Machine learning AI spot arguments online Wikipedia explores the fascinating intersection of artificial intelligence, machine learning algorithms, and online discussions surrounding their application in spot markets. This dive into the topic examines how these technologies are utilized, the arguments surrounding their use, and how online platforms like Wikipedia reflect these debates. We’ll uncover the key applications, analyze the controversies, and delve into the intricacies of online discussions surrounding this technology.

Expect a comprehensive overview, examining everything from the fundamentals of machine learning to real-world examples and the nuances of online discourse.

From defining machine learning and AI to detailing the historical context, this exploration uncovers the core principles and concepts. It delves into the practical applications of machine learning in spot markets, discussing how models predict and optimize trading strategies. The analysis moves to the arguments surrounding these applications, including the ethical implications and common misconceptions. We’ll also examine the role of Wikipedia in disseminating information about this topic, acknowledging both its strengths and limitations.

Illustrative examples and case studies will round out the exploration, providing concrete applications and a deeper understanding of the technology.

Defining Machine Learning and AI

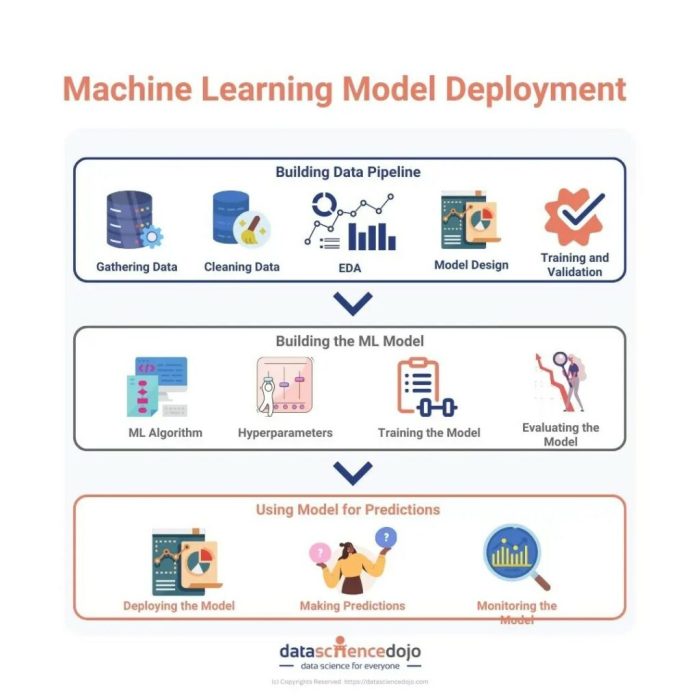

Machine learning and artificial intelligence (AI) are rapidly transforming industries and daily life. These technologies empower computers to learn from data, identify patterns, and make decisions with minimal human intervention. Understanding their fundamental concepts is crucial for navigating this evolving landscape.Machine learning algorithms are at the core of these advancements. They enable computers to learn from data without explicit programming.

Scrolling through online Wikipedia articles about machine learning and AI, I often see heated arguments. It’s fascinating how quickly these technologies are evolving, but also how quickly their implications become entangled in real-world issues like the case of the Rabbani encryption password charged with terrorism at a UK airport. rabbani encryption password charged terrorism uk airport This incident highlights the complex ethical considerations and security concerns surrounding AI and machine learning, forcing us to re-evaluate how we use these powerful tools.

Ultimately, the online arguments about machine learning and AI deserve thoughtful consideration, especially in light of these developments.

This approach allows systems to adapt and improve their performance over time, leading to increasingly sophisticated capabilities.

Machine Learning Algorithms

Machine learning algorithms are mathematical models that learn from data. These models identify patterns and relationships in the input data to make predictions or decisions. A crucial aspect is the iterative process of refining the model’s accuracy through repeated exposure to new data. This iterative process, often involving optimization techniques, is essential for achieving desired outcomes. Examples of algorithms include linear regression, support vector machines, and decision trees.

Types of Machine Learning Models and Applications

Various machine learning models cater to different tasks. Supervised learning models learn from labeled data, where the input data is paired with corresponding output values. Unsupervised learning models, on the other hand, identify patterns in unlabeled data. Reinforcement learning models learn through trial and error, receiving rewards or penalties based on their actions.Supervised learning models are used for tasks like image recognition, spam detection, and medical diagnosis.

Unsupervised learning is valuable in customer segmentation, anomaly detection, and recommendation systems. Reinforcement learning finds applications in game playing, robotics, and autonomous driving.

Artificial Intelligence and its Relationship with Machine Learning

Artificial intelligence is a broader concept encompassing various approaches to creating intelligent agents. Machine learning is a key component of AI, enabling machines to learn from data and improve their performance. Other approaches include expert systems, natural language processing, and computer vision.AI aims to create machines that can perform tasks that typically require human intelligence, such as understanding language, recognizing objects, and making decisions.

Machine learning provides the tools for achieving these goals.

Historical Development of Machine Learning and AI

The field of machine learning has roots in the mid-20th century. Early work focused on developing algorithms for pattern recognition and decision-making. The development of powerful computing capabilities and the availability of large datasets have significantly accelerated the progress of machine learning in recent decades. AI’s evolution is closely tied to advances in computing power, algorithmic development, and data availability.

Key Differences between Machine Learning and Traditional Programming

Traditional programming relies on explicit instructions to solve problems. Machine learning, conversely, allows computers to learn from data and adapt their behavior without being explicitly programmed for each task. This difference is crucial because machine learning algorithms can handle complex situations and adapt to changing data patterns, while traditional programming struggles with these dynamic scenarios.

Comparison of Machine Learning Algorithms

| Algorithm | Description | Strengths | Weaknesses |

|---|---|---|---|

| Linear Regression | Predicts a continuous output variable based on a linear relationship with input variables. | Simple to understand and implement; computationally efficient. | Assumes a linear relationship between variables; sensitive to outliers. |

| Support Vector Machines (SVM) | Finds an optimal hyperplane to separate different classes of data points. | Effective in high-dimensional spaces; good generalization performance. | Computationally intensive for large datasets; can be sensitive to the choice of kernel function. |

| Decision Trees | Creates a tree-like model of decisions and their possible consequences. | Easy to interpret and visualize; handles both numerical and categorical data. | Prone to overfitting; may not generalize well to unseen data. |

| Naive Bayes | Classifies data points based on the probability of each class given the input features. | Simple to implement; works well with high-dimensional data. | Assumes feature independence; may not perform well with correlated features. |

AI and Machine Learning in the Spot Market

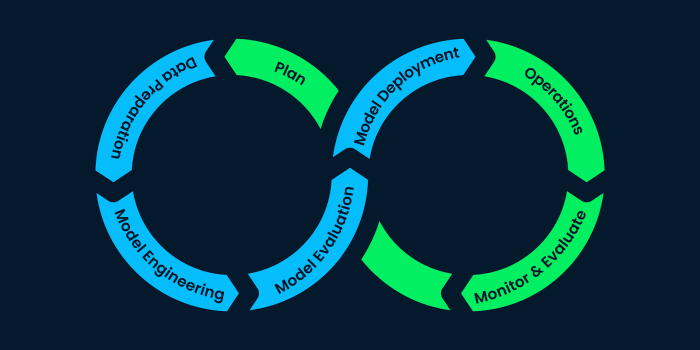

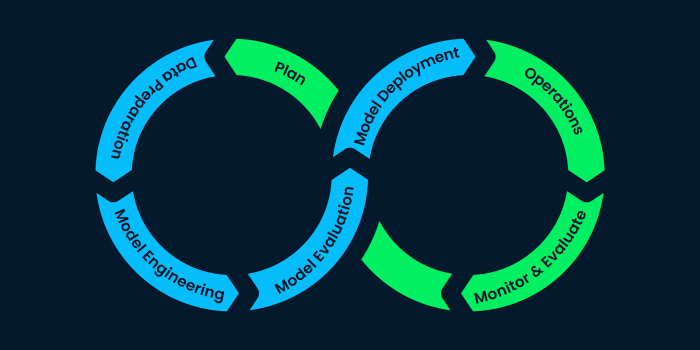

The online spot market, characterized by its immediacy and volatility, presents a fertile ground for AI and machine learning applications. These technologies are increasingly used to enhance trading strategies, predict market trends, and identify profitable opportunities, transforming the landscape of financial transactions. This dynamic interplay between technology and finance promises to reshape the spot market’s efficiency and profitability.Machine learning models are employed in online spot markets to analyze vast datasets of historical price movements, order books, and market sentiment.

These models, trained on this data, can identify patterns and anomalies that might otherwise be missed by human analysts. By learning from these patterns, the models can anticipate future price movements and adapt to changing market conditions. The speed and scale at which machine learning algorithms process data are crucial for success in the fast-paced spot market.

Machine Learning Models in Spot Market Trading

Machine learning models excel at processing massive datasets to detect subtle patterns in market trends. These models learn from historical data, identifying correlations and causations that might not be immediately apparent to human traders. Sophisticated algorithms are used to analyze factors like supply and demand dynamics, news sentiment, and even social media buzz to gain insights into potential price fluctuations.

Recent online discussions about machine learning and AI, often found on Wikipedia, frequently highlight potential biases and ethical concerns. This debate is increasingly relevant in light of the Google CEO Sundar Pichai’s recent congressional hearing regarding Google’s project, Dragonfly google ceo sundar pichai congress house hearing dragonfly. The public scrutiny of such projects forces us to reconsider how AI systems are developed and deployed, ultimately influencing the ongoing discourse about machine learning and AI spot arguments online on platforms like Wikipedia.

For example, a model trained on historical Bitcoin price data could predict future price movements with a degree of accuracy, allowing traders to adjust their positions proactively.

AI for Predicting and Optimizing Trading Strategies

AI plays a critical role in optimizing trading strategies by automating the process of identifying and testing various strategies. By analyzing large datasets, AI can identify optimal parameters for different strategies, such as the entry and exit points for trades. For example, a machine learning model could identify the optimal time to enter a trade on a cryptocurrency spot market based on various technical indicators and market conditions.

This automated approach leads to faster responses and better adaptation to changing market conditions compared to human-based strategies.

Machine Learning for Market Trend Analysis

Machine learning algorithms can be effectively used to analyze market trends by identifying patterns and anomalies in price movements. By learning from historical data, these algorithms can identify potential trends and predict future price movements. For instance, a model trained on stock market data could identify an emerging trend of increasing demand for a specific stock, allowing traders to anticipate and capitalize on this trend.

AI for Identifying Arbitrage Opportunities

AI can be instrumental in detecting arbitrage opportunities in the spot market. By analyzing multiple markets simultaneously, AI can quickly identify discrepancies in pricing across different exchanges or for different assets. This allows traders to capitalize on temporary price imbalances, thereby generating substantial profits. Real-time analysis of market data, provided by AI, is crucial in identifying these fleeting opportunities.

Trading Strategies Using Machine Learning

| Strategy | Description | Data Used | Expected Outcome |

|---|---|---|---|

| Trend Following | Identifies and capitalizes on established trends in the market. | Historical price data, volume data, technical indicators. | Profitable trades during periods of sustained market movement. |

| Mean Reversion | Predicts that prices will return to their average value after significant deviations. | Historical price data, volatility data, statistical measures. | Profits from price corrections and mean reversion. |

| Arbitrage | Exploits price discrepancies across different markets or assets. | Real-time market data from multiple exchanges. | Quick profits from temporary price imbalances. |

Online Discussions and Arguments

The burgeoning use of AI and machine learning in spot markets has sparked a vibrant, and often heated, online discourse. Proponents highlight the potential for increased efficiency and profitability, while critics express concerns about algorithmic bias, market manipulation, and the potential displacement of human traders. This discussion delves into the core arguments, exploring both the potential benefits and risks.The diverse perspectives surrounding AI in spot markets often stem from differing interpretations of the technology’s capabilities and the potential consequences of its widespread adoption.

This includes concerns about transparency, accountability, and the overall impact on market fairness and stability. A deep understanding of these differing viewpoints is crucial for navigating the evolving landscape of AI-driven financial markets.

Common Arguments and Debates

The online discussions frequently revolve around the balance between technological advancement and potential negative consequences. Proponents argue that AI can optimize trading strategies, identify patterns and anomalies, and improve market liquidity, leading to more efficient price discovery. Conversely, critics express anxieties about potential algorithmic bias, the risk of market manipulation, and the erosion of human expertise in the trading process.

Potential Risks and Benefits

The potential benefits of AI in spot markets include enhanced speed and accuracy in executing trades, improved risk management, and potentially lower transaction costs. However, the potential risks include algorithmic bias leading to discriminatory outcomes, the possibility of unintended consequences from complex algorithms, and the potential for market manipulation or instability.

Ethical Considerations

Ethical considerations surrounding the use of machine learning in spot markets are significant. Concerns about data privacy, algorithmic transparency, and the potential for manipulation need careful attention. Bias in training data can perpetuate existing market inequalities, leading to unfair outcomes for certain participants. Ensuring equitable access to AI-powered tools and fostering a level playing field are critical ethical considerations.

Common Misconceptions and Myths

A common misconception is that AI will completely replace human traders. In reality, the most effective strategies likely involve a combination of human judgment and AI-powered analysis. Another misconception is that AI algorithms are inherently objective. This is not the case, as the algorithms are only as good as the data they are trained on, and biases in this data can lead to biased outcomes.

Factors Influencing Public Opinion

Several factors influence public opinion on AI in spot markets. Media portrayals, personal experiences with financial markets, and perceived levels of transparency and accountability all play a role. A lack of understanding of how these algorithms work can contribute to apprehension and mistrust. Education and clear communication are crucial for building public confidence.

Opposing Viewpoints on AI in Online Discussions

| Argument 1 | Argument 2 | Supporting Evidence | Counter-Argument |

|---|---|---|---|

| AI enhances market efficiency by processing vast amounts of data faster and more accurately than humans. | AI-driven trading can lead to increased volatility and instability in spot markets due to unforeseen consequences of complex algorithms. | Studies show AI-powered trading algorithms can identify subtle patterns and anomalies that human traders might miss. | There are documented cases of algorithmic trading contributing to sudden price swings and market crashes, highlighting the risk of unforeseen outcomes. |

| AI reduces trading costs by automating tasks and optimizing strategies. | AI algorithms can be susceptible to manipulation and bias, potentially leading to unfair advantages for certain participants. | Automated trading platforms using AI have demonstrably lowered trading costs for some market participants. | The potential for malicious actors to exploit vulnerabilities in AI algorithms raises concerns about market integrity. |

| AI improves risk management by identifying and mitigating potential losses more effectively. | The reliance on AI in spot markets can lead to a loss of human oversight and judgment, potentially resulting in critical errors. | Sophisticated AI models can assess market risk with greater precision than human traders. | In cases of system failure or unforeseen market events, the lack of human intervention can exacerbate problems. |

Wikipedia and Related Information

Wikipedia, while a valuable resource for general information, presents unique challenges when discussing complex topics like machine learning and AI in spot markets. Its collaborative nature, while fostering diverse perspectives, can also lead to inaccuracies or biases. This section will explore how Wikipedia addresses these topics, highlighting strengths, weaknesses, and common limitations.

Structure and Content Overview

Wikipedia articles on machine learning and AI in spot markets generally follow a standard structure. They typically begin with definitions of key terms, progressing to explanations of algorithms and models used in these contexts. Discussions often include examples of successful implementations and potential applications. The structure, however, can vary widely depending on the specific article. Some articles delve deeply into technical aspects, while others focus on broader market implications.

I’ve been digging into machine learning AI arguments spotted online, like on Wikipedia. It’s fascinating how different perspectives clash. While researching this, I stumbled upon some amazing deals on Caraway ceramic cookware – check out save on caraway ceramic cookware for some seriously tempting discounts. This makes me think about the potential bias in information, even when looking for reliable sources on machine learning AI debates.

It’s a complex topic, no doubt!

A common thread is the description of real-world applications, ranging from algorithmic trading to fraud detection.

Strengths of Wikipedia as a Source

Wikipedia’s strengths lie in its accessibility and comprehensiveness. Its vast collection of articles allows for quick overviews of complex concepts, providing a starting point for research. The collaborative nature of Wikipedia means that information is often updated and revised, reflecting current developments in the field. Its global reach also exposes readers to a diverse range of perspectives.

Weaknesses and Limitations

Despite its strengths, Wikipedia suffers from limitations. Its reliance on volunteer editors means that the quality of information can vary. Lack of rigorous peer review can lead to inaccuracies, outdated information, and biases. Furthermore, Wikipedia’s coverage might be incomplete, neglecting niche or specialized areas of machine learning and AI in spot markets. The subjective nature of interpretation also plays a role in the presentation of different perspectives.

Common Biases and Limitations

Wikipedia articles on this subject may exhibit biases reflecting the current trends and debates in the broader machine learning and AI community. For instance, articles might focus heavily on the positive aspects of using AI in spot markets, while potentially downplaying the risks or ethical concerns. Additionally, technical jargon and complexity might make the content inaccessible to non-experts.

Comparison of Perspectives

Different Wikipedia pages might present varying perspectives on the same topic. For example, articles on algorithmic trading might highlight the potential for increased efficiency and profitability, while others might emphasize the potential for market manipulation or the need for regulatory oversight.

Table Summarizing Key Topics

| Topic | Key Concepts | Relevant Articles | Strengths |

|---|---|---|---|

| Algorithmic Trading | High-frequency trading, market making, order book analysis | Algorithmic Trading, High-Frequency Trading, Market Making | Often provides a basic overview of the concept and its applications. |

| AI-driven Market Prediction | Machine learning models, forecasting techniques, data analysis | AI in Finance, Machine Learning in Finance | Highlights the potential use of machine learning in forecasting. |

| Ethical Concerns | Bias in algorithms, transparency, accountability | AI Ethics, Bias in Machine Learning | Sometimes includes brief discussions of ethical concerns, though often superficial. |

| Regulatory Frameworks | Market regulations, oversight, compliance | Financial Regulation, Market Manipulation | May provide background information on relevant regulations. |

Illustrative Examples: Machine Learning Ai Spot Arguments Online Wikipedia

Machine learning’s potential in spot markets is becoming increasingly apparent. Real-world applications demonstrate its ability to analyze vast datasets, identify patterns, and make predictions that can significantly improve trading strategies and market insights. This section explores successful deployments and fictional models, offering a tangible understanding of the practical impact of AI in these dynamic environments.

Successful Applications in Spot Markets, Machine learning ai spot arguments online wikipedia

Machine learning algorithms are proving useful in various spot market applications. These algorithms are trained on historical data, allowing them to predict future price movements and optimize trading strategies. The result is improved efficiency and potential profitability in these volatile markets.

- Predicting Commodity Prices: Machine learning models can analyze factors like weather patterns, geopolitical events, and supply chain disruptions to forecast commodity prices. This allows traders to make more informed decisions and potentially mitigate risks associated with price volatility. For example, models could predict fluctuations in the price of agricultural commodities like wheat or corn based on historical data and external factors like weather forecasts.

- Optimizing Trading Strategies: AI can analyze market data to identify optimal trading strategies. This involves identifying patterns and correlations in market behavior that may be missed by human traders. This automation can lead to more consistent profits and potentially reduce the risk of emotional decision-making.

- Improving Liquidity: Machine learning can enhance liquidity in spot markets by facilitating automated trading and matching orders. By processing data quickly and efficiently, these models can improve the speed and volume of trades, ultimately benefiting market participants.

Case Studies of AI-Enhanced Trading Strategies

Numerous case studies illustrate how AI has been instrumental in improving trading strategies. These strategies are often based on complex algorithms that identify patterns and anomalies in market data.

- Algorithmic Trading in Financial Markets: Many high-frequency trading firms utilize machine learning to execute trades at high speed and scale. These models are trained on massive datasets of market data, allowing them to react quickly to price fluctuations. This can result in more efficient execution of trades and improved market liquidity.

- Predictive Modeling in Energy Markets: Machine learning models are applied to energy markets to forecast demand and supply. This allows energy companies to optimize their production and distribution strategies, leading to cost savings and improved efficiency. For instance, a model might analyze weather data, historical energy consumption patterns, and government regulations to forecast electricity demand in the coming hours.

Real-World Scenarios of AI Impact

AI is already having a tangible impact on spot markets across various industries.

- Improved Risk Management in Agricultural Markets: AI models can predict weather-related risks in agricultural markets, allowing farmers and traders to hedge against potential losses. For instance, a model might use historical weather data and crop yield data to predict the likelihood of drought or flood in a specific region, allowing farmers to adjust their planting strategies accordingly.

- Enhancing Efficiency in Currency Trading: Machine learning models can analyze economic data and news events to forecast currency exchange rates. This can help traders optimize their trading strategies and potentially profit from short-term fluctuations in currency markets.

Fictional Example: A Machine Learning Model for a Spot Market

Imagine a machine learning model designed for a spot market for rare earth minerals. The model, “TerraPredict,” analyzes a multitude of data points, including supply chain disruptions, geopolitical tensions, and recent market trends. Based on this analysis, TerraPredict generates predictions for the price of rare earth minerals in the coming weeks. This allows market participants to make informed decisions about buying and selling, contributing to a more stable and efficient market.

Market Trend Predictions

| Example | Description | Impact | Visual Representation |

|---|---|---|---|

| Rare Earth Minerals | TerraPredict model predicts a slight increase in the price of neodymium over the next 3 months due to geopolitical instability in a major supplier nation. | Traders can adjust their positions and potentially profit from the anticipated price increase. | A line graph showing a slight upward trend for neodymium price over a 3-month period, with a noticeable spike predicted at a specific point. The graph should include a horizontal axis labeled with dates and a vertical axis labeled with price. |

| Crude Oil | Machine learning model forecasts a decrease in crude oil prices over the next quarter due to an unexpected increase in global oil production. | Oil companies can adjust their production plans, and investors can potentially profit by selling their oil holdings before the predicted price drop. | A line graph depicting a downward trend in crude oil prices over the next three months. The graph should be similar to the previous one, with a clear indication of the predicted price decrease. |

Final Thoughts

In conclusion, machine learning AI’s role in spot markets is a complex and multifaceted topic, with a dynamic interplay of technical aspects, ethical considerations, and online discourse. This exploration highlighted the diverse applications of machine learning models in spot markets, ranging from predicting market trends to identifying arbitrage opportunities. The arguments and debates surrounding this technology, including the potential risks and benefits, were examined, alongside the role of Wikipedia as a source of information.

Ultimately, the discussion underscored the need for a nuanced understanding of machine learning’s potential and its impact on financial markets, with ongoing discussion and scrutiny necessary for responsible implementation.