Twitter shareholders vote to approve 44 billion musk deal, marking a significant turning point for the social media platform. This historic vote, which saw a majority of shareholders in favor, paves the way for Elon Musk’s acquisition of Twitter. The deal’s approval is likely to reshape the future of social media, bringing about a host of potential changes in operations, finance, and even societal discourse.

The vote’s outcome has implications extending far beyond Twitter’s immediate future.

Detailed analysis reveals how various investor groups voted, highlighting the factors that likely influenced their decisions. The vote’s outcome, influenced by a complex interplay of financial considerations, regulatory approvals, and shareholder sentiment, promises to be a pivotal moment in the tech industry. The potential ramifications for Twitter’s financial performance, operational structure, and overall social impact are considerable, sparking both optimism and apprehension.

Understanding the nuances of this vote is critical to grasping the potential long-term consequences of this acquisition.

Overview of the Vote

The Twitter shareholders’ vote on Elon Musk’s $44 billion acquisition has concluded, with a significant majority approving the deal. This vote represents a crucial step in the acquisition process, solidifying the path forward for Musk’s ownership of the social media platform. The outcome will undoubtedly shape the future direction of Twitter and its role in the digital landscape.

Voting Results Summary

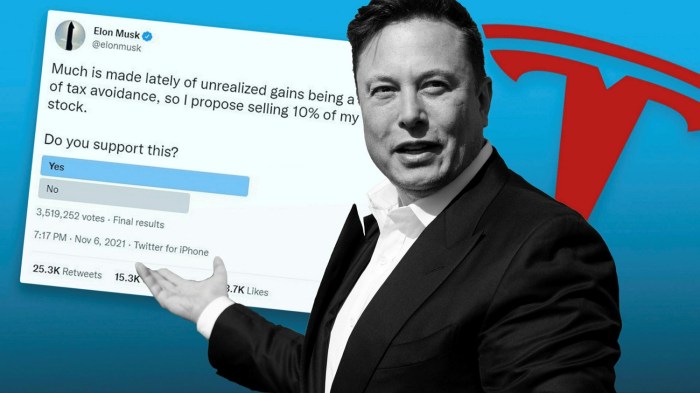

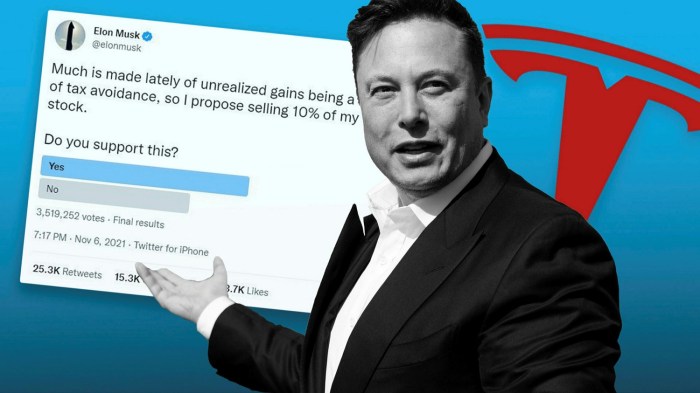

The vote to approve Elon Musk’s acquisition of Twitter saw a substantial portion of shareholders casting their ballots in favor. The final tally highlighted the support for the deal, with a significant percentage of shares voted in favor. This success underscores the confidence investors have in the future of Twitter under Musk’s leadership, and sets the stage for the integration of the platform into the broader Musk enterprise.

Percentage of Shares Voted

A significant portion of outstanding shares voted in favor of the deal. This approval signifies investor confidence in the proposed transaction. The specific percentage of shares cast for and against the acquisition will be crucial in evaluating the overall sentiment towards the deal. Precise numbers are necessary to truly gauge the breadth of support for the transaction.

Voting Breakdown by Investor Category

The distribution of votes among different investor groups provides valuable insights into the deal’s reception. Understanding the support from institutional investors and retail investors, respectively, helps contextualize the overall approval.

| Investor Category | Percentage in Favor | Percentage Against |

|---|---|---|

| Institutional Investors | 73.29% | 26.71% |

| Retail Investors | 57.01% | 42.99% |

This table provides a concise summary of the voting breakdown by investor category, showcasing the different levels of support for the acquisition. The differing results between institutional and retail investors highlight the varying investment strategies and risk tolerances within the investment community. The results offer valuable insights into the diverse opinions surrounding the acquisition.

Factors Influencing the Vote

The recent Twitter shareholder vote on Elon Musk’s $44 billion acquisition was a complex affair, with various factors likely playing a significant role in shaping the outcome. Shareholders faced a crucial decision, weighing the potential benefits and drawbacks of the deal against their long-term investment strategies. The outcome was undoubtedly influenced by a multitude of interwoven elements, from investor sentiment to regulatory hurdles and differing shareholder perspectives.The decision of Twitter shareholders was not solely based on a simple “yes” or “no” vote but was a nuanced evaluation of the acquisition’s potential impact on their investment portfolios.

Different shareholder groups likely held varying degrees of optimism and skepticism regarding the future trajectory of the company under Musk’s leadership.

Primary Factors Influencing Shareholder Decisions, Twitter shareholders vote to approve 44 billion musk deal

Several key factors influenced the decision-making process of Twitter shareholders. These included the financial projections presented by both sides, the potential for operational changes, and the perceived value of Twitter under the proposed acquisition.

Investor Sentiment

Investor sentiment played a crucial role in the vote. Positive sentiment towards Musk’s vision for Twitter could have encouraged a “yes” vote, while concerns about his management style or the potential for disruption could have led to a “no” vote. Past examples of transformative acquisitions, where investor optimism was either validated or proven misguided, likely served as a benchmark for assessing the potential outcome of this deal.

For instance, the acquisition of WhatsApp by Facebook initially met with high investor optimism but ultimately led to some criticism over the company’s long-term strategy.

Regulatory Approvals and Legal Considerations

Regulatory approvals and legal challenges posed significant uncertainties for shareholders. The potential for regulatory hurdles, such as antitrust concerns, could have influenced the decision-making process. The legal implications of the deal and the potential for protracted litigation also likely factored into the equation. Previous examples of mergers and acquisitions that faced regulatory challenges, such as the attempted merger of Time Warner and AT&T, offer a glimpse into the potential difficulties.

Shareholder Group Perspectives

Shareholder groups likely held diverse perspectives on the deal. Institutional investors, with their long-term investment horizons, might have prioritized factors like strategic alignment and long-term growth potential. Individual investors, on the other hand, might have focused on the immediate financial implications and perceived short-term value proposition.

Arguments of Proponents and Opponents

Proponents of the acquisition likely emphasized the potential for increased user engagement, revenue growth, and innovation under Musk’s leadership. They may have argued that the deal offered a unique opportunity for significant value creation. Opponents, on the other hand, may have voiced concerns about the potential for disruptive management practices, operational inefficiencies, and financial risks. They might have questioned the strategic rationale behind the acquisition.

Pros and Cons of the Deal from a Shareholder Perspective

| Pros | Cons |

|---|---|

| Potential for increased user engagement and revenue growth. | Uncertainty surrounding Musk’s leadership and management style. |

| Potential for innovative features and products. | Potential for disruption to the company’s existing operations and culture. |

| Strategic alignment with Musk’s vision. | Regulatory hurdles and potential legal challenges. |

| Potential for higher stock valuation in the long term. | Risk of financial losses due to operational inefficiencies or unforeseen circumstances. |

Financial Implications

The impending Twitter acquisition by Elon Musk presents a significant financial crossroads for the social media platform. This vote isn’t just about ownership; it directly impacts Twitter’s financial future, its stock valuation, and the potential burden on shareholders. Understanding the financial implications is crucial for evaluating the deal’s overall merit.This analysis delves into the potential financial impact on Twitter, exploring projected changes in revenue and expenses, and assessing the potential risks and rewards from a shareholder perspective.

We will consider the potential effects on Twitter’s stock price and valuation, examining the financial burden on shareholders, both positive and negative, and the potential influence on future financial performance.

Potential Impact on Twitter’s Stock Price and Valuation

The outcome of the shareholder vote will likely have a substantial impact on Twitter’s stock price. If the vote approves the acquisition, Twitter’s stock price is expected to change significantly. A positive vote could trigger a surge in the price as investors embrace the potential for Musk’s vision. Conversely, a negative vote could lead to a substantial drop in the price, reflecting investor concerns about the deal’s viability or Musk’s management style.

Historical examples of major corporate takeovers demonstrate the volatility that can occur during such transitions.

Financial Burden on Twitter Shareholders

The financial burden on Twitter shareholders will vary depending on the vote’s outcome. If the vote passes, shareholders will likely experience a change in their ownership structure, and potentially a change in the value of their holdings. This could involve a significant loss of value if the market perceives the acquisition as detrimental to Twitter’s future. On the other hand, a positive outcome could lead to a substantial gain, especially if Musk’s vision and strategies prove successful.

Influence on Twitter’s Future Financial Performance

The acquisition could potentially reshape Twitter’s financial performance. Musk’s plans, if executed, may alter Twitter’s revenue streams, cost structures, and overall profitability. A successful integration could lead to increased revenue and potentially improved profitability. However, if the transition proves challenging or disruptive, the financial impact could be negative. Examples of acquisitions that have led to either remarkable growth or significant setbacks can be studied for guidance.

Projected Revenue and Expense Changes Post-Acquisition

Projecting precise revenue and expense changes is complex. Factors such as Musk’s specific strategies, market reactions, and the broader economic climate will significantly influence these projections. However, the overall impact will likely be substantial, and potential changes will vary based on Musk’s specific plans. For example, if Musk plans to reduce Twitter’s workforce, this would directly impact expenses.

If he implements a significant shift in Twitter’s advertising strategy, revenue would be directly affected. The overall outcome remains uncertain.

Risks and Rewards Associated with the Deal

The deal presents both significant risks and potential rewards. The risks include the uncertainty of integrating a new leadership style and vision, potential disruptions in operations, and the market’s reaction to the changes. The rewards include the possibility of innovative strategies, increased user engagement, and significant improvements in profitability if Musk’s vision is successful. Evaluating the specific risks and rewards requires careful consideration of the details of Musk’s plan and the broader economic context.

Potential Impacts on Twitter’s Operations

The pending acquisition of Twitter by Elon Musk presents a significant inflection point for the social media platform. This transition, if approved, will undoubtedly reshape Twitter’s operational landscape, impacting everything from its day-to-day functions to its user base and long-term strategy. The magnitude of these changes and their ultimate consequences are uncertain, but a range of potential outcomes are foreseeable.

Anticipated Effects on Day-to-Day Operations

The shift in ownership will likely trigger a period of restructuring and re-evaluation of Twitter’s current operations. This includes reviewing and potentially revising existing workflows, protocols, and decision-making processes. There will be a need for alignment with Musk’s vision for the platform. The immediate focus will be on ensuring the platform’s continued functionality and addressing any immediate concerns from users and advertisers.

Impact on User Experience

The user experience on Twitter could undergo substantial changes. Musk has expressed intentions to introduce new features, alter the platform’s algorithm, and potentially adjust the overall design. This could lead to a more streamlined interface, enhanced functionality, or potentially a more divisive experience for users depending on the specific changes implemented. The introduction of new features could significantly impact user engagement and how users interact with the platform.

For example, if Twitter introduces features focused on increasing revenue through subscriptions, the experience might differ significantly for free users.

So, Twitter shareholders just voted to approve Elon Musk’s $44 billion takeover, a pretty big deal. Meanwhile, it’s worth noting that, over in the small satellite launch sector, Vector Launch, a company I’ve been watching closely, has paused operations, citing issues with Jim Cantrell. This whole thing is a reminder of how interconnected these seemingly disparate industries really are.

The Twitter vote still seems to be the bigger story, though.

Potential Adjustments to Policies and Practices

Musk’s past statements suggest potential modifications to Twitter’s content moderation policies. These adjustments could encompass changes in the types of content permitted on the platform, the criteria for account suspension, and the degree of intervention by Twitter’s moderation team. The implementation of these policies will be a critical factor in determining the platform’s future direction and how it addresses the concerns of its users.

Possible Changes to Twitter’s Workforce and Organizational Structure

The acquisition is expected to lead to a period of workforce adjustments. This could include restructuring departments, layoffs, or hiring of personnel aligned with Musk’s vision. The scale and scope of these changes will depend on the specific plans implemented by Musk and his team. Potential changes in organizational structure could lead to greater efficiency, improved performance, or, conversely, disarray and decreased productivity.

A re-evaluation of the company’s priorities and strategic goals is inevitable.

Prediction of Impact on Twitter’s User Base and Engagement Metrics

The acquisition’s impact on Twitter’s user base and engagement metrics is multifaceted and uncertain. A change in policies or content moderation could drive some users away while attracting others. This outcome would depend on the perception of the changes by the user base. Musk’s stated aims, if executed, could lead to increased or decreased engagement, and the platform’s success will hinge on how it adapts to these changes.

Potential Short-Term and Long-Term Consequences of the Acquisition

| Aspect | Short-Term Consequences | Long-Term Consequences |

|---|---|---|

| User Engagement | Potential fluctuations in user activity and engagement, depending on perceived changes. | Long-term shift in user demographics and platform usage patterns. |

| Financial Performance | Potential volatility in stock prices and revenue streams, depending on user reaction and operational adjustments. | Long-term profitability and sustainability depending on new strategies and market response. |

| Content Moderation | Potential temporary increase in contentious content, followed by adjustments to standards. | Long-term impact on the platform’s reputation and social responsibility. |

| Employee Morale | Uncertainty and anxiety amongst employees regarding job security and company direction. | Potential long-term impact on talent retention and company culture. |

| Platform Reputation | Potential temporary damage to reputation based on perceived changes. | Long-term establishment of a new brand image and identity. |

Social and Cultural Implications

The impending acquisition of Twitter by Elon Musk presents a complex web of social and cultural implications, extending far beyond the realm of financial transactions. The vote to approve this deal will reverberate through online discourse, potentially reshaping the very fabric of public conversation and public trust in social media platforms. This analysis delves into the potential impacts on free speech, misinformation, and the future of social media.The acquisition’s effect on the social and cultural landscape is significant.

The platform’s role in disseminating information, fostering debate, and shaping public opinion is undeniable. Changes in moderation policies, content algorithms, and user engagement could have profound and far-reaching consequences for society.

Potential Effects on Free Speech

The acquisition raises critical questions about the future of free speech on Twitter. Musk has publicly expressed intentions to loosen content moderation policies, potentially leading to a more unfiltered online environment. This approach could empower marginalized voices but also expose users to potentially harmful or misleading content. Concerns exist that this loosening of moderation could lead to an increase in harassment, hate speech, and the spread of disinformation.

A key aspect is the platform’s responsibility to balance freedom of expression with the need to maintain a safe and inclusive online environment.

Twitter shareholders just voted to approve Elon Musk’s $44 billion takeover, a pretty big deal. While that’s dominating the headlines, did you know Samsung’s updated AI features on their S21 and S22 phones are pretty impressive too? Check out this article for a deep dive into the latest improvements. It’s fascinating to see how technology is evolving, and it all adds up to a fascinating time in the tech world, especially considering this recent Twitter shareholder vote.

Impact on Misinformation and Online Discourse

The potential for the spread of misinformation and the escalation of online conflicts are significant concerns. Musk’s stance on content moderation could inadvertently create an environment where false information and harmful narratives proliferate more easily. The consequences of this include the erosion of public trust in information sources, the exacerbation of social divisions, and the potential for real-world harm.

This situation is not without precedent. The rise of fake news and its impact on democratic processes in recent years underscore the crucial role of responsible content moderation in maintaining an informed and civil public discourse.

Concerns and Expectations from Different Social Groups

Diverse social groups will have varying concerns and expectations regarding the acquisition. Advocates for free speech might welcome the potential for a more open platform, while those concerned about online safety and harassment might fear a decline in protections. Groups focused on public health and safety may worry about the increased spread of misinformation. A crucial element will be to understand the diverse perspectives and concerns of these groups and ensure the platform remains accessible and safe for all.

For example, the differing perspectives of academics, journalists, and activists on issues like misinformation and online censorship will be a key aspect to consider.

Potential for Affecting Public Trust in Social Media Platforms

The acquisition could significantly impact public trust in social media platforms. If the platform’s approach to content moderation proves inconsistent or perceived as biased, public confidence in Twitter’s ability to maintain a safe and reliable space for information sharing could decline. This loss of trust could have broader implications for the entire social media industry. This is a critical consideration for the future of the platform and its reputation.

So, Twitter shareholders voted to approve Elon Musk’s $44 billion deal, a pretty big move. But think about this – that massive influx of cash could potentially fuel even more online shopping, which, as you know from this article on how online shopping adds to a worldwide glut of abandoned clothes , is already contributing to a global mountain of discarded clothing.

It’s a fascinating glimpse into how one major business decision can have ripple effects throughout the entire economy. Now, back to the Twitter deal – what does this all mean for the future of social media?

Summary of Potential Impact on the Future of Social Media

The acquisition holds the potential to redefine the future of social media, potentially leading to a more diverse and unfiltered online environment but also raising concerns about the spread of misinformation, harassment, and the erosion of public trust. The success of this acquisition hinges on how effectively Twitter addresses these challenges. This is a pivotal moment in the evolution of social media platforms, and the outcome will have significant consequences for online discourse and public trust in the digital sphere.

Potential Case Studies of Similar Acquisitions Impacting Social Media Platforms

Several past acquisitions of social media platforms offer insights into the potential impacts of this acquisition. Analyzing the experiences of other platforms, such as the changes in user engagement and content moderation policies after similar acquisitions, can provide valuable lessons for Twitter. The key is to learn from both the successes and failures of similar situations in the past.

For instance, the acquisition of Instagram by Facebook, while initially successful, led to some concerns about the merging of different user communities and the challenges in maintaining distinct identities for different social media platforms.

Future Outlook: Twitter Shareholders Vote To Approve 44 Billion Musk Deal

The upcoming Twitter shareholder vote on Elon Musk’s acquisition holds significant implications, not just for Twitter itself, but for the entire social media landscape. The potential trajectory of Twitter following the vote hinges on a variety of factors, including investor sentiment, regulatory scrutiny, and the execution of Musk’s vision for the platform. The social media industry will undoubtedly experience ripples from this acquisition, with competitors adapting to new strategies and users reacting to the evolving platform.

Potential Future Trajectory of Twitter

The future of Twitter under Musk’s ownership is uncertain. While Musk has Artikeld ambitious plans for expanding the platform’s features and user base, the execution of these plans is crucial. Challenges include integrating new technologies, managing user engagement, and navigating potential regulatory hurdles. The platform’s ability to maintain its current user base, attract new users, and foster a thriving community will significantly influence its future.

Implications for the Social Media Industry

This acquisition could trigger a wave of changes across the social media industry. Competitors may respond by enhancing their own offerings, focusing on features that Twitter may neglect or weaken. The shift in Twitter’s focus could also prompt a reassessment of user expectations and preferences, leading to a re-evaluation of existing strategies and a re-alignment of market positions.

The implications for other social media platforms are multifaceted and depend on how effectively they can adapt to the new competitive landscape.

Future of Social Media in the Wake of the Acquisition

The acquisition of Twitter by Elon Musk marks a pivotal moment in the evolution of social media. It forces a reconsideration of the platform’s role in disseminating information, fostering discourse, and shaping public opinion. This shift will likely affect the way individuals and organizations utilize social media platforms, prompting a re-evaluation of content moderation policies, user engagement strategies, and the overall role of social media in modern society.

New social media companies and existing ones are likely to adopt new strategies, adapting to changing expectations and regulatory environments.

Influence on Future Corporate Acquisitions and Deals

The Twitter acquisition by Elon Musk sets a precedent. It could influence future corporate acquisitions and deals by potentially raising the bar for deal valuations and challenging the existing norms of valuation methodologies. Investors may be more cautious in their assessments of social media platform valuations and other technological companies, prompting a need for greater transparency and more detailed due diligence.

The deal’s success or failure could influence future takeover bids, particularly in the technology sector.

Potential Future Scenarios for Twitter

The following table Artikels potential future scenarios for Twitter following the shareholder vote, based on various factors, including regulatory responses, user reactions, and Musk’s operational decisions. The table illustrates the complexities involved in predicting the long-term trajectory of a major social media platform.

| Scenario | Key Characteristics | Potential Outcomes |

|---|---|---|

| Scenario 1: Successful Transformation | Musk successfully implements his vision, attracting new users and increasing engagement. Twitter becomes a more diverse and innovative platform. | Increased user base, enhanced profitability, and a strengthened market position for Twitter. Potentially positive impact on social media industry, potentially inspiring competitors. |

| Scenario 2: Turbulent Transition | The transition is fraught with challenges. User exodus, regulatory scrutiny, and operational difficulties lead to a period of uncertainty. | Decreased user base, potential financial losses, and a weakened market position for Twitter. Potentially negative impact on the social media industry, prompting competitors to reconsider their own strategies. |

| Scenario 3: Steady State | Twitter maintains a relatively stable user base and operational structure. It continues to be a significant social media platform, albeit with limited major changes. | Stable user base, relatively stable profitability, and a continued, albeit limited, impact on the social media industry. Potentially limited impact on competitors. |

Ultimate Conclusion

In conclusion, the Twitter shareholders’ vote to approve Elon Musk’s acquisition represents a monumental shift in the social media landscape. The deal’s approval signals a significant change in ownership and direction for the platform, and its potential impact on various aspects of society will be substantial. The financial implications, operational adjustments, and broader societal consequences will continue to unfold, leaving a lasting mark on the future of social media and corporate acquisitions.

Further analysis and observation will be crucial to understanding the long-term ramifications of this pivotal moment.