Google getting ready to sell auto insurance and maybe buy CoverHound is shaking up the industry. This potential move by the tech giant into the world of insurance raises many questions. How will Google leverage its technology to compete with established players? What does this mean for CoverHound’s future? And how might consumers benefit or be impacted?

This deep dive explores Google’s potential entry into the auto insurance market, analyzing the strengths and weaknesses compared to competitors. We’ll also examine CoverHound’s position, potential impact of a Google acquisition, and the technological innovations Google could bring. Finally, we’ll discuss the regulatory hurdles, competitive landscape, and potential public perception of this major shift in the insurance sector.

Google’s Potential Entry into Auto Insurance Market

Google’s expanding presence in the financial services sector, with ventures like Google Pay and its burgeoning array of financial products, suggests a broader ambition to offer comprehensive financial solutions. This expansion hints at a strategic approach to potentially leveraging its vast data resources and technological capabilities to disrupt existing industries. The company’s foray into the auto insurance market would represent a significant step in this direction.Google’s current financial services offerings are primarily focused on enabling transactions and providing basic financial tools.

The company has not yet directly competed in the complex and regulated space of insurance. This potential entry into the auto insurance market, therefore, is a notable shift, hinting at Google’s desire to create a more comprehensive financial ecosystem.

Google’s Current Financial Services Presence

Google’s financial services presence is characterized by its existing payment platforms, such as Google Pay, which allows for seamless transactions and provides a foundation for future financial offerings. Google’s foray into financial services also includes a range of products and partnerships, showcasing its ambition to build a comprehensive financial ecosystem. This includes collaborations and investments in financial technology companies, demonstrating Google’s strategic approach to expanding its reach in the financial sector.

Google’s getting ready to dive into the auto insurance market, potentially snapping up CoverHound. It’s a fascinating move, especially considering the recent tech trends. Meanwhile, I’ve been having a blast in this awesome quest game, i took Elon Musk’s advice and nuked Mars in this amazing quest game , which has been incredibly engaging. All this tech innovation makes me wonder if the insurance market is about to get a major shake-up, like the one I experienced in the game when I nuked Mars! Maybe this whole auto insurance thing is going to be just as exciting.

Potential Motivations for Entering the Auto Insurance Market

Google’s motivations for entering the auto insurance market likely stem from several key factors. First, leveraging its massive data sets, Google can potentially analyze driving patterns, accident rates, and other factors to offer highly personalized and accurate insurance premiums. Second, Google can use its technological expertise to create innovative user experiences, making the insurance process more efficient and user-friendly.

Third, Google aims to expand its financial services portfolio and establish a stronger position in the broader financial ecosystem.

Potential Advantages of Google Entering the Market

“Data-driven pricing models and personalized services are key to attracting customers in the competitive insurance market.”

The advantages of Google entering the auto insurance market include the potential for highly personalized pricing based on individual driving behavior and risk profiles. Google’s vast data collection and analytics capabilities can allow for more accurate risk assessment, potentially leading to lower premiums for safe drivers and higher premiums for those with a higher accident risk. This data-driven approach could also lead to improved claims processing and faster settlements.

Google’s user-friendly interface and existing online presence can also simplify the insurance purchasing and management process for customers.

Potential Disadvantages of Google Entering the Market

There are also significant disadvantages to consider. Navigating the complex regulatory landscape of the insurance industry is a major hurdle. Building trust and credibility in a highly regulated sector will take time and effort. Furthermore, Google will face fierce competition from established insurance companies, who have years of experience and established customer bases.

Potential Strategies for Competition

Google’s potential strategies to compete with existing players include:

- Focusing on niche markets, such as young drivers or specific geographic regions, where Google can leverage its data and targeting capabilities to provide competitive rates.

- Leveraging its existing technology infrastructure to streamline the claims process and improve customer service.

- Offering innovative insurance products, such as customized packages tailored to specific needs and driving habits.

- Partnering with insurance brokers and agents to expand its reach and offer a broader range of coverage options.

Comparison of Google’s Strengths and Weaknesses Against Competitors

| Competitor A (e.g., Progressive) | Competitor B (e.g., State Farm) | ||

|---|---|---|---|

| Data Analysis Capabilities | Strong | Moderate | Moderate |

| Technological Innovation | Strong | Moderate | Moderate |

| Brand Recognition | High | High | Very High |

| Insurance Industry Expertise | Low | Very High | Very High |

| Regulatory Compliance Knowledge | Low | Very High | Very High |

CoverHound’s Role and Potential Impact

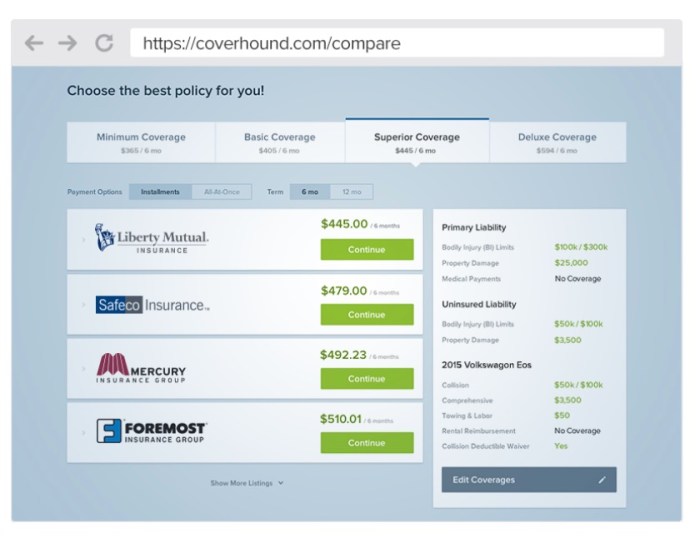

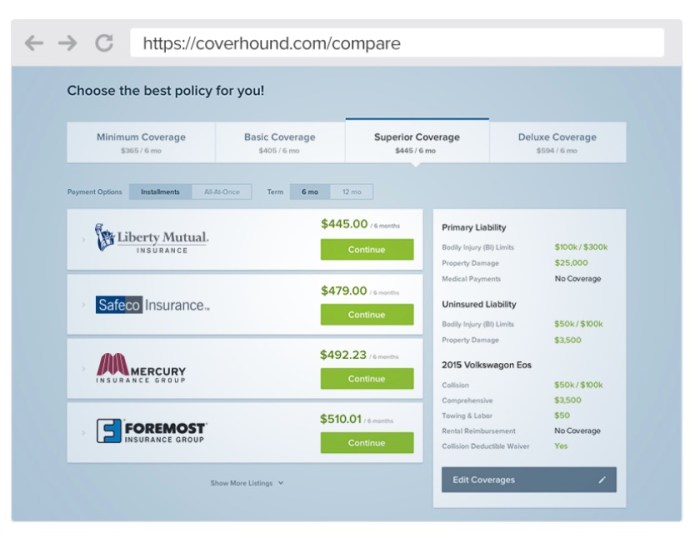

Google’s potential foray into the auto insurance market, potentially including the acquisition of CoverHound, raises intriguing questions about the future of the industry. CoverHound, a well-established online comparison platform, currently plays a significant role in helping consumers navigate the often-complex world of auto insurance. Understanding its current position and potential future trajectory under Google’s ownership is crucial to assessing the overall impact on the market.

CoverHound’s Current Business Model and Target Market

CoverHound operates as a digital marketplace connecting consumers with various auto insurance providers. Their core business model revolves around providing a user-friendly platform where customers can compare quotes from different insurers. This allows consumers to quickly identify the best deals and potentially save money on their insurance premiums. CoverHound’s target market encompasses a broad spectrum of drivers, including those seeking cost-effective solutions and those who prioritize specific coverage types, like accident forgiveness.

Potential Benefits and Risks for CoverHound if Acquired by Google

An acquisition by Google presents both potential benefits and risks for CoverHound. A major benefit would be access to Google’s vast resources, including its sophisticated technology infrastructure and extensive user base. This could lead to increased platform traffic, improved user experience, and enhanced data analytics capabilities for refining insurance offerings. However, integration with Google’s existing operations and adapting to Google’s corporate culture could pose challenges.

There’s also the possibility of potential conflicts of interest if Google leverages CoverHound’s data to benefit its other business ventures. Furthermore, a shift in CoverHound’s brand identity or service offerings could alienate existing customers accustomed to the current model.

Comparison of Google and CoverHound’s Customer Bases

Google’s massive user base spans across various demographics and interests. CoverHound, on the other hand, has a more niche focus on auto insurance shoppers. While there’s significant overlap in their customer bases, the differences exist. Google’s extensive data collection capabilities could help tailor CoverHound’s services to specific customer segments, but it also necessitates a delicate balance to avoid alienating the existing CoverHound clientele.

Reshaping the Auto Insurance Landscape

Google’s acquisition of CoverHound could reshape the auto insurance landscape by potentially creating a more competitive and customer-centric market. The combination of Google’s technological prowess and CoverHound’s existing customer relationships could lead to innovative insurance products and streamlined comparison processes. The integration of Google’s AI and machine learning capabilities could result in more accurate risk assessments, potentially offering personalized insurance options and further reducing costs for consumers.

Potential Changes in the Auto Insurance Market

| Current State | Potential Future State | Impact |

|---|---|---|

| Fragmented auto insurance market with various providers and comparison platforms | Potential consolidation with Google leveraging data to offer personalized and cost-effective insurance | Increased competition, potentially lower premiums for consumers |

| Limited personalized insurance options for customers | Development of tailored insurance plans based on individual driving habits and risk profiles using advanced analytics | Improved customer experience, enhanced value proposition for consumers |

| Traditional insurance providers struggle to compete with online comparison platforms | Increased pressure on traditional insurers to adapt and innovate their services, possibly leading to reduced costs and better coverage | Increased innovation and efficiency in the auto insurance industry |

Technological Implications and Innovations

Google’s potential foray into the auto insurance market promises exciting technological advancements. Leveraging its vast data resources and sophisticated AI capabilities, Google could reshape the entire landscape of insurance, offering greater transparency, efficiency, and personalized experiences for both customers and insurers. This innovative approach has the potential to revolutionize how auto insurance is priced, processed, and understood.Google’s extensive experience in data analysis, machine learning, and AI can be applied to significantly improve the auto insurance sector.

This includes developing more accurate risk assessments, enhancing claims processing, and providing customers with tailored insurance products. This transformation is poised to improve the customer experience, while also potentially lowering costs for consumers.

Data Analytics for Personalized Pricing

Google’s vast data collection capabilities allow for the creation of highly granular customer profiles. This data, combined with real-time driving data (with user consent), can inform precise risk assessments. Factors such as driving behavior, location, and vehicle type can be meticulously analyzed to tailor insurance premiums to individual needs. This personalized approach moves away from generalized risk profiles, potentially leading to more accurate and fair pricing for drivers.

For example, a driver with a proven history of safe driving could receive a lower premium, while a driver with a higher accident risk would be appropriately charged more.

AI-Powered Claims Processing

AI can significantly streamline the claims process. Sophisticated algorithms can analyze images and video data from accidents, aiding in faster and more accurate assessments. This automation could drastically reduce the time it takes to process a claim, potentially resolving issues within days instead of weeks. Furthermore, AI can identify fraudulent claims more effectively, thus mitigating losses and enhancing the overall efficiency of the claims process.

For example, an AI system might analyze damage patterns in accident photos to quickly determine the extent of the damage and trigger the appropriate claim response.

Machine Learning for Enhanced Risk Assessment

Machine learning models can analyze a vast array of data points, from driving patterns to weather conditions, to predict the likelihood of accidents. This advanced approach allows insurers to identify and assess risks with greater accuracy. By identifying trends and patterns in driving behavior, Google can help determine risk profiles more accurately, leading to better risk assessment and premium adjustments.

Consider a scenario where a machine learning model identifies a particular route is prone to accidents during rush hour, it can then provide customized risk assessments for drivers traveling that route.

Transparency and Efficiency

Google’s potential entry could usher in a new era of transparency in auto insurance. By leveraging its data analytics and AI capabilities, the company can provide clear and understandable explanations for pricing and risk assessment. This transparency can lead to greater customer trust and satisfaction. Moreover, the increased efficiency in claims processing and risk assessment could lead to lower administrative costs, ultimately benefitting consumers.

Potential Technological Improvements

- Predictive Modeling: Using vast data sets to anticipate potential accidents and adjust premiums proactively.

- Personalized Risk Profiles: Creating customized risk profiles for individual drivers based on their unique driving behaviors and vehicle characteristics.

- Real-Time Risk Assessment: Adapting insurance policies in real-time based on immediate driving conditions, such as weather and traffic.

- Improved Claims Resolution: Implementing automated systems for claims processing, using data and image analysis to speed up claim resolution.

- Driver Behavior Monitoring and Coaching: Offering tools to drivers to improve their driving habits and potentially reduce insurance costs.

Competitive Landscape and Potential Disruptions

Google’s potential foray into the auto insurance market is not a simple matter of adding another product line. It’s a significant challenge to an established industry, poised to disrupt the status quo by leveraging its vast data resources and technological prowess. This entry will inevitably trigger a cascade of responses from existing players, reshaping the competitive landscape in ways we’re only beginning to imagine.

Key Players and Market Share

The auto insurance market is dominated by established players, each with decades of experience and significant market share. Companies like State Farm, Geico, Allstate, and Progressive have built extensive distribution networks and customer bases. Data on exact market share varies slightly depending on the source and reporting period, but these companies consistently hold the majority of the market.

Understanding their current market positions is crucial to assessing Google’s potential impact.

Google’s Potential Competitive Advantage

Google’s entry into the auto insurance market presents a unique challenge to incumbents. Its access to vast amounts of data, including location data, driving habits, and even social media activity, allows for potentially highly accurate risk assessments. This could lead to highly personalized premiums, attracting customers seeking competitive pricing. Google’s established online presence and digital marketing capabilities could also significantly impact how insurance is sold and marketed.

Furthermore, Google can leverage its artificial intelligence capabilities to analyze data and provide better predictive modeling of risk, potentially offering tailored coverage and discounts.

Potential Disruptions to the Status Quo

Google’s entry into the auto insurance market will likely create several disruptions to the status quo. The most immediate effect is likely to be a price war, as Google attempts to capture market share by offering more competitive rates. Existing players might react by adjusting their pricing strategies, introducing new bundled services, or focusing on specific customer segments.

Further disruptions could come from innovative product offerings, such as entirely new insurance models based on usage-based insurance or real-time risk assessments. Google’s potential entry could also prompt other tech companies to enter the market, fostering further competition and innovation.

Potential Reactions from Other Insurance Companies

The established insurance companies are likely to react in several ways to Google’s entry. Some will likely try to adapt their existing business models to compete with Google’s data-driven approach, perhaps by improving their own data collection and analysis capabilities. Others might adopt a defensive posture, focusing on their existing customer base and traditional distribution channels. Some might even consider acquisitions or partnerships to maintain their market share or gain a foothold in emerging technologies.

Summary of Competitive Landscape and Potential Changes

| Company | Market Share (Estimated) | Potential Response |

|---|---|---|

| State Farm | ~15% | Likely to adjust pricing strategies, potentially explore new data-driven approaches, and emphasize customer loyalty programs. |

| Geico | ~12% | Likely to emphasize competitive pricing and explore partnerships to improve data analysis. |

| Allstate | ~9% | Potential to focus on targeted marketing campaigns and develop innovative risk assessment tools. |

| Progressive | ~8% | May implement usage-based insurance programs and focus on digital channels. |

| Google (Potential Entry) | 0% (Initially) | Likely to offer highly competitive pricing, leverage data-driven insights, and employ aggressive digital marketing strategies. |

Regulatory and Legal Considerations

Google’s foray into the auto insurance market, potentially including the acquisition of CoverHound, presents a complex web of regulatory and legal hurdles. Navigating these challenges will be crucial for Google’s success and for ensuring consumer protection. The sheer scale and reach of Google, coupled with the sensitive nature of insurance, necessitates careful consideration of potential impacts on competition, consumer rights, and market stability.The regulatory landscape surrounding insurance is highly fragmented and varies significantly by jurisdiction.

This poses unique challenges for a company like Google, accustomed to a more standardized digital environment. Google will need to meticulously understand and comply with each state’s unique regulations, creating a substantial logistical and legal undertaking. Additionally, any potential acquisition of CoverHound will bring its own set of legal implications that need careful consideration, potentially requiring adjustments to existing business practices and compliance procedures.

Potential Regulatory Hurdles

Google’s entry into the auto insurance market faces several potential regulatory challenges. These include issues related to data privacy, anti-trust concerns, and the unique complexities of state-based insurance regulations. Existing insurance regulations are often highly specific and vary greatly between states, making compliance a significant hurdle. This creates a challenging environment for a tech giant accustomed to a more centralized and streamlined approach.

Google’s foray into auto insurance, potentially including a buy-out of Coverhound, raises interesting questions about data security. The sheer volume of customer information Google would handle necessitates robust security measures, especially considering the security obstacle to the cloud. This crucial aspect needs careful consideration to avoid any breaches and maintain customer trust. Ultimately, Google’s success in this new market will hinge on their ability to protect user data.

Furthermore, the increasing scrutiny of Big Tech companies in the financial sector underscores the importance of demonstrating responsible and transparent practices.

Legal Implications of a CoverHound Acquisition

A potential acquisition of CoverHound by Google raises legal questions about potential anti-trust violations. Anti-trust laws aim to prevent monopolies and maintain fair competition within markets. Mergers that could reduce competition or stifle innovation may face scrutiny from regulatory bodies. A thorough analysis of market share, potential impact on consumers, and the competitive dynamics of the insurance sector will be crucial in addressing these concerns.

The acquisition would likely trigger reviews by state insurance departments and federal agencies. Previous examples of similar mergers in other sectors provide valuable insight into the types of legal challenges that might arise.

Challenges Due to Regulatory Frameworks

Regulatory frameworks in the insurance industry are often fragmented and complex. Each state has its own set of rules and regulations regarding insurance operations. This contrasts sharply with the more streamlined approach often seen in other tech sectors. Google, accustomed to operating in a relatively uniform digital environment, will need to adapt to this highly localized regulatory landscape.

The varied regulations across different states could potentially impact the operational efficiency and cost structure of Google’s insurance offerings.

Regulatory Considerations in Similar Markets

Examples from other industries offer insights into the regulatory challenges Google might face. The entry of large tech companies into financial sectors, such as banking or lending, often triggers regulatory scrutiny and necessitates compliance with specific guidelines. In the case of banking, there are strict regulations regarding capital adequacy, risk management, and consumer protection. These regulations are designed to maintain the stability and integrity of the financial system.

Applying these lessons to Google’s insurance foray is critical to mitigating potential risks.

Google’s foray into auto insurance, potentially including a CoverHound acquisition, is intriguing. It’s a significant shift, but it also raises questions about data collection practices. Meanwhile, Apple’s privacy icon on iOS, macOS High Sierra, and other systems highlights the growing concern around personal information security. This emphasizes the importance of user data control , which is something to consider when thinking about Google’s potential auto insurance service.

Ultimately, the market for auto insurance is ripe for disruption, and Google’s entry will be fascinating to watch.

Potential Regulatory Issues

| Issue | Potential Solution | Impact |

|---|---|---|

| State-specific insurance regulations | Develop a highly localized compliance strategy that adapts to each state’s specific regulations. Engage with state insurance departments to gain a thorough understanding of requirements. | Compliance costs may increase, and the operational complexity will likely increase, but this is necessary to achieve compliance and market access. |

| Antitrust concerns | Conduct thorough market analysis to assess the potential impact of the acquisition on competition. Demonstrate the benefits of the acquisition to consumers, such as potentially lower premiums or increased innovation. | Potential legal challenges and delays in regulatory approvals could significantly impact Google’s timeline and strategy. |

| Data privacy concerns | Implement robust data security measures and ensure compliance with relevant data privacy regulations (e.g., GDPR, CCPA). Provide clear and transparent data handling policies to consumers. | Negative publicity and potential legal action could harm Google’s reputation and brand. Strict adherence to privacy regulations is vital to consumer trust. |

Public Perception and Consumer Impact

Google’s potential foray into the auto insurance market is poised to generate considerable public interest and diverse consumer reactions. The sheer scale and reputation of Google, coupled with its existing data-driven approach in other sectors, will undoubtedly influence how consumers perceive its entry into this traditionally conservative market. The public’s perception will be shaped by factors ranging from trust in Google’s handling of sensitive personal data to the perceived value proposition of its insurance offerings.

Potential Consumer Reactions, Google getting ready to sell auto insurance and maybe buy coverhound

Consumer reactions to Google’s auto insurance will likely be multifaceted. Some consumers might view Google’s entry with skepticism, concerned about the potential for increased data collection and its implications for privacy. Others might be attracted by the promise of innovative services and potentially competitive pricing, particularly if Google leverages its vast data resources to create a more personalized and efficient insurance experience.

The perceived trustworthiness of Google’s brand and its commitment to user privacy will be crucial in shaping these reactions.

Potential Impact on Consumer Choice and Affordability

Google’s entry into the auto insurance market could significantly impact consumer choice and affordability. Competition from a tech giant could force existing insurers to adapt their pricing strategies and service offerings. This could lead to more competitive premiums, particularly for those who align with Google’s data-driven underwriting models. However, it could also lead to potential displacement of smaller, local insurance providers.

The availability of more diverse insurance options might lead to a more nuanced and competitive market, benefiting consumers who previously had limited choices.

Potential Consumer Concerns and Expectations

Consumer concerns and expectations regarding Google’s entry into the auto insurance space will vary considerably. Some will focus on privacy, while others will be interested in cost savings and improved services.

| Concern | Expectation | Potential Impact |

|---|---|---|

| Data Privacy | Transparency and control over data usage. Assurance that personal information is handled securely and ethically. | Google’s reputation and handling of user data in other contexts will be closely scrutinized. Trust-building initiatives and clear privacy policies will be essential for success. |

| Pricing Competitiveness | Lower premiums and more tailored pricing options based on individual driving behavior and risk profiles. | Existing insurers may respond by matching or lowering their own premiums. Consumers will benefit from increased choice and potentially lower costs. |

| Service Quality and Convenience | Ease of use, digital accessibility, and personalized services (e.g., real-time claims processing). | A seamless digital experience could lead to greater customer satisfaction and loyalty. Conversely, technical glitches or a lack of personalized service could negatively impact perception. |

| Customer Support | Reliable and accessible customer support channels. | Google’s existing infrastructure for customer service may or may not translate effectively to the insurance domain. A strong support system is critical. |

| Transparency of Risk Assessment | Understanding how Google evaluates driving risk and how it affects premiums. | Clear communication about risk assessment methods and factors is crucial to build trust. |

Final Summary: Google Getting Ready To Sell Auto Insurance And Maybe Buy Coverhound

Google’s potential foray into auto insurance, possibly including the acquisition of CoverHound, promises significant changes. The implications for consumers, the competitive landscape, and the industry as a whole are substantial. From technological advancements to regulatory hurdles, this move has the potential to dramatically reshape how we insure our vehicles. Stay tuned as we navigate the complexities of this emerging market.