Specified number of years of teaching experience. |

Repayment Obligations After Forgiveness

Forgiving student loans is a significant relief for many borrowers, but the implications aren’t always straightforward. While the initial forgiveness removes the debt burden, certain circumstances can lead to the reinstatement of repayment obligations. Understanding these conditions is crucial for borrowers to plan effectively for their financial future.The general rule is that forgiven student loans are discharged, meaning the debt is extinguished and no further repayment is required.

However, exceptions exist, and these exceptions are critical to understand. Knowing the conditions under which repayment might be required allows borrowers to proactively address potential financial implications.

Circumstances Requiring Repayment

After student loan forgiveness, repayment obligations can arise under specific conditions. These conditions often involve the original terms of the loan or changes in the borrower’s circumstances.

While you can’t be forced to repay forgiven student loans unless there’s a significant legal change, understanding the evolving job market is crucial. For example, the recent shift in employment trends, like the rise of remote work and automation, as explored in articles like defining moments the future of the workforce , might play a role in shaping future repayment obligations.

So, keeping an eye on these defining moments could help determine if or when loan forgiveness might become enforceable again.

- Repayment of Forgiven Loans Under Fraudulent Circumstances: If the forgiveness was obtained through fraud or misrepresentation, the borrower may be required to repay the forgiven amount. This could include situations where false information was provided to qualify for the forgiveness program. The loan servicer or the relevant governing agency would investigate such cases. For instance, a borrower who falsified their income to qualify for income-driven repayment plans might face repayment obligations after the forgiveness is granted.

- Repayment After Modification or Consolidation: If a borrower’s loan was modified or consolidated in a way that resulted in forgiveness, and the modification or consolidation was later determined to be improper, repayment may be required. The original terms of the loan, the modification agreements, and the governing regulations will be crucial in determining whether repayment is necessary. For example, if a loan was consolidated and the consolidation was deemed improper, the forgiven amount could become subject to repayment.

- Repayment After Subsequent Loan Defaults: In certain circumstances, if a borrower defaults on another loan after their initial student loan was forgiven, the forgiven loan may be subject to repayment. The default on a separate loan may trigger a review of the original loan forgiveness and result in a demand for repayment. This situation would involve the specific terms of the loan forgiveness program and the subsequent loan default.

Legal Precedents and Legislative Frameworks

The legal framework governing student loan forgiveness and subsequent repayment obligations is complex and varies depending on the specific program or legislation under which the forgiveness was granted. Understanding the relevant regulations is essential to navigate the potential complexities of repayment after forgiveness. The laws and regulations governing these situations often contain provisions for repayment in specific situations, and the details of the legal frameworks are available through the respective governing agencies.

“The specific laws and regulations governing student loan forgiveness programs are complex and vary depending on the program or legislation.”

Financial Implications of Repayment

Repayment after forgiveness can have significant financial implications. The borrower may face substantial financial hardship if they are required to repay a substantial amount. This could impact their ability to save, invest, or achieve other financial goals. The financial impact depends on the amount forgiven, the repayment terms, and the borrower’s overall financial situation. For example, a borrower who relied on the forgiven loan for their retirement plan or to purchase a home could face serious financial issues if they have to repay the amount.

Potential Scenarios and Repayment Obligations

| Scenario | Repayment Obligation |

|---|---|

| Loan forgiveness due to fraud | Likely required to repay the forgiven amount. |

| Loan modification deemed improper | May be required to repay the forgiven amount. |

| Default on a subsequent loan | Possible repayment of the forgiven amount under specific circumstances. |

| Loan forgiveness under a program with clear stipulations | Repayment not likely, unless program terms are violated. |

Exceptions to the General Rule

While the general principle of forgiven student loans not being repayable applies in most cases, there are exceptions. These exceptions often involve situations where the loan forgiveness was obtained through fraudulent or misleading means. Understanding these exceptions is crucial for both borrowers and lenders, as it highlights the importance of honesty and transparency in the student loan forgiveness process.The legal framework surrounding forgiven student loans is complex, and specific circumstances can lead to mandatory repayment obligations.

These circumstances often involve actions taken by the borrower that violate the terms of the loan or the policies governing loan forgiveness programs. Such actions may include fraud, misrepresentation, or other forms of deceit.

Fraudulent Loan Forgiveness Claims

Loan forgiveness programs are designed to provide relief to eligible borrowers. However, fraud and misrepresentation can undermine the integrity of these programs. When a borrower knowingly makes false claims or intentionally misrepresents facts to obtain loan forgiveness, repayment may be required. These cases often involve detailed investigations to determine the validity of the borrower’s claims.

Misrepresentation and Material Omissions

A borrower who provides false information or withholds critical details during the loan forgiveness application process may face repayment requirements. Misrepresentation can range from inaccurate employment history to incorrect financial statements. Material omissions, where crucial information is intentionally left out, can also trigger repayment obligations.

Violation of Loan Terms and Conditions

Borrowers are expected to comply with the terms and conditions of their student loans. Breaches of these terms, such as failing to meet required academic progress or violating enrollment requirements, could result in repayment obligations if the loan forgiveness was contingent on adhering to these terms. The specific terms and conditions vary depending on the loan program.

Legal Interpretations and Applications

Different jurisdictions and courts may interpret the laws surrounding forgiven student loans differently, leading to varying outcomes in cases involving fraud or misrepresentation. Some jurisdictions may be stricter in enforcing repayment requirements than others. This variation highlights the need for borrowers to be meticulously careful when applying for loan forgiveness programs.

Examples of Scenarios Triggering Repayment

| Scenario | Description | Repayment Obligation |

|---|---|---|

| Fraudulent Application | Borrower fabricated employment history to qualify for loan forgiveness. | Likely |

| Misrepresentation of Income | Borrower intentionally misrepresented income levels to qualify for a lower repayment plan, leading to forgiveness. | Likely |

| Violation of Enrollment Requirements | Borrower dropped out of school without notifying the lender, leading to loan forgiveness being revoked. | Possible |

| Failure to Disclose Relevant Information | Borrower failed to disclose a significant change in employment status or financial circumstances during the loan forgiveness process. | Possible |

Legal Considerations and Protections

Navigating the legal landscape surrounding student loan forgiveness can be complex. Understanding the relevant laws and regulations is crucial for borrowers to protect their rights and avoid potential pitfalls. This section explores the legal framework, highlighting the protections available to those whose loans are forgiven, and potential recourse if repayment is unexpectedly demanded.The legal framework for student loan forgiveness is not static.

It evolves with policy changes and court decisions. Borrowers must stay informed about the latest developments and consult with legal professionals if needed.

Federal Laws and Regulations

Federal laws and regulations play a critical role in governing student loan forgiveness programs. These legal frameworks Artikel the eligibility criteria, the forgiveness process, and the potential consequences for borrowers. The key statutes and regulations provide the framework for the student loan forgiveness programs.

- The Higher Education Act of 1965: This foundational legislation establishes the framework for federal student aid programs, including the eligibility criteria for various loan programs and forgiveness options.

- Department of Education Regulations: The Department of Education issues regulations that interpret and implement the provisions of the Higher Education Act, providing detailed guidance on loan forgiveness programs, eligibility requirements, and the appeal process.

- Relevant Court Decisions: Court decisions interpreting and clarifying the provisions of the Higher Education Act and Department of Education regulations are crucial for understanding the scope of borrowers’ rights and obligations.

Potential Legal Recourse

If a borrower is required to repay forgiven student loans, they may have legal recourse. This recourse varies depending on the specific circumstances and the legal precedents established in previous cases. For example, if a borrower believes the repayment demand is unjustified, they may be able to challenge it in court.

- Challenging the Basis for Forgiveness: If the borrower believes the original loan forgiveness was granted under false pretenses or in violation of established rules, legal action may be taken to dispute the repayment demand.

- Seeking Judicial Review: The borrower might seek a court review to challenge the decision to require repayment. The specific procedures for this would depend on the applicable federal regulations and relevant court precedents.

- Misrepresentation or Fraud: If the borrower believes the lender or government agency misrepresented information related to the forgiveness, they may pursue legal action based on fraud or misrepresentation.

Protections Afforded to Borrowers, You cant be forced to repay forgiven student loans unless this happens

Certain protections are afforded to borrowers in cases where repayment is required. These protections are intended to ensure fairness and due process.

- Due Process: Borrowers have the right to be notified of the reasons for the repayment demand and to have an opportunity to present their case.

- Administrative Appeals: Many programs provide for administrative appeals within the relevant government agency before resorting to court action. This allows for internal review and resolution of disputes.

- Time Limits: The borrower must act within a reasonable timeframe, established by law, to pursue legal recourse. These time limits vary depending on the specific circumstances and applicable regulations.

Key Legal Provisions and Implications

The following table summarizes key legal provisions and their implications for borrowers.

Forgiven student loans aren’t automatically off the hook—you can still be forced to repay them if there’s a major legal change, like a new government ruling. Recent news about the Amazon HQ2 bids process in cities like Queens, Arlington, Nashville, and Crystal City ( amazon hq2 bids process cities queens arlington nashville crystal city ) highlights the complex interplay between corporate decisions and the ripple effects they have on individual financial situations.

Ultimately, the repayment of forgiven loans hinges on the specifics of the forgiveness program and any subsequent legal developments.

| Legal Provision | Implications for Borrowers |

|---|---|

| Higher Education Act of 1965 | Establishes the foundation for federal student aid programs, including eligibility criteria and forgiveness options. |

| Department of Education Regulations | Provide detailed guidance on loan forgiveness, eligibility, and the appeal process. |

| Court Decisions | Interpret and clarify provisions of the Higher Education Act and Department of Education regulations, impacting borrowers’ rights and obligations. |

Practical Implications and Financial Impacts

Forgiving student loan debt can be a significant relief, but the potential for future repayment obligations has real-world implications for borrowers’ financial stability. Understanding these implications is crucial for anyone considering a forgiveness program, or for those already facing the prospect of repaying forgiven debt. The financial strain can be substantial, affecting various aspects of a borrower’s life, from their budget to their credit score.

Financial Strain and Hardship

The sudden need to repay forgiven student loans can place a substantial financial burden on borrowers. This is especially true for those who have already experienced financial difficulties or have limited financial resources. Repayment could require significant adjustments to their budget, potentially impacting their ability to save, invest, or address other financial obligations. Unexpected expenses like medical bills or home repairs could be exacerbated by the added repayment burden.

Impact on Financial Stability

Repaying forgiven student loans can significantly disrupt a borrower’s financial stability. A borrower who is already struggling with debt or low income may find it difficult to meet the new repayment obligations. This can lead to reduced savings, delayed or forgone major life goals like homeownership or retirement planning, and potentially increased stress and anxiety. For example, a borrower who had planned to use their financial resources to start a business or invest in education might need to re-evaluate these plans due to the loan repayment.

Effect on Credit Scores and Other Financial Metrics

The repayment of forgiven student loans can have a negative impact on credit scores. Missed or late payments will inevitably lower credit scores. This can impact borrowers’ ability to secure loans for various purposes, such as mortgages, car loans, or even personal loans. Furthermore, the need to repay can hinder a borrower’s ability to build credit, especially if they are already experiencing credit issues.

Potential Financial Consequences of Repaying Forgiven Loans

| Category | Potential Consequence | Example |

|---|---|---|

| Budget | Reduced ability to save, invest, or pay other debts | A borrower may need to cut back on discretionary spending or reduce savings contributions to meet loan repayment obligations. |

| Financial Stability | Increased stress, anxiety, and difficulty meeting other financial obligations. | A borrower may experience difficulties meeting their rent or mortgage payments, or forgoing necessary medical expenses due to the repayment obligation. |

| Credit Score | Potential decrease in credit score due to missed or late payments. | Missed payments can significantly lower a borrower’s credit score, making it harder to obtain credit for future needs. |

| Future Financial Goals | Delayed or forgone opportunities like homeownership or retirement savings. | A borrower may need to postpone or forgo plans to purchase a home or contribute to retirement savings due to the repayment burden. |

Illustrative Case Studies: You Cant Be Forced To Repay Forgiven Student Loans Unless This Happens

Navigating the complexities of student loan forgiveness often leads to unforeseen circumstances, particularly when repayment is unexpectedly required. Real-world case studies provide valuable insight into the intricacies of these situations, shedding light on the legal and practical implications. Understanding these examples helps to clarify the nuanced conditions under which forgiveness might be reversed, highlighting the importance of careful consideration and proactive measures.Analyzing these case studies reveals the wide range of factors that can influence the outcome of a forgiveness program.

They illustrate the need for borrowers to thoroughly understand the terms and conditions of forgiveness agreements and to be prepared for potential contingencies. These examples demonstrate that simply receiving forgiveness doesn’t automatically absolve borrowers from all future obligations.

Cases Involving Fraudulent Activity

Understanding situations where borrowers engaged in fraudulent activity is crucial to grasping the exceptions to the general rule of non-repayment. These cases often involve falsified documentation or misrepresentation of facts, leading to the invalidation of the forgiveness program.

“In cases where borrowers have been found to have engaged in fraudulent activity related to their loan applications or eligibility for forgiveness, the Department of Education has the authority to reverse the forgiveness and require repayment.”

One example involves a borrower who submitted fabricated transcripts to falsely claim eligibility for a specific forgiveness program. Upon discovery, the Department of Education revoked the forgiveness, requiring the borrower to repay the full amount of the forgiven loans. The legal reasoning centered on the borrower’s intentional misrepresentation, violating the terms and conditions of the forgiveness program. The lesson learned is that fraudulent activity severely jeopardizes the forgiveness status and can lead to substantial financial repercussions.

Another case involves a borrower who falsely claimed to have met specific income requirements for forgiveness. When the Department of Education uncovered the falsehood, they initiated a repayment demand. The legal reasoning in this case emphasized the borrower’s violation of the truthfulness requirements, a key factor in the forgiveness program’s legitimacy.

Cases Involving Changes in Law or Policy

Significant shifts in law or policy can also trigger the reinstatement of repayment obligations. These cases demonstrate that the terms of forgiveness can be subject to change, and borrowers need to stay informed about potential revisions.

“Occasionally, a change in federal law or a modification of the Department of Education’s policies regarding student loan forgiveness can lead to the reinstatement of repayment obligations for previously forgiven loans.”

A recent example illustrates how a change in the income-driven repayment plan (IDR) affected borrowers who had already entered into an IDR plan and had a portion of their loans forgiven. The revised IDR plan’s requirements led to a reassessment of eligibility for the borrowers in question, potentially requiring repayment of the forgiven portion. This emphasizes the importance of borrowers remaining aware of any updates or modifications to the applicable laws and regulations, as these can alter the financial obligations associated with forgiven loans.

Another case involves a change in the definition of a qualifying disability, affecting borrowers who had previously received loan forgiveness based on that definition. The revised definition, clarifying certain requirements, led to a reassessment of the eligibility status and, consequently, a requirement to repay the forgiven loans. This highlights the critical need to stay informed about potential legal and regulatory changes that might impact one’s financial obligations.

Cases Involving Undisclosed or Hidden Circumstances

Instances where unforeseen circumstances or previously undisclosed information emerged can lead to the revocation of loan forgiveness. These cases highlight the importance of complete disclosure and transparency during the forgiveness application process.

“If, after forgiveness, previously undisclosed information emerges that would have impacted the borrower’s eligibility, the Department of Education might require repayment.”

A case involving a borrower who later disclosed a significant change in financial circumstances, such as a substantial inheritance or unexpected income increase, might lead to a reevaluation of the forgiveness decision. The revised assessment of the borrower’s financial standing might result in a demand to repay the forgiven portion of the loans. Another case involves a borrower who had previously failed to disclose a significant asset that would have impacted the eligibility requirements.

The revelation of this previously undisclosed asset led to a reassessment of the borrower’s financial status, triggering a requirement to repay the forgiven portion of the loan. This underscores the significance of thorough disclosure throughout the forgiveness process.

Illustrative Scenarios

Understanding the potential repayment situations after student loan forgiveness requires examining various scenarios. Each case presents unique circumstances and outcomes, highlighting the complexities of navigating this area of law and finance. These examples aim to illustrate common situations and potential pitfalls, fostering a better understanding of the practical implications of loan forgiveness.

Scenario 1: Forgiveness Through Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program offers a path to forgiveness for qualifying borrowers. This program typically requires working full-time in a qualifying public service job for a specific period.

- Circumstances: A teacher works full-time in a public school for 10 years, making timely payments on their federal student loans while adhering to PSLF program requirements.

- Potential Outcomes: The loans are forgiven. The borrower avoids future repayment obligations, saving significant financial resources.

Scenario 2: Forgiveness Through Income-Driven Repayment (IDR) Plans

Income-Driven Repayment (IDR) plans adjust monthly payments based on a borrower’s income and family size. These plans often result in lower monthly payments and potentially lead to loan forgiveness after a set period.

- Circumstances: A recent college graduate takes out student loans and enrolls in an IDR plan. Their income remains relatively low for several years, leading to low monthly payments.

- Potential Outcomes: If the borrower remains in the IDR plan for the required length of time and meets all eligibility criteria, their loan balance might be forgiven.

Scenario 3: Forgiveness Due to Economic Hardship

Certain federal programs offer loan forgiveness in cases of economic hardship.

- Circumstances: A borrower experiences a significant and unexpected loss of employment, leading to severe financial distress and inability to make loan payments.

- Potential Outcomes: The borrower may qualify for a loan modification or forgiveness under specific hardship programs. The specific program eligibility, application process, and loan forgiveness amount can vary.

Scenario 4: Forgiveness Through Bankruptcy

Bankruptcy can impact student loan repayment obligations.

- Circumstances: A borrower files for bankruptcy due to overwhelming debt. Their student loans are included in the bankruptcy proceedings.

- Potential Outcomes: The court might discharge all or part of the student loan debt. This outcome varies based on the specifics of the bankruptcy case, the laws in place, and the borrower’s unique circumstances.

Scenario 5: Forgiveness Through Consolidation

Consolidation can combine multiple federal student loans into a single loan.

- Circumstances: A borrower has multiple federal student loans with varying interest rates and repayment plans. They consolidate their loans to simplify their repayment.

- Potential Outcomes: Consolidation may not lead to loan forgiveness. However, it can potentially lower monthly payments or change the repayment plan. Important considerations include interest rates and repayment terms.

Illustrative Table of Scenarios

| Scenario | Circumstances | Potential Outcomes |

|---|---|---|

| PSLF | Qualifying public service employment | Loan forgiveness |

| IDR | Low income and enrollment in an IDR plan | Potential loan forgiveness after a set period |

| Economic Hardship | Significant, unexpected financial distress | Loan modification or forgiveness |

| Bankruptcy | Overwhelming debt leading to bankruptcy | Potential discharge of all or part of the loan |

| Consolidation | Multiple federal loans combined | Potential lower monthly payments or changed repayment plan |

End of Discussion

In conclusion, while student loan forgiveness is generally final, there are exceptions. Understanding these exceptions, the legal framework, and potential financial implications is critical for borrowers. This article serves as a comprehensive guide, providing clarity and empowering informed decisions about forgiven loans. Knowing your rights and potential responsibilities is key to avoiding unforeseen financial burdens.