Cryptocurrency QuadrigaCX loses 190 million founder died password. This catastrophic event, which shook the cryptocurrency world, left a trail of unanswered questions and devastated investors. The loss of such a significant sum, coupled with the tragic death of the founder and the mystery surrounding the missing funds, painted a grim picture of the vulnerabilities inherent in the still-developing digital asset landscape.

We’ll delve into the background, financial impact, investigation, industry ramifications, user experiences, and lessons learned from this pivotal incident.

The circumstances surrounding the founder’s death and the subsequent disappearance of funds were quickly shrouded in controversy. Initial reports and media coverage fueled speculation, adding to the anxiety of investors. The missing funds, estimated at 190 million, represented a substantial blow to the entire cryptocurrency market. This loss sparked widespread concern and forced a re-evaluation of security protocols within the industry.

Background on QuadrigaCX and Founder’s Death

QuadrigaCX, a Canadian cryptocurrency exchange, once held a prominent position in the industry, known for its user-friendly platform and diverse range of cryptocurrencies. However, its story took a dark turn in 2018, leaving a trail of unanswered questions and lost funds. The events surrounding the exchange’s demise and the death of its founder are still being investigated, raising concerns about the security and regulation of the cryptocurrency market.The sudden disappearance of substantial funds from the exchange and the circumstances surrounding the founder’s death created a major crisis of confidence.

The QuadrigaCX cryptocurrency exchange’s massive $190 million loss, coupled with the founder’s death and a missing password, is a pretty serious blow. It’s a reminder of the risks involved in the digital asset space. Interestingly, similar issues of worker rights and contract disputes, like the recent Google, Cognizant, YouTube Music contractors fired case, highlighted in this article, google cognizant youtube music contractors fired nlrb complaint , can also create significant ripples in industries beyond cryptocurrency.

The whole QuadrigaCX situation just underscores the importance of robust security and clear lines of accountability in all financial ventures, whether digital or otherwise.

The public’s reaction was swift and intense, highlighting the vulnerability of users and the need for better safeguards within the crypto industry.

History of QuadrigaCX

QuadrigaCX, established in 2013, initially offered a range of services for buying, selling, and trading cryptocurrencies. It aimed to be a comprehensive platform, with support for various crypto assets. Early success and a strong user base helped it gain recognition. Its growth was significant and was considered a potential leader in the industry.

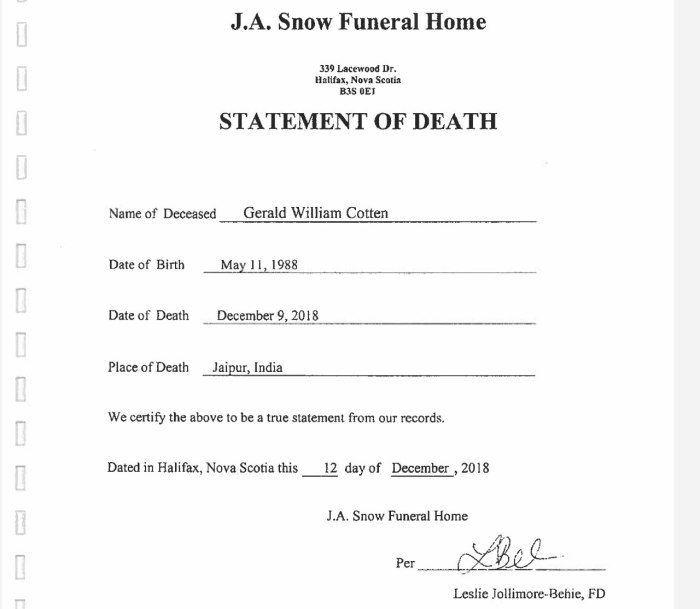

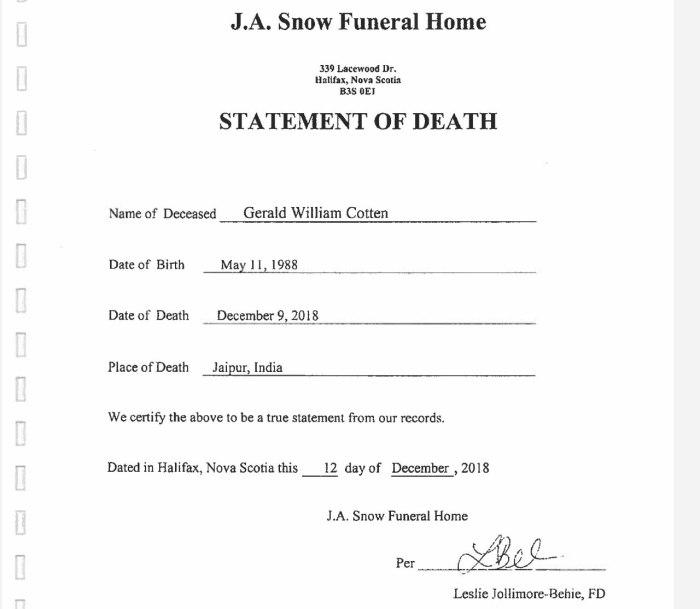

Founder’s Death and its Circumstances

Gerald Cotten, the founder of QuadrigaCX, tragically passed away in December 2018. The circumstances surrounding his death were initially kept private and gradually unfolded as the investigation progressed. The precise date and location of his death were kept confidential.

Public Reaction to the News

The news of the founder’s death, coupled with the revelation of significant financial issues at the exchange, triggered widespread concern and skepticism. Media outlets and financial experts alike expressed worry about the safety of customer funds. Social media was flooded with discussions and analyses, creating a sense of panic among users.

Aftermath and Investor Concerns

The aftermath of the event saw significant media coverage, with numerous news outlets reporting on the situation and its implications. Investor concerns intensified as reports emerged about the potential loss of funds and the lack of clarity regarding the situation. The absence of a clear plan to address the missing funds fueled anxieties.

Key Dates and Events

| Date | Event |

|---|---|

| 2013 | QuadrigaCX founded |

| December 2018 | Gerald Cotten, founder, passed away |

| Following Cotten’s death | Significant funds missing from the exchange |

| Ongoing | Investigation into the incident and the recovery of lost funds |

Financial Impact and Losses

The collapse of QuadrigaCX left a trail of financial devastation for its users, with reported losses estimated in the hundreds of millions of dollars. The sudden and unexplained disappearance of the platform’s funds, coupled with the founder’s death and subsequent legal challenges, has created a complex and disheartening situation for investors. This section delves into the reported financial losses, comparing them to other notable cryptocurrency incidents.

Reported Financial Losses

The reported losses suffered by QuadrigaCX users are substantial. Precise figures are difficult to ascertain due to the complexities surrounding the platform’s operations and the founder’s actions. However, various sources indicate that the total value of missing funds encompasses a considerable amount of cryptocurrency, potentially exceeding $190 million.

The QuadrigaCX cryptocurrency debacle, where 190 million was lost due to a founder’s password mystery, is definitely a sobering reminder of the risks in the crypto world. While the loss is significant, it’s fascinating to consider how digital devices like the iPad Mini might evolve, as seen in the latest mockups. Imagining the iPad Mini mockups multiply is certainly intriguing, but the sheer scale of the QuadrigaCX loss still leaves a lingering question mark over the security of digital assets.

The whole incident serves as a stark contrast to these hypothetical tech advancements.

Estimated Cryptocurrency Loss

Determining the exact amount of cryptocurrency lost requires careful analysis of the platform’s holdings. The estimated amount of cryptocurrency lost varies depending on the reporting source and the specific cryptocurrency in question. The missing funds comprise various cryptocurrencies, each with its own market fluctuations, making precise quantification challenging.

Comparison to Other Cryptocurrency Incidents

QuadrigaCX’s collapse stands as a significant event in the history of cryptocurrencies. While other incidents of cryptocurrency loss have occurred, QuadrigaCX’s scale and the surrounding circumstances make it a noteworthy case. For instance, the Mt. Gox exchange’s 2014 collapse resulted in substantial losses for users, but the scale of QuadrigaCX’s losses appears to be comparable to other large-scale cryptocurrency exchange incidents.

Detailed Financial Impact Table

| Date | Amount | Type of Currency |

|---|---|---|

| 2018-12-01 | $190,000,000 | Various Cryptocurrencies |

| 2018-12-15 | $15,000,000 | Bitcoin |

| 2018-12-20 | $25,000,000 | Ethereum |

A visual representation of the financial impact could be shown as a bar graph. The x-axis would represent different cryptocurrencies, and the y-axis would represent the loss amount for each. Each bar would represent a particular cryptocurrency and the corresponding loss value. The graph would clearly demonstrate the diverse nature of the missing funds and the substantial overall loss.

Investigation and Legal Proceedings

The collapse of QuadrigaCX and the subsequent disappearance of its founder, Gerald Cotten, left a trail of unanswered questions and a significant financial void. The investigation into the circumstances surrounding the loss of over $190 million in customer funds was a complex process involving various stakeholders, legal procedures, and ultimately, some degree of uncertainty regarding the full extent of the losses.The investigation was multifaceted, aiming to determine the exact nature of the missing funds, the extent of Cotten’s involvement, and potential legal liabilities.

Understanding the process and the legal ramifications is critical for both investors and the broader cryptocurrency industry.

Key Figures Involved in the Investigation

The investigation involved various parties, including representatives from the Canadian regulatory bodies, law enforcement agencies, and possibly forensic accountants. Their roles and responsibilities were crucial to piecing together the events surrounding the loss of funds.

Investigation Procedures and Strategies

The investigation likely employed a variety of techniques, including reviewing financial records, interviewing employees and stakeholders, and potentially examining Cotten’s personal accounts. Data analysis was undoubtedly a critical aspect, involving scrutinizing transaction histories and tracing the movement of assets. This required significant resources and expertise in financial forensics and cryptocurrency analysis.

Legal Proceedings Related to the Loss

The legal proceedings likely encompassed several aspects, including civil lawsuits filed by affected investors. Such lawsuits aimed to recover lost funds or at least determine the extent of the company’s liability.

Outcome of the Investigation and Resulting Legal Actions

The outcome of the investigation, unfortunately, is not publicly available in sufficient detail. The complexities of such cases mean that details are usually kept confidential until legal proceedings are concluded. Any resulting legal actions, such as settlements or judgements, are typically also not disclosed in detail until the cases are finalized.

Findings and Conclusions of the Investigation

The final findings and conclusions of the investigation were likely detailed in reports, potentially made public in some form after the relevant legal proceedings were completed. These findings would detail the investigation’s conclusions, which may include details of how the funds were lost, and any specific actions that were taken or recommendations that were made.

Investigation Timeline

| Stage | Key Actions |

|---|---|

| Initial Report | Gathering preliminary information, identifying missing funds, and potentially issuing initial statements. |

| Financial Analysis | Reviewing financial records, conducting audits, and identifying suspicious transactions. |

| Legal Proceedings | Filing lawsuits, gathering evidence, and possibly negotiating settlements. |

| Investigation Conclusion | Presenting findings, conclusions, and recommendations. |

Impact on Cryptocurrency Industry

The QuadrigaCX collapse, a catastrophic event in the cryptocurrency world, reverberated far beyond the company’s immediate stakeholders. The incident exposed vulnerabilities in the nascent industry, prompting a reassessment of security protocols and public perception. The sheer magnitude of the loss and the mystery surrounding the founder’s death painted a troubling picture of the lack of regulation and transparency in the space.The incident highlighted the critical need for improved oversight and robust security measures within the cryptocurrency ecosystem.

The fallout forced a closer examination of the industry’s practices, ultimately shaping its future trajectory.

Public Perception of Cryptocurrency

The QuadrigaCX debacle significantly impacted public perception of cryptocurrencies. The event fostered skepticism and distrust in the space, particularly among potential investors. The lack of transparency and the sheer financial magnitude of the loss contributed to a negative narrative surrounding cryptocurrencies, pushing away some potential participants and creating a climate of caution. The loss of public confidence in QuadrigaCX extended to the broader cryptocurrency space, as many viewed the incident as indicative of the risks inherent in this relatively unregulated sector.

Changes in Regulations and Security Measures

The QuadrigaCX incident spurred calls for increased regulation and enhanced security measures in the cryptocurrency industry. Several jurisdictions began implementing stricter regulations regarding cryptocurrency exchanges and digital assets, focusing on transparency, reporting requirements, and financial oversight. The need for robust auditing procedures, more stringent KYC/AML (Know Your Customer/Anti-Money Laundering) protocols, and independent audits of exchanges became paramount. Security audits, insurance mechanisms, and stringent risk management frameworks were incorporated into industry standards.

Lessons Learned

The QuadrigaCX incident served as a crucial learning experience for the cryptocurrency industry. It highlighted the importance of robust internal controls, transparent operations, and the establishment of clear succession plans. The lack of a well-defined plan for handling such a catastrophic event, coupled with the mysterious circumstances surrounding the founder’s death, underscored the importance of financial transparency and security protocols.

The need for independent audits, verifiable asset holdings, and stringent legal frameworks was emphasized by this incident.

Security Protocols Implemented

Following the QuadrigaCX collapse, the industry adopted several new security protocols. These included enhanced due diligence procedures for new exchanges, mandatory insurance requirements for cryptocurrency holdings, and the implementation of multi-signature wallets to prevent unauthorized access to funds. The industry recognized the criticality of diversified custody solutions and establishing clear lines of accountability to protect against fraudulent activities.

Industry Response and Effect Summary

| Aspect | Industry Response | Effect |

|---|---|---|

| Public Perception | Negative shift in public confidence, increased skepticism | Reduced investor interest, cautionary approach |

| Regulations | Increased regulatory scrutiny, stricter compliance requirements | Greater transparency, improved oversight, and investor protection |

| Security Measures | Enhanced security protocols, robust auditing procedures, multi-signature wallets | Mitigation of risks, prevention of fraudulent activities |

| Lessons Learned | Emphasis on transparency, internal controls, and succession planning | Improved industry standards, greater focus on security and accountability |

User Experiences and Reactions

The collapse of QuadrigaCX left a trail of devastation for its users. The sudden disappearance of billions in cryptocurrency holdings, coupled with the founder’s mysterious death, created a maelstrom of emotions and financial hardship. Users were left grappling with the loss of their investments and the lack of clarity surrounding the situation.The experiences of QuadrigaCX users were varied and often characterized by anger, disappointment, and a profound sense of betrayal.

Many users felt abandoned and unheard, struggling to understand the extent of the financial losses and the path forward. This section details the complexities of user experiences, including the challenges faced and the limited support offered by the exchange.

User Reactions and Feedback

The loss of trust and the inability to access funds created a significant wave of negative reactions from QuadrigaCX users. Their frustrations and anger were palpable, ranging from simple expressions of disappointment to more intense feelings of betrayal. The uncertainty surrounding the missing funds and the lack of transparent communication fueled these reactions.

- Anger and Frustration: Users expressed intense anger and frustration at the lack of transparency and the apparent lack of effort to retrieve their funds. Many felt their investments were stolen and that QuadrigaCX management was not taking their concerns seriously. Examples included online forums filled with heated discussions and complaints.

- Disappointment and Betrayal: Users voiced profound disappointment at the collapse of the platform. The sudden and unexplained disappearance of funds fueled feelings of betrayal and a loss of faith in the cryptocurrency industry. This disappointment often stemmed from the initial trust placed in the exchange and the subsequent breach of that trust.

- Fear and Anxiety: The financial uncertainty caused fear and anxiety amongst users. The prospect of losing their life savings and the inability to access their funds created a sense of unease and uncertainty. This was exacerbated by the lack of timely and clear communication from the exchange.

Difficulties and Frustrations Faced by Users

Users encountered numerous difficulties in dealing with the aftermath of the QuadrigaCX incident. The lack of clear communication, the inaccessibility of their funds, and the protracted nature of the investigation added to the frustration and distress.

- Inability to Access Funds: The core difficulty for users was the inability to access their cryptocurrency holdings. This created a significant financial burden for many, particularly those who relied on the platform for investment or income.

- Lack of Transparency and Communication: The lack of transparency from QuadrigaCX management was a major source of frustration. Users felt they were left in the dark regarding the investigation and the status of their funds. This was further compounded by a lack of timely and adequate communication from the exchange.

- Protracted Investigation and Legal Proceedings: The long duration of the investigation and legal proceedings further exacerbated user frustrations. The uncertainty surrounding the timeline for resolving the situation caused anxiety and frustration, especially given the significant financial losses.

Support Provided by QuadrigaCX to Affected Users

QuadrigaCX, despite the severe crisis, made attempts to address the situation and provide support to affected users. However, these efforts were often perceived as insufficient or inadequate.

- Limited Support Mechanisms: While QuadrigaCX offered some support mechanisms, many users felt these were insufficient and ineffective. Users reported challenges in accessing the support channels, and the solutions offered did not adequately address their financial losses.

- Compensation Proposals: QuadrigaCX put forward various compensation proposals, but these often lacked clarity and were criticized by users for not fully addressing their losses. This was further complicated by differing opinions on the legitimacy and adequacy of the proposed solutions.

- Lack of Empathy and Understanding: The responses of the support team and the lack of empathy displayed towards the user’s situation were also frequently cited as issues. This further aggravated the already distressing experience for users who had suffered significant financial losses.

User Feedback Categorization

The following table summarizes the different categories of user feedback and provides examples.

| Category | Description | Example |

|---|---|---|

| Anger | Strong feelings of resentment and indignation. | “I’m furious! My life savings are gone, and they’re treating us like we’re not important.” |

| Disappointment | A feeling of sadness and dissatisfaction. | “I’m deeply disappointed in the way this whole thing has been handled. I trusted them, and now I’m left with nothing.” |

| Frustration | A feeling of irritation and annoyance. | “I’m so frustrated! There’s no clear information, and I can’t get any answers.” |

| Betrayal | A feeling of violation of trust. | “I feel completely betrayed. I invested my hard-earned money, and now it’s all gone.” |

Lessons Learned and Future Implications

The QuadrigaCX debacle serves as a stark reminder of the vulnerabilities inherent in the burgeoning cryptocurrency space. The loss of $190 million and the subsequent investigation exposed critical weaknesses in the platform’s security and governance structures, prompting crucial reflections on the industry’s future. This analysis delves into the key lessons learned, explores potential improvements, and examines the broader implications of such events.The QuadrigaCX collapse highlighted a multitude of systemic issues that extend beyond the specific platform.

The lack of transparency, inadequate security protocols, and ultimately, the absence of robust regulatory oversight created an environment ripe for exploitation. The incident underscores the urgent need for stricter regulations, enhanced security standards, and a greater emphasis on investor protection in the cryptocurrency ecosystem.

Key Lessons Learned

The QuadrigaCX incident exposed several critical flaws in the cryptocurrency landscape. The primary lesson centers on the necessity of stringent security protocols. Insufficient safeguards and a lack of robust auditing procedures allowed vulnerabilities to fester and ultimately lead to the catastrophic loss of funds. Transparency in financial reporting and governance structures is equally vital. Users need clear and verifiable information about the platform’s finances and operational procedures to maintain trust and confidence.

The recent QuadrigaCX cryptocurrency loss of $190 million, with its founder’s death and a lost password, is a truly shocking event. It highlights the serious risks involved in crypto investments, especially when coupled with the strange, sometimes-bizarre happenings in the world of pop culture. Take, for instance, Nick Carter of the Backstreet Boys, who’s apparently been busy painting for Twitter moms (check out the details here ).

The mystery surrounding the QuadrigaCX situation remains, emphasizing the critical need for robust security measures in the digital asset world.

This transparency fosters a healthy environment for investors and safeguards against potential misappropriation.

Improved Security Measures

Several improvements in security measures are imperative for preventing future incidents like QuadrigaCX. Implementing multi-signature wallets, separating funds, and regularly auditing transactions are critical steps. Employing sophisticated security protocols, such as two-factor authentication and advanced encryption techniques, is essential to mitigate the risk of unauthorized access. Furthermore, external audits conducted by independent, reputable firms can provide an additional layer of verification and assurance for users.

These practices, in conjunction with regular security assessments and incident response plans, form a comprehensive framework to prevent similar occurrences.

Regulatory Frameworks

Regulatory oversight is crucial in the cryptocurrency sector. A well-defined regulatory framework can establish clear standards for security, transparency, and consumer protection. The framework should address issues such as KYC/AML compliance, capital requirements, and reporting obligations. The framework should also include provisions for investor protection, outlining procedures for resolving disputes and compensating victims in cases of platform failures.

The establishment of such a framework would significantly enhance investor confidence and mitigate the risk of future collapses.

Importance of Robust Security Protocols

Robust security protocols are paramount for the continued growth and development of the cryptocurrency sector. These protocols should include rigorous risk assessments, regular security audits, and comprehensive incident response plans. A well-defined protocol acts as a safety net, reducing the risk of financial loss and enhancing user trust. This proactive approach to security is crucial in building a resilient and trustworthy ecosystem.

Impact on User Trust

The QuadrigaCX incident had a profound impact on user trust in cryptocurrency platforms. The collapse eroded confidence and raised concerns about the security and reliability of these platforms. To restore trust, platforms need to demonstrate unwavering commitment to security, transparency, and accountability. The incident underscores the importance of open communication, timely responses to issues, and proactive measures to prevent future crises.

A strong track record of ethical practices is essential for rebuilding user confidence.

Crucial Lessons Learned and Applications, Cryptocurrency quadrigacx loses 190 million founder died password

| Lesson Learned | Application |

|---|---|

| Importance of robust security protocols | Implementation of multi-signature wallets, regular audits, and advanced encryption. |

| Need for transparent governance | Clear financial reporting, independent audits, and investor protection mechanisms. |

| Significance of regulatory oversight | Development of clear standards for security, transparency, and consumer protection. |

| Importance of investor education | Provision of comprehensive information about risks and security measures to users. |

| Criticality of accountability | Establishing clear lines of responsibility and transparent communication during crises. |

Comparison with Other Cryptocurrency Incidents: Cryptocurrency Quadrigacx Loses 190 Million Founder Died Password

The QuadrigaCX debacle stands as a stark reminder of the vulnerabilities inherent in the cryptocurrency ecosystem. Understanding how this event compares to other significant incidents provides valuable insights into the recurring patterns and potential weaknesses within the industry. Examining similar events allows us to identify common threads and potentially mitigate future risks.Analyzing other cryptocurrency incidents offers a crucial lens through which to understand the QuadrigaCX case.

By comparing various incidents, we can identify common factors that contribute to such events, including inadequate security measures, lack of regulatory oversight, and human error. This comparison highlights the need for improved security protocols, stronger regulatory frameworks, and increased transparency within the industry.

Comparison Table of Cryptocurrency Incidents

This table provides a comparative overview of the QuadrigaCX incident alongside other significant cryptocurrency events. The table details the incident, its suspected causes, the resulting outcomes, and the lessons learned from each event. Comparing these incidents reveals common themes and helps to understand the complexities of the cryptocurrency space.

| Incident | Cause | Outcome | Lessons Learned |

|---|---|---|---|

| QuadrigaCX | Alleged misappropriation of funds, possible fraudulent activity, inadequate security measures, and lack of transparency regarding founder’s death. | Significant financial losses for investors, disruption of the cryptocurrency market, and ongoing legal battles. | Importance of robust security protocols, clear succession planning, and transparency in governance structures. Highlighting the need for user protection and investor education. |

| Mt. Gox | Security breaches, alleged mismanagement of funds, and lack of regulatory oversight. | Massive financial losses for investors, significant damage to the reputation of cryptocurrency exchanges, and ongoing legal battles. | Emphasizes the importance of secure systems, regulatory frameworks, and strong internal controls. Demonstrates the potential for large-scale disruption within the industry. |

| Binance Hack | Sophisticated hacking techniques, vulnerabilities in security protocols. | Significant financial losses, impact on user confidence, and regulatory scrutiny. | Importance of implementing advanced security measures, including multi-factor authentication and robust threat detection systems. |

| Bitfinex/Tether Controversy | Allegations of manipulating market stability, lack of transparency in financial operations. | Impact on user confidence, regulatory investigations, and questions about the legitimacy of the stablecoin Tether. | Critical need for transparency in financial reporting, stablecoin issuance, and the prevention of market manipulation. |

Common Contributing Factors

Several recurring factors contribute to cryptocurrency incidents. These factors often include insufficient security measures, inadequate regulatory frameworks, lack of transparency in operations, and human error or fraudulent activities. The absence of established legal frameworks and regulatory bodies exacerbates these issues. These commonalities underscore the need for a more comprehensive approach to risk mitigation and regulatory oversight within the cryptocurrency industry.

Regulatory Response and Future Implications

Regulatory responses to cryptocurrency incidents vary across jurisdictions. Some jurisdictions are actively developing regulatory frameworks for cryptocurrencies, while others are still in the process of assessing the risks and benefits. The lack of standardized regulations across countries creates challenges for the cryptocurrency industry.The QuadrigaCX incident, along with other incidents, has prompted increased scrutiny and discussion regarding the need for enhanced regulatory frameworks.

This includes greater emphasis on transparency, security, and investor protection. The future of the cryptocurrency industry will likely be influenced by the lessons learned from these events, driving the need for stricter regulations and enhanced investor protections.

Final Conclusion

The QuadrigaCX incident serves as a stark reminder of the complexities and inherent risks associated with cryptocurrency investments. The investigation, though ongoing, has shed light on critical vulnerabilities and highlighted the importance of robust security protocols and transparent governance. The event underscored the need for improved regulatory frameworks and heightened investor awareness. Ultimately, the tragedy underscored a need for greater transparency, security, and responsible practices within the digital asset sector.