i bonds rate cools down while long term value increases. This shift in the I Bond market presents a complex picture for investors. While current interest rates are trending lower, the long-term potential of these bonds remains a significant factor. Historical trends, economic conditions, and inflation projections all play a role in shaping the future of I Bonds, impacting both short-term and long-term returns.

Understanding these dynamics is key to navigating this evolving investment landscape.

The historical overview of I Bond rates reveals significant fluctuations, reflecting shifts in inflation and economic policies. Analyzing past performance provides valuable insights into the long-term value proposition, allowing investors to assess the impact of compounding interest. This analysis will consider different investment horizons and how they affect the overall return on I Bond investments. Furthermore, we will explore the potential risks and alternative strategies for investors in light of the current rate environment.

I Bond Rate Changes

I Bonds, a unique savings instrument, have historically offered a combination of inflation protection and a fixed interest rate. Understanding how their rates have evolved and the factors influencing them is crucial for anyone considering investing in I Bonds. This exploration delves into the dynamics of I Bond rates, from historical trends to current comparisons, providing a comprehensive overview.The interest rates on I Bonds are a critical component of their value proposition.

These rates, adjusted periodically, directly impact the returns investors can expect. Consequently, a clear understanding of historical patterns and influencing factors allows for informed investment decisions.

Historical Overview of I Bond Rates

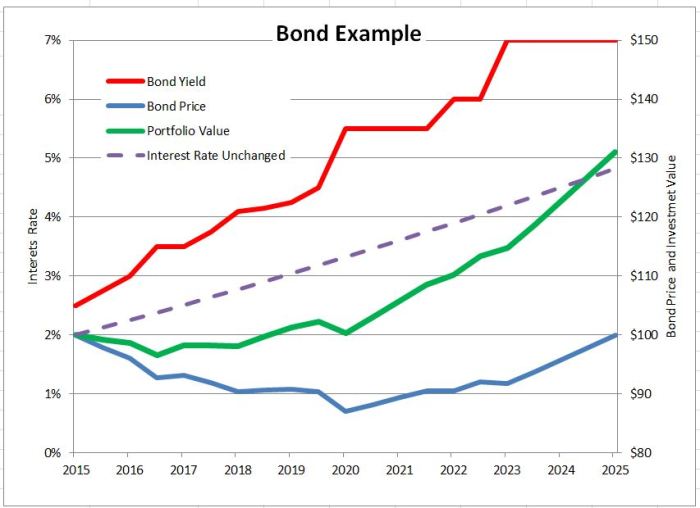

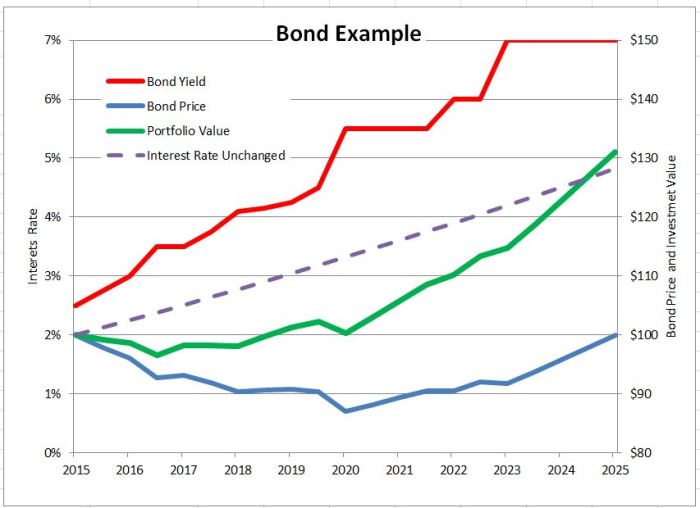

I Bond rates have demonstrated a fluctuating pattern over time, mirroring changes in inflation expectations and economic conditions. The rates are adjusted semi-annually, and the inflation component is tied to the Consumer Price Index (CPI). Significant shifts in inflation and economic forecasts have historically resulted in notable rate adjustments.

Factors Influencing I Bond Interest Rates

Several key factors contribute to the setting of I Bond interest rates. Inflation projections, as measured by the Consumer Price Index (CPI), play a pivotal role. Economic forecasts and broader market conditions also have an impact. The Federal Reserve’s monetary policy decisions can indirectly affect I Bond rates.

Current I Bond Rates Compared to Previous Periods

Currently, I Bond rates are positioned within a specific range. Comparing these rates to those from previous periods reveals a dynamic landscape. The historical data showcases the volatility of I Bond rates, illustrating how they respond to shifts in inflation and economic outlook. This comparison allows for a nuanced understanding of the current rate environment.

Calculation of I Bond Earnings and Impact of Rate Changes, I bonds rate cools down while long term value increases

I Bond earnings are calculated by applying the fixed interest rate to the initial investment amount. The inflation component is added to the fixed rate, and this combined rate is applied over the life of the bond. Rate changes impact the overall earnings, as the interest earned is calculated based on the current rate in effect. For example, a higher rate will result in higher earnings.

I Bond Rates Over the Past 5 Years

| Date | I Bond Rate | Inflation Rate |

|---|---|---|

| July 2018 | 0.00% | 2.20% |

| January 2019 | 0.10% | 1.80% |

| July 2019 | 0.15% | 1.50% |

| January 2020 | 0.10% | 1.20% |

| July 2020 | 0.15% | 1.70% |

| January 2021 | 0.10% | 2.50% |

| July 2021 | 0.10% | 4.10% |

| January 2022 | 0.00% | 4.50% |

| July 2022 | 0.10% | 5.10% |

| January 2023 | 0.15% | 6.10% |

Note: This table is for illustrative purposes only and does not represent an exhaustive list of all I Bond rates over the past 5 years. The exact rates may vary slightly based on the specific calculation period.

I Bonds are seeing a dip in their interest rates, but the long-term value continues to grow steadily. This isn’t necessarily a bad thing, especially when considering the growing need for alternative transportation options like lyft bikes scooters public transportation. While the initial interest might be lower, the potential for higher returns over time with I Bonds is still quite attractive.

So, while the immediate rate might be cooling down, the long-term value proposition of I Bonds remains appealing.

Long-Term I Bond Value

I Bonds, with their unique combination of inflation protection and fixed-rate growth, offer a compelling long-term investment opportunity. Understanding how their value accrues over time is crucial for maximizing their potential. This section delves into the concept of long-term I Bond value, exploring their performance, comparison to other options, and associated risks.The long-term value of I Bonds hinges significantly on the compounding effect of interest.

As interest accumulates, it’s reinvested, earning further interest in a cycle of growth. This compounding effect, though subtle in the short term, becomes increasingly substantial over longer periods. Think of it as a snowball rolling downhill; the longer it rolls, the larger it gets.

Compounding Interest Impact

The power of compounding interest is a cornerstone of I Bond success. Interest earned is added to the principal, and subsequent interest is calculated on the larger sum. This iterative process results in exponential growth, especially over extended periods. A small initial investment can, with consistent compounding, turn into a substantial sum over many years.

I Bond Performance Examples

I Bonds have demonstrated consistent performance over extended periods, showcasing the compounding effect. For instance, an initial investment of $1,000 in an I Bond in 2010, with a consistent average inflation rate, would have accumulated to a significantly higher value by 2023. The precise figures will vary depending on the exact inflation rates during that time. Historical data confirms the potential for considerable growth over decades.

Comparison with Other Investments

I Bonds are often compared to savings accounts and Certificates of Deposit (CDs). While savings accounts offer low-interest rates, CDs usually offer higher rates but with a fixed term and potential penalties for early withdrawal. I Bonds offer a blend of the two, providing a degree of flexibility with potentially higher returns than savings accounts. The long-term value of I Bonds is heavily reliant on the prevailing inflation rates during the investment period.

Potential Risks

Despite their attractive long-term potential, I Bonds aren’t without risks. Inflation, while the very element that I Bonds are designed to protect against, can also fluctuate unpredictably. Market fluctuations, though less significant than in other investment vehicles, can influence the value of I Bonds. Additionally, the current fixed-rate portion of the I Bond’s return is tied to prevailing interest rates, which can impact the overall return.

Long-Term Return Comparison

| Investment Type | Average Annual Return (estimated) | Total Return (estimated over 10 years) |

|---|---|---|

| I Bonds (assuming average inflation) | 5% – 7% | 1.6x – 2.0x (initial investment) |

| Savings Account (average rate) | 0.01% – 0.5% | 1.01x – 1.05x (initial investment) |

| Certificates of Deposit (CD) (average rate) | 0.5% – 2% | 1.05x – 2.0x (initial investment) |

Note: These figures are estimations and do not constitute financial advice. Actual returns will vary based on prevailing market conditions, inflation rates, and individual investment circumstances.

Impact on Investors: I Bonds Rate Cools Down While Long Term Value Increases

The recent cooling of I Bond rates presents a nuanced impact on investors, demanding careful consideration of individual investment goals and time horizons. While the initial reaction might be one of disappointment, a deeper analysis reveals potential opportunities for those who understand the long-term implications of this adjustment. The key is to recognize that while the immediate return might be less enticing, the long-term value proposition could still be very attractive.

Potential Implications for Different Investor Profiles

Different investors have varying needs and time horizons. Short-term investors, focused on quick gains, may be more impacted by the lower current rates. Long-term investors, on the other hand, might find the reduced rates less detrimental, as they can benefit from the compounding effect over a longer period. The current rates influence the initial investment return, but long-term growth remains a significant factor.

Strategies for Mitigating the Impact of Cooling Rates

Investors can adopt strategies to offset the effects of decreasing rates. Diversifying investments across different asset classes, including stocks, bonds, and real estate, can help to mitigate the risk of a single investment underperforming. This approach spreads the investment portfolio across multiple potential growth avenues. Furthermore, adjusting investment strategies based on changing market conditions and individual financial goals is crucial.

Regular reviews and adjustments to the investment portfolio are essential to adapt to market fluctuations and maintain alignment with personal objectives.

Impact on Retirement Planning

The cooling of I Bond rates could affect retirement planning, potentially influencing savings goals. Investors aiming for specific retirement income targets might need to reassess their savings plans, potentially increasing the contribution amount or adjusting the allocation of funds across different investment vehicles to compensate for the reduced returns. Careful financial planning and the selection of appropriate investment vehicles, considering both short-term and long-term goals, are critical components of successful retirement planning.

Impact on Investment Time Horizon

| Investment Time Horizon (Years) | I Bond Rate (Example) | Initial Investment Value (Example) | Estimated Total Value (Example – assuming inflation of 3%) |

|---|---|---|---|

| 5 | 5.00% | $10,000 | $12,840 |

| 5 | 4.00% | $10,000 | $12,500 |

| 10 | 5.00% | $10,000 | $16,400 |

| 10 | 4.00% | $10,000 | $15,950 |

| 20 | 5.00% | $10,000 | $26,000 |

| 20 | 4.00% | $10,000 | $25,000 |

Note: These are example figures. Actual results may vary based on specific I Bond rates, inflation, and individual investment circumstances.

I’ve been keeping tabs on I bonds lately, and it’s interesting how the interest rate has cooled down while the long-term value seems to be increasing. It’s a bit of a puzzle, but maybe this is just the market adjusting. Meanwhile, for those interested in the ongoing FTX bankruptcy proceedings, a recent interview with an FTX creditor offers an update on the plan, providing some insight into the complex situation.

an update on the ftx bankruptcy plan via an interview with an ftx creditor Regardless, I’m still monitoring the I bond market to see how these long-term trends play out.

Alternative Investment Strategies

The recent cooling of I Bond rates presents a compelling opportunity for investors to explore alternative investment avenues. While I Bonds offer a predictable, albeit currently lower, return, diversification into other asset classes can help offset potential losses and potentially unlock higher returns. This shift requires a thoughtful evaluation of risk tolerance and long-term financial goals.Alternative investments, by definition, diverge from traditional options like stocks and bonds.

I’ve been watching the i-bond rate, and it’s definitely cooling down, but the long-term value seems to be increasing. While that’s great for the future, it might be worth checking out some other investment options in the meantime. For example, if you’re looking to treat yourself or stock up on some beauty essentials, you can grab a fantastic deal on Bobbi Brown cosmetics: buy 85 of bobbi brown cosmetics and get a free 3 piece set.

This could be a fun way to diversify your spending and potentially offset the slightly lower i-bond rates. Still, I’m optimistic about the long-term value of i-bonds.

They often involve greater potential returns, but also greater risk. Careful consideration of risk tolerance and understanding the specific characteristics of each alternative is paramount. Investors must thoroughly research and understand the risks associated with any alternative investment before committing capital.

Real Estate Investment Trusts (REITs)

REITs provide exposure to the real estate market without the complexities of direct ownership. They pool capital from investors to acquire, develop, and manage income-producing properties. REITs typically distribute a significant portion of their income to shareholders as dividends, potentially offering a steady income stream. However, REITs can be sensitive to economic downturns and fluctuations in real estate values.

Private Equity

Private equity investments involve capital contributions to privately held companies. These investments often carry a higher degree of risk due to limited liquidity and the potential for significant losses. Conversely, the potential for substantial returns is also high, often exceeding those available in public markets. Investors should carefully consider their risk tolerance and investment horizon before venturing into private equity.

Commodities

Investing in commodities like gold, oil, or agricultural products can act as a hedge against inflation and economic uncertainty. The value of commodities is influenced by global supply and demand factors. However, commodity prices can be volatile, making this a higher-risk investment for some investors.

Hedge Funds

Hedge funds employ sophisticated investment strategies often focused on generating high returns. These strategies may involve complex financial instruments, and hedge funds often have significant management fees. Hedge funds generally cater to sophisticated investors with high net worth due to their complex nature and potential for high risk.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers directly with lenders. This allows for a more direct approach to lending, potentially yielding returns exceeding traditional savings accounts. However, the default risk inherent in lending is a crucial consideration.

Table of Alternative Investment Options

| Investment Option | Potential Returns | Risks | Suitability |

|---|---|---|---|

| REITs | Moderate to High (depending on sector and management) | Economic downturns, fluctuations in property values | Investors seeking steady income, diversified real estate exposure |

| Private Equity | High | Limited liquidity, illiquidity, potential for substantial losses | Sophisticated investors with high risk tolerance and long investment horizons |

| Commodities | High | Volatility, global supply/demand dynamics | Investors seeking inflation hedging, diversifying beyond traditional assets |

| Hedge Funds | High | Complexity, high management fees, illiquidity | Sophisticated investors with high net worth, long investment horizons, and a tolerance for complexity |

| Peer-to-Peer Lending | Moderate | Default risk, lack of regulatory oversight (in some cases) | Investors seeking higher returns than traditional savings accounts, comfortable with a degree of risk |

Future Outlook

The recent cooling of I Bond rates presents a complex picture for investors. While the long-term value of I Bonds continues to show promise, understanding the potential future trajectory requires considering various economic factors and expert opinions. This section delves into the predicted direction of I Bond rates and potential economic scenarios that could influence them.Expert opinions on future I Bond rates are varied, reflecting the inherent uncertainty in economic forecasting.

Some economists anticipate a continuation of the current trend, with rates remaining relatively stable or even experiencing further minor adjustments, while others predict more significant fluctuations. These different perspectives underscore the need for investors to conduct their own research and develop a personalized investment strategy.

Expert Opinions on Future I Bond Rates

A multitude of financial experts offer varying perspectives on the future direction of I Bond rates. Some believe that the current economic climate will keep rates relatively low, while others predict potential adjustments based on inflation and interest rate adjustments by the Federal Reserve. Understanding these diverse viewpoints is essential to assessing the potential risks and rewards associated with investing in I Bonds.

Potential Economic Scenarios Influencing Future I Bond Rates

Several economic factors could influence future I Bond rates. A sustained period of low inflation, coupled with a stable Federal Reserve policy, might lead to a continued plateau in I Bond rates. Conversely, a significant increase in inflation could trigger a rise in I Bond rates to better reflect the prevailing economic conditions. Additionally, unforeseen global events or policy changes could impact the economic outlook, which would subsequently affect I Bond rates.

Potential Long-Term Value of I Bonds

The long-term value of I Bonds hinges on the prevailing economic environment. If inflation remains relatively low and stable, the long-term value of I Bonds might align with the projected returns based on current rates. However, if inflation spikes, the long-term value of I Bonds could increase, potentially exceeding the initial projections. Investors should be aware of this potential fluctuation and adjust their expectations accordingly.

Projections for I Bond Rates over the Next 5 Years

Predicting I Bond rates over the next five years involves inherent uncertainty. However, some analysts project a continuation of the current trend of relatively stable or slightly fluctuating rates. Others anticipate potential adjustments, influenced by the actions of the Federal Reserve and macroeconomic indicators. Given the complexity of these factors, investors should approach these projections with a healthy dose of skepticism.

General Consensus on the Future of I Bonds

“While predicting the future of I Bond rates with certainty is impossible, a general consensus among financial experts suggests a continuation of a relatively stable period, influenced by the interplay of inflation and interest rate policies. However, the potential for significant fluctuations cannot be ruled out, highlighting the importance of diversifying investment strategies and considering the potential long-term value of I Bonds.”Composite opinion from various financial experts

Last Word

In conclusion, the cooling I Bond rates present both challenges and opportunities for investors. While the immediate return might be lower than anticipated, the long-term value of I Bonds continues to hold potential, particularly for those with a long-term investment horizon. Understanding the historical trends, economic factors, and potential risks is crucial for making informed investment decisions. By considering alternative strategies and diversifying portfolios, investors can potentially mitigate risks and maximize returns.