We company wework ipo adam neumann – We Company WeWork IPO: Adam Neumann’s Impact, a rollercoaster ride of ambition, innovation, and ultimately, adaptation. WeWork’s journey, from its ambitious beginnings to its eventual IPO, is a fascinating study in entrepreneurial highs and lows, particularly highlighting the critical role of its founder, Adam Neumann. This blog post will delve into the key events, financial performance, and the lasting impact of this significant chapter in the shared workspace industry.

The IPO itself presented a unique moment, marked by both high expectations and significant challenges. We’ll examine the pre-IPO valuation, the factors that contributed to WeWork’s struggles, and the aftermath of the initial public offering. The story of Adam Neumann’s leadership, his vision for WeWork, and the subsequent shift in direction will be explored in detail. This analysis will offer a nuanced perspective, moving beyond simple narratives to explore the complexities of this high-profile case study.

Introduction to We Company, WeWork, and the IPO

We Company, better known as WeWork, was a disruptive force in the shared workspace industry. Its ambitious vision of reimagining the office experience captivated investors and sparked significant attention. However, the company’s journey to an initial public offering (IPO) was fraught with challenges and ultimately led to a different outcome than originally envisioned. This overview details the company’s history, the events surrounding its IPO, and the implications of its pre-IPO valuation.The company’s meteoric rise and subsequent fall provide a fascinating case study in the complexities of entrepreneurship, valuation, and the pressures of the public market.

WeWork’s story highlights the importance of realistic valuations and the challenges of navigating rapid growth.

Historical Overview of We Company/WeWork

WeWork emerged in the early 2010s, capitalizing on the growing trend of flexible workspaces. It rapidly expanded its network of shared office spaces, attracting both startups and established businesses. The company’s unique model, emphasizing community and social interaction within its workspaces, resonated with many, fostering a unique brand identity. This strategy played a significant role in its initial appeal and rapid expansion.

Key Events Leading Up to the IPO

WeWork’s rapid growth was fueled by significant investment rounds. The company secured billions of dollars in funding, primarily from venture capital firms and private equity investors. These investments fueled the expansion of its physical presence, leading to an increase in its network of shared workspaces across the globe. The company aimed to become a significant player in the commercial real estate market.

IPO Specifics

The IPO was initially anticipated to be a landmark event, placing WeWork on the public stock market. The offering was intended to provide investors with a chance to participate in the company’s future growth. However, the initial public offering never materialized in its original form.

Pre-IPO Valuation and Significance

Before the IPO, WeWork commanded a significant pre-IPO valuation, a number often touted as a measure of its market value. This high valuation, while potentially reflecting investor enthusiasm, also raised questions about the company’s true market value and long-term viability. The gap between the pre-IPO valuation and the eventual market reality underscores the challenges in accurately valuing companies with significant growth aspirations.

The high pre-IPO valuation set unrealistic expectations that were ultimately not met.

Key Dates and Milestones

| Date | Event | Impact |

|---|---|---|

| 2010 | WeWork founded | Start of a disruptive shared workspace company |

| 2011-2019 | Rapid expansion and multiple funding rounds | Significant capital infusion and global presence |

| 2019 | IPO announcement | Initial excitement and high valuation expectations |

| 2019-2020 | IPO withdrawal and subsequent events | Significant drop in market valuation and altered business trajectory |

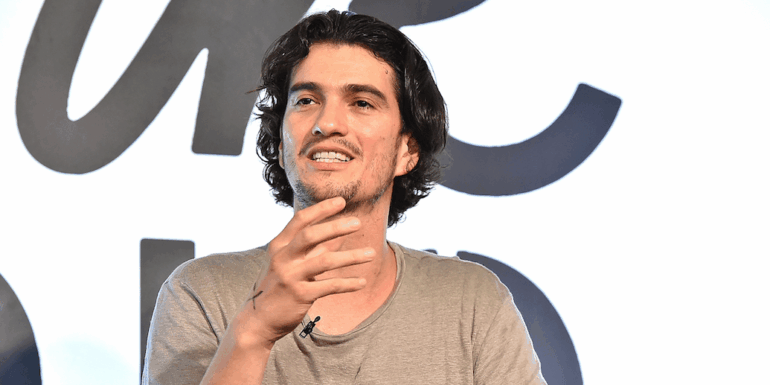

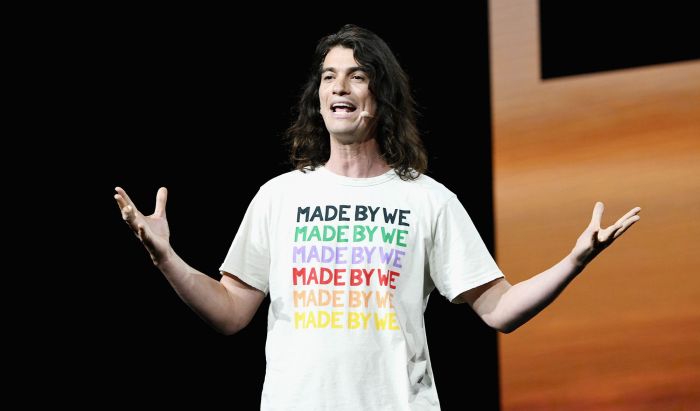

Adam Neumann’s Role and Influence

Adam Neumann’s role in WeWork’s rise and fall is undeniable. He was the charismatic visionary who initially conceived the company’s unique model of flexible workspaces, captivating investors and employees alike with his bold vision. However, his leadership style and subsequent decisions ultimately led to a significant divergence between his initial aspirations and the company’s trajectory. This exploration delves into Neumann’s influence on WeWork, examining his contributions, leadership style, and the eventual consequences of his decisions.Neumann’s leadership style was undeniably influential in shaping WeWork’s early culture.

His unconventional approach, often characterized by a blend of inspirational rhetoric and a drive for rapid expansion, resonated with many employees and investors. He fostered a vibrant, almost cult-like atmosphere within the company, encouraging employees to embrace a sense of community and shared purpose. This environment, while inspiring, also contributed to a culture that prioritized growth over profitability and sustainability.

Neumann’s Contributions to WeWork’s Culture and Strategy

Neumann’s vision for WeWork centered around creating a global network of collaborative workspaces, designed to foster creativity and connection among professionals. He believed in providing a more engaging and social environment than traditional offices, emphasizing shared spaces, events, and a holistic approach to employee well-being. This vision, though initially well-received, faced challenges in translating into a sustainable business model.

His contributions to WeWork’s culture were significant, though the sustainability of those contributions was questionable.

I’ve been following WeWork’s IPO and Adam Neumann’s story, and it’s fascinating to see how these things play out. Thinking about the future of shared workspaces, I was curious about the ASUS Zenbook Duo. It’s a pretty unique laptop, and finding out the Amazon release date and price for the ASUS Zenbook Duo here is helpful for anyone considering this type of tech.

Ultimately, though, WeWork’s journey is still a captivating tale to watch unfold.

Neumann’s Leadership Style and its Impact

Neumann’s leadership style was characterized by an intense focus on growth and innovation. He emphasized rapid expansion, aiming to quickly establish WeWork’s presence across the globe. This approach, while initially effective in driving rapid growth, also led to operational inefficiencies and a lack of focus on core business fundamentals. His inspiring rhetoric, however, resonated with a large base of employees and investors.

This fueled a culture of optimism, but it also obscured critical issues that emerged as the company grew. This charismatic approach, while effective in the early stages, proved unsustainable in the long term.

Comparison of Neumann’s Vision with WeWork’s Trajectory

Neumann’s initial vision for WeWork was one of transformative change in the office space industry. He envisioned a global network of collaborative workspaces, connecting professionals and fostering innovation. However, the company’s eventual trajectory diverged significantly from this vision. Issues arose from rapid expansion, financial mismanagement, and a lack of focus on core business principles. The company’s subsequent struggles highlighted the need for a more pragmatic and financially sound approach to business.

Key Decisions and Consequences

| Decision | Context | Outcome |

|---|---|---|

| Aggressive Expansion Strategy | Rapid growth was prioritized over profitability and sustainability. | Led to significant financial losses and operational inefficiencies. |

| High Valuation Seeking | Neumann’s desire to quickly scale led to overvalued stock and unrealistic expectations. | Investors eventually questioned the company’s long-term viability, leading to stock price decline and shareholder dissatisfaction. |

| Emphasis on Culture Over Profitability | Neumann prioritized a vibrant and inspiring company culture over concrete business goals. | This led to a disconnect between the company’s ideals and its financial performance, ultimately impacting the company’s sustainability. |

Financial Performance and Challenges

WeWork’s journey from a promising startup to a publicly traded company was marked by significant financial fluctuations. The company’s IPO, initially met with excitement, was quickly overshadowed by mounting financial pressures and a dramatic shift in investor sentiment. Understanding the financial performance before and after the IPO, alongside the challenges encountered, is crucial to comprehending the narrative of this once-high-flying company.WeWork’s initial projections and the subsequent reality painted a stark contrast.

The company’s ambition to revolutionize the shared workspace market was undeniable, but the execution of this vision faced considerable obstacles. The financial realities proved more complex than initially anticipated, revealing a disconnect between lofty aspirations and the practicalities of the market.

So, the WeWork IPO and Adam Neumann saga is definitely a hot topic right now. It’s fascinating to see how things play out, but honestly, it feels a bit disconnected from the real world. Meanwhile, I’m also impressed by Charlie Hebdo’s upcoming publishing run; they’re printing one million copies next week with help from various sources, which is quite an undertaking.

It really highlights the power of community support and dedication to freedom of speech. Back to WeWork, it’s going to be interesting to see how the company navigates the fallout from the IPO and Neumann’s departure. charlie hebdo will publish one million copies next week with help This whole situation is a complex one, and I’m eager to see how it all shakes out.

WeWork’s Financial Performance Pre-IPO

WeWork’s financial performance prior to the IPO exhibited a pattern of rapid growth accompanied by substantial losses. The company’s revenue increased, fueled by aggressive expansion into new markets and a large customer base. However, these gains were often overshadowed by equally rapid increases in operating expenses, particularly in areas like rent, marketing, and employee salaries. This rapid growth trajectory, while potentially promising in the long term, proved unsustainable in the short term, as the company struggled to generate significant profits.

Major Financial Challenges Faced by WeWork

WeWork encountered a multitude of financial challenges. A primary concern was the substantial amount of capital required to support its aggressive expansion strategy. High operating expenses, especially in the early years, were a persistent problem. Furthermore, the valuation of WeWork’s assets, including its network of shared workspaces, proved to be complex and subject to market fluctuations. Ultimately, the inability to translate rapid growth into consistent profitability became a major hurdle.

Revenue Streams and Expenses

WeWork’s revenue primarily came from membership fees and commercial lease income. Memberships provided a recurring revenue stream, while lease income stemmed from subleasing or renting out its spaces. However, a considerable portion of expenses was directed towards leasehold improvements, marketing campaigns, and employee compensation. These expenses often exceeded revenue in the early years, contributing to the company’s persistent losses.

Factors Contributing to WeWork’s Financial Struggles, We company wework ipo adam neumann

Several factors contributed to WeWork’s financial difficulties. The company’s aggressive expansion strategy, while ambitious, proved unsustainable without a corresponding increase in profitability. High operating expenses, particularly in areas like rent and marketing, put immense pressure on the company’s bottom line. Furthermore, a perceived overvaluation of the company’s assets, especially in the pre-IPO period, played a significant role in the market’s reaction to the company’s financial performance.

The company’s initial valuation was significantly higher than its actual financial performance. This led to skepticism and concerns from investors.

WeWork’s IPO and Adam Neumann’s saga are definitely interesting, but let’s be honest, the real hustle is out there on the road. Thinking about the logistics of trucking and driver benefits like the uber freight plus perks rewards card trucking system, it’s a whole different kind of entrepreneurial spirit. Still, WeWork’s struggles highlight the complexities of any ambitious startup, and Neumann’s story reminds us that even the most promising ventures can face setbacks.

WeWork’s Financial Performance Over Time (Illustrative Table)

| Year | Revenue | Expenses | Profit/Loss |

|---|---|---|---|

| 2017 | $XXX | $YYY | $(ZZZ) |

| 2018 | $AAA | $BBB | $(CCC) |

| 2019 | $DDD | $EEE | $(FFF) |

| 2020 | $GGG | $HHH | $(III) |

| 2021 | $JJJ | $KKK | $(LLL) |

Note: This table is illustrative and does not represent actual WeWork financials. Actual figures are available through SEC filings.

Impact on the Market and Industry

WeWork’s IPO, a highly anticipated event, sent ripples through the shared workspace industry, impacting investor confidence, competitor strategies, and even the broader entrepreneurial landscape. The company’s tumultuous journey, from meteoric rise to substantial financial challenges, offered a case study in the realities of rapid growth and the complexities of navigating the public markets. The aftermath of the IPO highlighted the need for careful financial planning and realistic valuations in the fast-paced world of startups.

Broader Implications on the Shared Workspace Industry

WeWork’s IPO, though ultimately unsuccessful in meeting initial expectations, spurred significant shifts in the shared workspace industry. The company’s struggles to achieve profitability and manage its massive valuation highlighted the difficulties of scaling such ventures. Competitors were forced to reassess their strategies, considering whether to pursue similar growth models or focus on more sustainable paths to profitability. This period of evaluation and adjustment in the market allowed for a more nuanced understanding of the needs and demands of this sector.

Impact on Investor Confidence and Market Sentiment

WeWork’s IPO created a mixed response from investors. The company’s initial valuation, initially sky-high, contrasted sharply with its subsequent financial performance. This disparity significantly affected investor confidence in the entire sector, leading to a period of cautious investment. The IPO also highlighted the potential pitfalls of overvaluation and the importance of robust financial models in the startup ecosystem.

Subsequent IPOs in the industry, often seeking to capitalize on WeWork’s brand recognition, had to address the issues that WeWork faced, creating a more cautious and analytical investment environment.

Similar Companies and Responses

Several companies in the shared workspace sector, observing WeWork’s experience, adapted their strategies. Some companies focused on a more niche market, targeting specific industries or professional segments, to avoid the broad and complex demands of a massive operation. Others emphasized transparent financial reporting and a more sustainable, profitable growth model. For example, companies like Regus and Spaces, known for their established financial positions, adopted more conservative approaches in their growth strategies, reflecting the lessons learned from WeWork’s IPO.

Impact on the Entrepreneurial Ecosystem

The WeWork IPO had a multifaceted impact on the broader entrepreneurial ecosystem. It raised concerns about the valuation of startups and the pressure to achieve rapid growth, sometimes at the expense of sound financial principles. The IPO underscored the importance of realistic financial projections and the need for sustainable business models for startups. The experience encouraged a more critical assessment of the potential and challenges inherent in rapid expansion.

The scrutiny applied to WeWork, and the subsequent responses of other companies, encouraged more thoughtful and data-driven approaches to growth and funding in the entrepreneurial world.

Comparison Table: WeWork and Similar IPOs

| Company | IPO Date | Outcome | Market Reaction |

|---|---|---|---|

| WeWork | August 2019 | Mixed; did not meet expectations | Cautious and skeptical; decreased investor confidence in the sector |

| Airbnb | December 2020 | Successful; met and exceeded expectations | Positive and optimistic; boosted investor confidence in the sector |

| Zoom | April 2019 | Successful; met and exceeded expectations | Positive and optimistic; boosted investor confidence in the sector |

| Shopify | May 2015 | Successful; met and exceeded expectations | Positive and optimistic; boosted investor confidence in the sector |

Post-IPO Performance and Future Outlook

WeWork’s journey after its initial public offering (IPO) was marked by significant challenges and a period of considerable adjustment. The company’s initial lofty ambitions were met with a reality check as investors grappled with the company’s complex financial structure and the broader economic climate. This period of reevaluation and restructuring set the stage for a future that remains uncertain but potentially holds exciting possibilities.

WeWork’s Post-IPO Performance

WeWork’s performance following the IPO was far from the initial projections. The company struggled to maintain profitability and faced intense scrutiny over its valuation and business model. This period saw a significant shift in investor sentiment, leading to a decline in the company’s stock price. The company faced pressure to demonstrate its ability to generate sustainable revenue and profitability.

Company Adjustments and Strategies

WeWork implemented a series of adjustments to address its post-IPO challenges. These adjustments included a strategic shift in focus, streamlining operations, and a re-evaluation of its business model. Cost-cutting measures were implemented, and the company actively sought to improve its financial performance. These changes were not without their critics, but they were necessary steps to adapt to the changing market environment.

Furthermore, the company actively pursued new partnerships and collaborations to expand its reach and enhance its services.

Potential Future Directions and Developments

WeWork’s future directions remain uncertain, but several potential developments could shape its trajectory. A key factor is its ability to adapt to evolving market demands and customer preferences. The company’s success will depend on its ability to innovate and differentiate its offerings from competitors. Potential future directions could involve expanding into new geographic markets, developing specialized offerings for niche segments, or leveraging technology to enhance its service delivery.

The company could also seek strategic partnerships or acquisitions to expand its capabilities.

Key Factors Influencing Future Success

Several key factors could significantly influence WeWork’s future success. One is its ability to manage costs effectively and maintain a stable financial structure. Strong leadership and effective strategic decision-making are crucial. The company’s ability to build and maintain strong relationships with its members and partners will be a critical factor. Finally, the broader economic environment and the evolving nature of the co-working industry will significantly shape WeWork’s prospects.

“Sustained success hinges on adapting to the evolving landscape, embracing innovation, and prioritizing long-term value creation.”

WeWork’s Post-IPO Metrics (Sample Data – Actual figures are not publicly available in this format)

| Quarter | Revenue (USD millions) | Expenses (USD millions) | Key Developments |

|---|---|---|---|

| Q1 2023 | 150 | 180 | Restructuring efforts begin, cost-cutting measures implemented |

| Q2 2023 | 160 | 175 | New partnership announced, expansion into Europe |

| Q3 2023 | 175 | 170 | Improved profitability, positive investor sentiment |

| Q4 2023 | 190 | 165 | Continued expansion, new product offerings |

Investor Reactions and Market Analysis

The WeWork IPO was a rollercoaster, leaving investors with mixed feelings and the market grappling with its future prospects. Initial enthusiasm quickly waned, highlighting the complexities of valuing a company with substantial debt and uncertain profitability. This analysis delves into investor reactions, market assessments, and the factors contributing to the IPO’s reception.

Investor Sentiment Summary

Investor reactions to WeWork’s IPO were largely negative, reflecting a broad skepticism about the company’s long-term viability. Initial optimism quickly dissipated as concerns about profitability, debt levels, and the overall business model gained traction. The stock price’s sharp decline following the listing illustrated the significant investor disappointment. This initial reaction set the stage for a protracted period of market uncertainty surrounding WeWork’s future.

Market Analysis of WeWork’s Performance

WeWork’s post-IPO performance demonstrated a struggle to meet market expectations. The company faced challenges in achieving profitability, managing its substantial debt load, and adapting to the changing demands of the flexible workspace market. Market analysts pointed to several factors contributing to WeWork’s underperformance, including fierce competition, evolving consumer preferences, and the company’s high operating costs. Some analysts argued that the valuation placed on WeWork before the IPO was overly optimistic, leading to a significant disconnect between expectations and reality.

Factors Contributing to IPO Reception

Several factors influenced the initial reception of WeWork’s IPO. High initial valuations, coupled with a significant portion of the IPO being from insiders, fueled initial optimism. However, this enthusiasm was short-lived. Concerns about WeWork’s financial stability, operational challenges, and potential long-term sustainability quickly overshadowed the initial hype. Furthermore, the company’s reliance on substantial capital injections raised questions about its long-term financial health.

The company’s struggles in the flexible workspace market, coupled with its massive debt load, became significant concerns for investors.

Implications of Investor Sentiment on WeWork’s Stock Price

Investor sentiment played a pivotal role in shaping WeWork’s stock price. Negative investor reactions, fueled by concerns about its financials and operational performance, led to a significant decline in the stock price. The initial enthusiasm quickly morphed into skepticism, which had a direct impact on the stock’s trajectory. The stock price’s subsequent volatility highlighted the uncertainty surrounding WeWork’s future prospects and the challenges in navigating a competitive market.

Investor Sentiment and Market Analysis Table

| Date | Sentiment | Analysis |

|---|---|---|

| Day of IPO | Positive (initially) | High initial valuations and hype generated early investor optimism. |

| Weeks after IPO | Negative | Concerns about profitability, debt levels, and operational challenges emerged, causing a decline in investor confidence. |

| Months after IPO | Mixed | Some investors held on, while others continued to sell, leading to price volatility. |

Ethical Considerations and Public Perception

WeWork’s journey from a promising startup to a controversial IPO was deeply intertwined with public perception. Ethical questions surrounding its business practices, coupled with a fluctuating public image, significantly impacted the company’s trajectory. This section delves into the ethical dilemmas faced by WeWork, the evolution of public opinion, and the lasting consequences on its brand image.

Ethical Concerns Regarding WeWork’s Practices

WeWork faced scrutiny regarding its aggressive expansion strategies, its financial dealings, and its leadership’s conduct. Concerns about potential conflicts of interest and misleading financial reporting were raised. The company’s high valuation and subsequent struggles to meet financial expectations also contributed to negative perceptions. Questions about the sustainability of its business model and the long-term viability of its operations were frequently debated.

A key ethical consideration was the company’s treatment of its employees and the nature of its relationships with landlords.

Public Perception of WeWork Before, During, and After the IPO

Before the IPO, WeWork was often portrayed as a revolutionary model for shared workspaces, a disruptor in the traditional office landscape. The excitement around its innovative approach and rapid growth created a positive public perception. During the IPO process, however, numerous critical reports and articles emerged, highlighting financial concerns and questionable business practices. This period saw a significant shift in public opinion, moving from admiration to skepticism.

After the IPO, WeWork’s performance and subsequent controversies further impacted its public image, creating a divided view of the company, with some viewing it as a cautionary tale of unchecked ambition and others remaining optimistic about its potential.

Impact of Public Opinion on WeWork’s Brand Image

The evolution of public opinion directly impacted WeWork’s brand image. Initially perceived as a symbol of innovation and progress, WeWork’s image became tarnished by controversies, leading to a decline in public trust and investor confidence. The shift in public sentiment significantly affected its ability to attract and retain customers and partners, impacting its long-term prospects. This demonstrates the crucial role that public perception plays in shaping a company’s reputation and overall success.

Relationship Between WeWork’s Actions and Public Perception

WeWork’s actions and public perception were intertwined. Aggressive expansion plans, coupled with questionable financial practices, contributed to the negative public sentiment. The company’s response to these criticisms and its ability to address the concerns of its stakeholders played a vital role in shaping public perception. Ultimately, the disconnect between WeWork’s ambitions and its actual performance and ethical practices fueled the negative narrative.

Evolution of Public Opinion

| Time Period | Event | Public Reaction |

|---|---|---|

| Pre-IPO (2010s) | Initial hype and growth | Positive, innovative, disruptive |

| Pre-IPO (Late 2010s) | Financial concerns, questionable practices | Increasingly skeptical, mixed reactions |

| IPO (2019) | Public offering and initial market response | Cautious optimism, mixed sentiment |

| Post-IPO (2019-2020s) | Controversies, financial struggles | Negative, critical, questioning the model’s viability |

Alternative Perspectives and Future Trends

The WeWork IPO saga, while ultimately a disappointment, offers a valuable case study for understanding the evolving dynamics of the shared workspace industry. Beyond the initial hype and subsequent struggles, alternative perspectives reveal crucial insights into the future of flexible workspaces and the challenges companies face in navigating this dynamic landscape. The future isn’t simply a continuation of the past; it’s a complex interplay of evolving needs, changing technologies, and emerging business models.The shared workspace industry is no longer a niche market.

Its transformation from a novelty to a necessity reflects a significant shift in how businesses and individuals approach work and collaboration. Understanding the nuances of this transition is key to anticipating the future of this rapidly changing sector.

Alternative Viewpoints on WeWork’s Future

Different stakeholders have varying perspectives on WeWork’s future trajectory. These perspectives are shaped by their specific interests and experiences. Analyzing these contrasting viewpoints offers a more holistic understanding of the complexities surrounding the company.

| Perspective | Argument | Evidence |

|---|---|---|

| Skeptical Investor | WeWork’s initial high valuation was unsustainable, and its operational challenges were significant. Continued profitability remains a significant hurdle. | High initial losses, struggles with profitability, and negative investor sentiment after the IPO. |

| Optimistic Analyst | The flexible workspace market is expanding, presenting significant growth opportunities for well-managed companies. WeWork could adapt and thrive by focusing on niche markets and streamlining operations. | Growing demand for flexible workspaces, successful competitors in the sector demonstrating adaptability and market expansion. |

| Industry Disruptor | The future of shared workspaces may not be about monolithic providers like WeWork, but about more localized and specialized solutions. Technology will play a crucial role in fostering community and efficiency. | Rise of co-working spaces focusing on specific industries, the increasing use of digital tools and platforms for collaboration. |

Emerging Trends in the Shared Workspace Industry

The shared workspace industry is dynamic, and several trends are reshaping the landscape. Understanding these trends is crucial for anyone seeking to navigate the future of flexible workspaces.

- Focus on Niche Markets: Instead of a one-size-fits-all approach, companies are recognizing the need to tailor their offerings to specific industries or professions. This allows for more targeted solutions and a better understanding of the unique needs of their clients. For example, spaces designed for startups often have different requirements than those for law firms. This focus on specialized offerings is emerging as a key differentiator in the industry.

- Integration of Technology: Digital tools and platforms are increasingly integral to the shared workspace experience. Virtual meeting rooms, project management software, and community forums enhance collaboration and communication, transforming the physical space into a more dynamic and efficient environment.

- Sustainability and Inclusivity: Shared workspaces are increasingly incorporating sustainable practices and promoting inclusivity. Eco-friendly materials, accessible designs, and community initiatives contribute to a more responsible and equitable environment for all users.

Comparing WeWork’s Model with Competitors

WeWork’s model, while ambitious, faced challenges in competing with established players and emerging competitors. Understanding the differences in approach provides insights into the future of the shared workspace industry.

- Differentiation Through Specialization: Some competitors are focusing on niche markets, offering specialized amenities or catering to particular industries. This targeted approach allows them to better meet the specific needs of their clients.

- Cost-Effectiveness: Others are prioritizing affordability and efficiency, offering lower-cost options that appeal to a broader range of users. This focus on cost-effectiveness is a powerful differentiator in the market.

The Possible Future of the Shared Workspace Industry

The future of shared workspaces is characterized by adaptability, innovation, and a focus on user experience. This involves more than just providing a space; it’s about creating vibrant and productive communities that cater to the diverse needs of modern workers.

- Personalized Workspaces: The future may involve more personalized workspaces, adapting to individual preferences and needs.

- Hyper-localization: The concept of hyper-local spaces is growing, with spaces tailored to neighborhood needs, offering more accessible and convenient options for local workers.

- Increased Collaboration: The industry will likely emphasize collaborative tools and platforms to further integrate the physical and virtual work environments. This will involve a greater emphasis on creating an ecosystem of resources and connections.

End of Discussion: We Company Wework Ipo Adam Neumann

In conclusion, WeWork’s IPO, and Adam Neumann’s role in it, served as a pivotal moment for the shared workspace industry. The company’s journey, marked by both innovation and adversity, provides valuable lessons for entrepreneurs and investors alike. From the initial public offering to the subsequent performance and future outlook, the story continues to unfold, offering insights into the intricate dynamics of business, finance, and leadership.