Its fiscal irresponsibility time. This deep dive explores the complex issue of fiscal irresponsibility, examining its causes, consequences, and potential solutions. From personal finances to government budgets and corporate spending, the pitfalls of irresponsible financial management are multifaceted and impactful. We’ll unpack what constitutes fiscal irresponsibility, how it manifests in various contexts, and ultimately, strategize ways to avoid it.

The article delves into the defining characteristics of fiscal irresponsibility, contrasting it with responsible financial practices. It analyzes the various consequences – from short-term setbacks to long-term economic instability – for individuals, businesses, and nations. The exploration touches upon historical case studies and presents compelling examples of how fiscal irresponsibility has manifested across different time periods and sectors.

Defining Fiscal Irresponsibility

Fiscal irresponsibility, a pervasive issue across personal finances, government budgets, and corporate spending, stems from a fundamental mismatch between spending and available resources. It often manifests as a pattern of unsustainable practices, leading to a cascade of negative consequences. This article delves into the multifaceted nature of fiscal irresponsibility, examining its various forms and implications.A crucial element of fiscal irresponsibility is the failure to prioritize long-term financial health over short-term gains.

This can manifest as excessive borrowing, overspending, or neglecting essential savings. The underlying principle is a disregard for the consequences of current actions on future financial well-being.

Different Contexts of Fiscal Irresponsibility

Fiscal irresponsibility is not confined to a single context. Its impact extends to personal finances, government budgets, and corporate entities, each with unique characteristics. Understanding these differences is critical to grasping the broader implications of this issue.

Personal Finances

Unsustainable spending habits, characterized by excessive debt accumulation and a failure to save for the future, represent a prime example of personal fiscal irresponsibility. Ignoring financial obligations, such as credit card payments, and prioritizing immediate gratification over long-term goals can lead to significant financial hardship. For instance, consistently spending more than one earns, without a concrete plan for addressing the gap, can quickly result in spiraling debt.

It’s undeniably a time of fiscal irresponsibility, with companies prioritizing short-term gains over long-term safety. Take, for example, the recent tesla full self driving child crash open letter , highlighting potentially catastrophic consequences of rushed development and questionable safety protocols. This, sadly, reflects a wider pattern of prioritizing profit over public well-being in the current economic climate.

A lack of financial literacy and inadequate budgeting are often contributing factors.

It’s definitely fiscal irresponsibility time, isn’t it? Thinking about dropping serious cash on a top-tier gaming rig like the Razer Maingear R1, which boasts impressive liquid cooling capabilities, Razer Maingear R1 gaming computer pipes liquid cooling is a definite temptation. But let’s be honest, that’s just one more reason why it’s fiscal irresponsibility time! We all know we should probably be saving, but sometimes these amazing tech toys just make it so hard.

Government Budgets

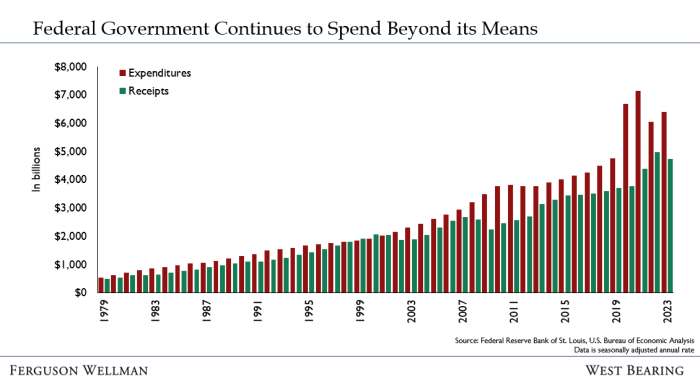

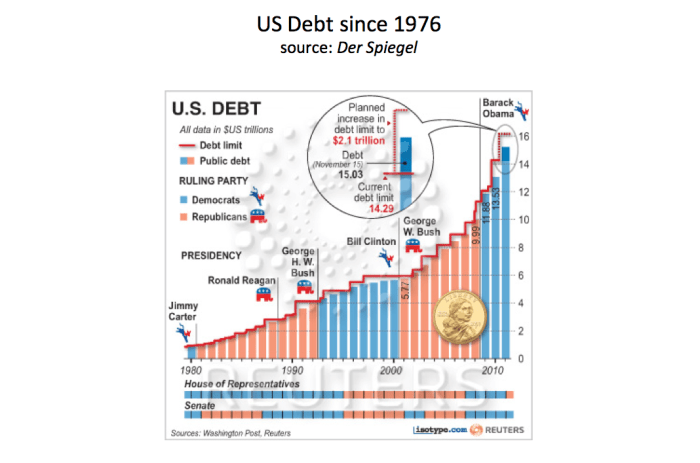

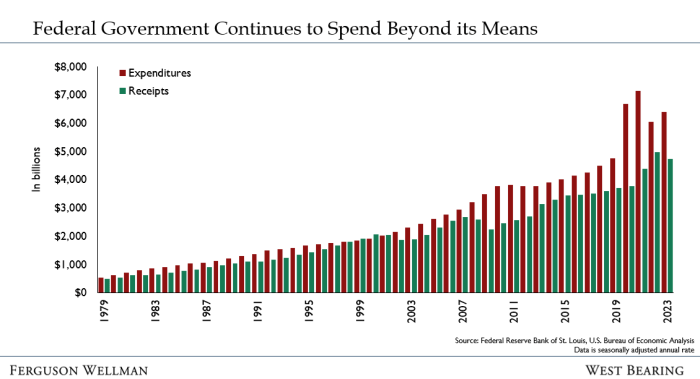

Government fiscal irresponsibility can take the form of excessive borrowing to fund current spending, leading to an unsustainable national debt. This can strain the economy, potentially leading to inflation, reduced economic growth, and diminished investor confidence. Examples include large-scale stimulus packages implemented without careful consideration of long-term implications. High levels of government spending, not supported by sufficient tax revenues or prudent budgeting, can create a debt crisis.

Corporate Spending

Corporate fiscal irresponsibility involves reckless investment decisions, excessive executive compensation packages, or a disregard for sustainable business practices. For instance, overspending on unnecessary acquisitions or investments without a clear return on investment can lead to financial distress for the company. A focus on short-term profits over long-term sustainability can result in a company’s demise. Ignoring potential risks, like environmental regulations, and prioritizing immediate profit can cause irreparable damage in the long run.

Perspectives on Fiscal Irresponsibility

Different stakeholders often hold varying perspectives on what constitutes fiscal irresponsibility. For instance, a government official might view a particular spending initiative as essential for societal progress, even if it leads to increased borrowing. Conversely, an investor might see the same initiative as a sign of fiscal recklessness. These differing perspectives highlight the potential for biases in the interpretation of fiscal policies and practices.

Indicators of Fiscal Irresponsibility

Identifying indicators of fiscal irresponsibility across various sectors is crucial for early detection and mitigation. Several key indicators can signal a potential problem.

- High levels of debt relative to income or assets.

- Inadequate savings or investment strategies.

- Inability to meet financial obligations.

- Unrealistic spending plans.

- Lack of financial planning.

These indicators, when observed in combination, can suggest a pattern of fiscal irresponsibility.

Prudent Financial Management vs. Fiscal Irresponsibility

Prudent financial management emphasizes long-term sustainability, planning, and responsible spending. It contrasts sharply with fiscal irresponsibility, which prioritizes immediate gratification and often leads to unsustainable debt burdens. Prudent management involves meticulous budgeting, careful investment strategies, and adherence to financial obligations.

| Characteristic | Prudent Financial Management | Fiscal Irresponsibility |

|---|---|---|

| Spending | Aligned with income and long-term goals | Exceeds income and prioritizes short-term gains |

| Debt Management | Controlled and manageable | Excessive and unsustainable |

| Savings | Prioritized and consistent | Negligible or non-existent |

These contrasting characteristics highlight the fundamental differences between responsible and irresponsible financial practices.

Consequences of Fiscal Irresponsibility

Fiscal irresponsibility, characterized by excessive government spending without a corresponding increase in revenue or a sustainable plan to manage debt, has profound and far-reaching consequences. The impact ripples through economies, affecting individuals, businesses, and nations as a whole, both in the short and long term. Understanding these consequences is crucial for formulating sound fiscal policies and avoiding potentially devastating economic downturns.The consequences of fiscal irresponsibility are multifaceted and interconnected.

Short-term effects might manifest as inflation, reduced consumer confidence, and temporary economic slowdowns. Long-term consequences, however, can be significantly more severe, potentially leading to a loss of investor confidence, higher interest rates, and an erosion of a nation’s economic standing. This often results in a diminished quality of life for citizens and decreased competitiveness in the global market.

Short-Term Consequences

Excessive government spending can lead to immediate inflationary pressures. Printing more money to fund deficits often results in higher prices for goods and services. This erosion of purchasing power impacts individuals and families, reducing their ability to afford essential items. Furthermore, the reduced confidence in the government’s financial management can lead to decreased consumer spending, negatively affecting businesses and employment.

A significant reduction in government investment in infrastructure and social programs can result in immediate disruptions to essential services.

Long-Term Consequences

The long-term consequences of fiscal irresponsibility are often more severe and can last for decades. Accumulated debt can lead to higher interest rates, making borrowing more expensive for both the government and private sector. This can stifle economic growth and reduce investment opportunities. A high level of national debt can also diminish a nation’s international standing and credibility, making it more difficult to attract foreign investment and obtain favorable trade agreements.

Furthermore, future generations may face the burden of paying off accumulated debt, limiting their opportunities and resources.

Consequences for Individuals

High inflation, as a consequence of fiscal irresponsibility, reduces the purchasing power of individuals. Reduced government investment in social programs can lead to a decrease in access to vital services like healthcare and education. Individuals may also face higher taxes or reduced benefits to offset the growing national debt. In extreme cases, citizens may experience a significant decline in their standard of living.

Consequences for Businesses

Businesses face increased operating costs due to inflation and higher interest rates. Reduced consumer spending due to decreased purchasing power can negatively impact sales and profits. Uncertain economic conditions due to fiscal irresponsibility often deter investment and create an unstable business environment. Government austerity measures can also impact businesses by reducing government contracts and potentially leading to job losses.

Consequences for Nations

Fiscal irresponsibility can result in a decrease in a nation’s economic growth and competitiveness. A loss of investor confidence and higher interest rates make it more challenging to attract foreign investment. The nation’s international standing may decline due to its financial instability. A weakened economy can result in social unrest and political instability.

Historical Examples

The Weimar Republic’s hyperinflation in the 1920s serves as a stark example of the devastating consequences of unchecked fiscal irresponsibility. Similarly, the 2008 financial crisis, in part, stemmed from excessive government spending and debt accumulation.

Economic Stability

Fiscal irresponsibility undermines economic stability by creating uncertainty and volatility in the market. Higher inflation and interest rates reduce investment and growth opportunities. A high national debt can lead to a loss of confidence in the government’s ability to manage the economy, potentially triggering a financial crisis.

Table of Potential Repercussions

| Scenario | Short-Term Impact | Long-Term Impact |

|---|---|---|

| Excessive Government Spending | Inflation, reduced consumer confidence, temporary economic slowdowns | Higher interest rates, loss of investor confidence, erosion of economic standing |

| High National Debt | Higher borrowing costs, reduced investment opportunities | Diminished international standing, limited future economic growth |

| Austerity Measures | Reduced government spending, potential job losses | Limited social program access, potential for economic stagnation |

Causes of Fiscal Irresponsibility

Fiscal irresponsibility, the failure to manage public finances prudently, has far-reaching consequences. Understanding its root causes is crucial for developing effective preventative measures. It’s not simply a matter of poor choices; often, complex interplay of political, economic, and societal factors fuels this problem. This exploration delves into the underlying drivers of fiscal irresponsibility, offering insights into how these pressures shape public spending and debt accumulation.Political pressures, economic downturns, and societal factors all contribute to the phenomenon of fiscal irresponsibility.

These forces often act in concert, creating a perfect storm that leads to unsustainable levels of spending and debt. Analyzing the intricate relationship between these factors is vital for comprehending the multifaceted nature of this problem.

Political Pressures

Political motivations frequently influence fiscal decisions. The pursuit of short-term gains, such as popular initiatives or promises made during election campaigns, can lead to unsustainable spending commitments. A need to garner political support or demonstrate strength can also push governments to spend more than they can afford, in the belief that this will increase public approval. The temptation to appease interest groups and prioritize certain sectors over others can also contribute to fiscal imbalances.

Furthermore, bureaucratic inefficiencies and lack of transparency in budget allocation processes can exacerbate the issue.

It’s definitely fiscal irresponsibility time, and frankly, it’s a bit tiring. Snap, trying to keep up with the short-form video game, has launched Spotlight, a new feature designed to rival TikTok and Reels. This new feature seems like a bold move, but with the current economic climate, it feels like a lot of unnecessary spending. Still, fiscal irresponsibility time continues, regardless of social media trends.

Economic Downturns

Economic downturns often force governments to intervene with increased spending to stimulate the economy and mitigate the impact of job losses and decreased tax revenue. This response, while often necessary, can lead to increased public debt if not carefully managed. The potential for prolonged economic downturns, combined with the necessity for large-scale interventions, poses a significant risk.

Societal Factors

Societal pressures also play a role in fiscal irresponsibility. Expectations for increased social welfare programs, healthcare services, or education opportunities, when not adequately supported by tax revenues, can strain public finances. Growing populations and aging demographics can place additional burdens on government budgets, contributing to fiscal challenges. In certain societies, a lack of accountability and a low tolerance for economic hardship can contribute to the problem.

A society’s perception of the role of government in addressing societal issues can also influence its fiscal decisions.

Contributing Factors of Fiscal Irresponsibility

| Nature of Factor | Description | Examples |

|---|---|---|

| Political | Short-term political gains, pressure from interest groups, election promises | Increased spending on popular programs before elections, neglecting long-term fiscal health. |

| Economic | Economic downturns, decreased tax revenue, recessionary periods | Increased government spending to stimulate the economy during a recession, leading to higher debt. |

| Societal | Increased expectations for social welfare programs, population growth, aging demographics | Growing demands for healthcare, education, and social security benefits outpacing tax revenue, resulting in unsustainable fiscal positions. |

Examples of Fiscal Irresponsibility

The Greek debt crisis, fueled by years of excessive spending and tax evasion, serves as a prime example of fiscal irresponsibility driven by a combination of political pressures and economic mismanagement. Similarly, certain countries’ responses to the 2008 financial crisis, while necessary in the short term, resulted in increased national debt, demonstrating the link between economic downturns and fiscal irresponsibility.

Identifying the Time Element: Its Fiscal Irresponsibility Time

Fiscal irresponsibility isn’t a static issue; its impact and consequences are profoundly shaped by the timing of actions and decisions. Understanding the interplay between time and fiscal choices is crucial for effective policymaking and preventing long-term crises. This section delves into the critical role of time in understanding and mitigating fiscal irresponsibility.The concept of time in fiscal matters goes beyond mere chronology.

It encompasses the temporal dimension of financial decisions, the ripple effects of current actions on future outcomes, and the varying perspectives across different stakeholders. Understanding how choices today influence tomorrow is fundamental to sound fiscal management.

The Impact of Timing on Consequences

The timing of fiscal decisions directly affects the severity of the consequences. A tax cut implemented during a period of economic prosperity might have minimal impact compared to the same cut during a recession. The former might stimulate growth, while the latter could exacerbate existing vulnerabilities. Similarly, a large infrastructure investment, when timed correctly, can boost economic output and productivity, but if implemented during a period of high inflation, the same investment may increase costs and slow economic progress.

Short-Term Gains and Long-Term Irresponsibility

Short-term gains often mask the potential for long-term fiscal irresponsibility. Governments might be tempted to prioritize immediate spending needs, like social programs or infrastructure projects, even if they require substantial borrowing or reduced future investment in critical areas. Such short-sightedness can lead to accumulating debt burdens, reduced public services, and a diminished capacity to respond to future economic shocks.The allure of immediate benefits can be powerful, but it’s crucial to consider the cumulative impact of these choices over time.

For example, a government that repeatedly runs large budget deficits may see short-term economic stimulus, but eventually faces higher interest rates, reduced investor confidence, and diminished long-term economic growth.

Understanding the Timeline of Fiscal Irresponsibility

Recognizing the timeline of fiscal irresponsibility is essential for effective prevention and mitigation strategies. Identifying patterns of fiscal mismanagement, such as consistently high levels of debt, can provide insights into the potential long-term consequences. Proactive measures, like implementing fiscal responsibility rules or adjusting tax policies, need to be implemented in a way that anticipates future trends and addresses potential risks.

A thorough understanding of the timeline allows for a proactive approach to fiscal health.

Comparison of Approaches Across Time Periods

Different approaches to fiscal responsibility have been adopted throughout history, reflecting evolving economic conditions and societal priorities. Historically, governments might have prioritized immediate spending to stimulate the economy, but the long-term consequences, such as increased national debt, were often underestimated. Modern approaches tend to emphasize long-term sustainability, incorporating elements of debt reduction, expenditure control, and responsible borrowing.

Examples of Time-Sensitive Fiscal Actions

| Fiscal Action | Time Period | Potential Impact |

|---|---|---|

| Increased military spending | Preceding a war | Improved national defense capability |

| Increased military spending | During a prolonged peacetime | Increased national debt, potentially leading to economic vulnerabilities |

| Investment in education | Current period | Increased human capital, improved productivity in the long term |

| Investment in education | Long-term period with reduced workforce growth | Increased unemployment, decreased economic output in the long term |

Case Studies of Fiscal Irresponsibility

Fiscal irresponsibility, characterized by excessive spending and inadequate revenue generation, can have devastating consequences for nations and individuals. Understanding past instances of this behavior, examining the underlying causes, and analyzing the subsequent repercussions provides valuable insights into the complexities of managing public finances. This section delves into a specific case study to illustrate these concepts.

The Greek Debt Crisis (2009-2018)

The Greek debt crisis, spanning from 2009 to 2018, serves as a stark example of the consequences of years of fiscal irresponsibility. A combination of factors contributed to Greece’s unsustainable debt levels, ultimately leading to a severe economic downturn and social unrest.

Factors Leading to Fiscal Irresponsibility

Greece’s fiscal problems stemmed from a confluence of factors, including:

- Excessively high public spending: Government expenditures, particularly on social programs and pensions, exceeded the country’s revenue capacity. The system became unsustainable as a result.

- Tax avoidance and evasion: A significant portion of the Greek population, particularly businesses, avoided paying taxes, reducing government revenue and exacerbating the fiscal imbalance.

- Economic stagnation and decline: Years of economic recession and declining GDP hampered Greece’s ability to generate sufficient tax revenue to meet its obligations.

- Mismanagement of public funds: Instances of corruption and mismanagement within the Greek government further exacerbated the fiscal crisis.

Consequences of Fiscal Irresponsibility

The fiscal irresponsibility led to a number of dire consequences:

- Sovereign debt crisis: Greece’s debt to GDP ratio soared to unsustainable levels, leading to a loss of investor confidence and credit rating downgrades.

- Economic contraction: The crisis triggered a severe economic downturn, characterized by high unemployment, reduced investment, and decreased standard of living.

- Social unrest: The economic hardship and austerity measures imposed as a result of the crisis sparked widespread protests and social unrest.

- Loss of international credibility: Greece’s reputation suffered due to its inability to manage its finances responsibly, impacting its ability to attract foreign investment.

Actions Taken to Address the Fiscal Irresponsibility

International bailout packages and stringent austerity measures were implemented to address the crisis. These measures included:

- Fiscal consolidation measures: Significant cuts to government spending, often impacting essential social programs and public services, were made.

- Tax reforms: New taxes and increased tax rates were introduced to boost government revenue.

- Structural reforms: Measures aimed at improving economic competitiveness and reducing bureaucracy were implemented.

- Debt relief: International organizations provided substantial debt relief to Greece, helping the country manage its financial burden.

Summary Table

| Time Period | Cause | Consequence | Resolution |

|---|---|---|---|

| 2009-2018 | High public spending, tax avoidance, economic stagnation, mismanagement | Sovereign debt crisis, economic contraction, social unrest, loss of international credibility | International bailout packages, austerity measures, debt relief |

Detailed Description of the Case Study

Greece’s debt crisis vividly illustrates the devastating effects of chronic fiscal irresponsibility. From 2009 onwards, Greece’s debt-to-GDP ratio climbed alarmingly, reaching levels that threatened the country’s economic stability and financial sustainability. This was exacerbated by the aforementioned factors. For example, the country’s debt-to-GDP ratio increased from approximately 110% in 2009 to over 175% by 2015. The resulting crisis prompted intervention from international organizations, resulting in significant financial aid packages and austerity measures.

The case study underscores the interconnectedness of economic factors and the crucial role of responsible fiscal management.

Strategies for Addressing Fiscal Irresponsibility

Fiscal irresponsibility, characterized by excessive spending and inadequate revenue generation, poses significant challenges to nations and organizations alike. Addressing this issue requires a multifaceted approach that encompasses a range of strategies, from prudent budgeting practices to robust regulatory frameworks. Effective solutions must not only mitigate current problems but also prevent future occurrences.Effective strategies for addressing fiscal irresponsibility necessitate a comprehensive understanding of the underlying causes and consequences.

Proactive measures, coupled with strong accountability mechanisms, are crucial for establishing sustainable financial health. This necessitates a shift from reactive crisis management to proactive prevention.

Budgetary Discipline and Planning, Its fiscal irresponsibility time

Sound fiscal management begins with a meticulously crafted budget that prioritizes essential expenditures and ensures revenue projections are realistic. A well-defined budget acts as a roadmap, guiding resource allocation and enabling informed decision-making. It helps identify potential fiscal risks early on, allowing for proactive adjustments. Furthermore, regular monitoring and evaluation of the budget’s performance are essential for identifying deviations and making necessary course corrections.

Revenue Enhancement Strategies

Boosting revenue streams is a crucial component of addressing fiscal irresponsibility. Strategies to achieve this can range from implementing efficient tax policies to fostering economic growth that generates more tax revenue. This might involve streamlining tax collection processes, improving tax compliance, or exploring alternative revenue sources, such as user fees or public-private partnerships. Identifying and capitalizing on untapped economic opportunities are vital in this regard.

Expenditure Efficiency and Prioritization

Minimizing wasteful spending is essential for responsible fiscal management. This involves identifying areas where expenditures can be reduced without compromising essential services. A critical analysis of existing expenditure patterns can highlight areas where efficiencies can be gained. Prioritizing essential services and programs based on their societal impact and cost-effectiveness is paramount. This requires a rigorous evaluation process, ensuring that resources are directed towards activities that yield the greatest return.

Debt Management and Sustainability

Responsible debt management is crucial for long-term fiscal sustainability. Strategies for managing public debt include negotiating favorable terms with creditors, diversifying funding sources, and implementing measures to reduce the debt burden over time. This often involves a combination of strategies, including reducing expenditure, increasing revenue, and restructuring debt obligations. It is important to avoid accumulating debt beyond manageable levels, which could lead to unsustainable debt servicing costs.

Strengthening Regulatory Frameworks

Robust regulatory frameworks are essential for preventing fiscal irresponsibility. This includes implementing stringent financial reporting requirements, establishing independent oversight bodies, and ensuring transparency in financial transactions. Clear guidelines and regulations concerning public spending and borrowing can provide a framework for responsible financial decision-making. Furthermore, the regulatory framework should be regularly reviewed and updated to address emerging challenges.

Promoting Transparency and Accountability

Transparency in government finances and accountability for financial decisions are critical components of effective fiscal management. This involves publishing detailed budget information, ensuring public access to financial data, and establishing mechanisms for auditing public funds. Furthermore, holding public officials accountable for their financial decisions is crucial. This creates a culture of responsibility and discourages irresponsible practices.

Proactive Measures and Education

Proactive measures, including preventative strategies and education initiatives, are vital in preventing fiscal irresponsibility. Education about the importance of fiscal responsibility and the consequences of irresponsibility can be delivered to the public. It can also involve fostering a culture of financial prudence within government institutions. Furthermore, proactive planning and monitoring are crucial for anticipating and mitigating potential financial risks.

Summary Table of Strategies

| Strategy | Potential Effectiveness | Examples |

|---|---|---|

| Budgetary Discipline and Planning | High | Detailed budget allocation, regular performance reviews, early risk identification |

| Revenue Enhancement Strategies | Medium to High | Streamlining tax collection, exploring alternative revenue sources, promoting economic growth |

| Expenditure Efficiency and Prioritization | High | Identifying and eliminating wasteful spending, prioritizing essential services |

| Debt Management and Sustainability | High | Negotiating favorable debt terms, diversifying funding sources |

| Strengthening Regulatory Frameworks | High | Implementing stringent financial reporting, independent oversight bodies |

| Promoting Transparency and Accountability | High | Public access to financial data, independent audits |

| Proactive Measures and Education | Medium to High | Public awareness campaigns, financial literacy programs, preventative planning |

Epilogue

In conclusion, understanding fiscal irresponsibility requires a holistic approach, considering the interplay of causes, consequences, and the crucial element of time. The consequences of poor financial management are far-reaching, impacting individuals, businesses, and entire economies. This exploration highlights the importance of responsible financial practices and the need for proactive strategies to mitigate the risks associated with fiscal irresponsibility. By recognizing the factors that contribute to these issues and developing effective solutions, we can strive for better financial health and stability across all sectors.