Credit cards interest rates and aprs everything you need to know – Credit cards interest rates and APRs: everything you need to know sets the stage for a deep dive into the world of personal finance. Understanding these crucial factors is essential for anyone carrying credit card debt. We’ll explore how interest rates and APRs are calculated, the various types available, how your credit score impacts your rates, and strategies for managing your credit card debt effectively.

This comprehensive guide will equip you with the knowledge to navigate the complexities of credit card interest and make informed decisions about your finances.

From introductory APRs to the impact of economic conditions, we’ll uncover the intricacies behind these financial tools. We’ll also look at the consequences of high-interest rates and provide resources to help you compare rates effectively. Ultimately, this guide aims to empower you to take control of your credit card debt and make smart financial choices.

Introduction to Credit Card Interest Rates and APRs: Credit Cards Interest Rates And Aprs Everything You Need To Know

Understanding credit card interest rates and APRs is crucial for responsible credit management. These figures determine the cost of borrowing, directly impacting your overall financial health. High interest rates can quickly lead to substantial debt accumulation, while lower rates allow you to repay your balance more efficiently. Knowing how these rates are calculated and the factors influencing them empowers you to make informed decisions about your credit card usage.Interest rates and APRs, while often used interchangeably, represent slightly different concepts.

Interest rates are the basic percentage charged on your outstanding balance. APRs, or Annual Percentage Rates, factor in additional fees and charges, providing a more comprehensive view of the total cost of borrowing. This difference is essential to consider when comparing various credit cards.

Factors Influencing Credit Card Interest Rates

Several key factors contribute to the interest rate assigned to a credit card. Creditworthiness, or your ability to repay a loan, is paramount. Lenders assess your credit history, payment history, and current debt levels to determine your risk profile. A strong credit history typically results in a lower interest rate. Economic conditions play a significant role as well.

During periods of high inflation, interest rates tend to rise, reflecting increased borrowing costs. The specific credit card issuer also sets the rate, considering their own operating costs and profit margins. Finally, the credit card’s features, such as rewards programs or introductory offers, can impact the rate.

Common Credit Card Interest Rate Ranges

Credit card interest rates vary considerably. These rates are influenced by numerous factors as discussed above. The table below provides a general overview of typical ranges, but these can change based on individual circumstances and market conditions.

| Credit Score Range | Estimated Interest Rate Range |

|---|---|

| Excellent (750+) | 6-12% |

| Good (700-749) | 10-16% |

| Fair (650-699) | 14-20% |

| Poor (Below 650) | 18-28% |

Note: These are approximate ranges. Actual interest rates will vary depending on individual creditworthiness and other factors.

Understanding APR Calculations

Knowing how your credit card’s Annual Percentage Rate (APR) is calculated is crucial for responsible spending. It allows you to anticipate the true cost of borrowing and make informed decisions about your purchases. This section delves into the mechanics of APR calculations, outlining the factors involved and providing real-world examples to illustrate how interest accrues.

APR Calculation Formula, Credit cards interest rates and aprs everything you need to know

The APR isn’t a fixed number; it’s a representation of the total cost of borrowing over a year. The calculation considers various factors, including the interest rate and the compounding frequency. A common formula used to calculate APR involves the interest rate and the number of compounding periods per year.

APR = (Interest Rate

Number of Compounding Periods per Year)

Components of APR Calculation

Several elements influence the APR calculation, each playing a significant role in determining the final figure. These elements include the interest rate, compounding frequency, and fees.

- Interest Rate: This is the fundamental rate used to calculate the interest charged on your balance. It’s usually expressed as a percentage and is a key indicator of the cost of borrowing.

- Compounding Frequency: This dictates how often interest is calculated and added to your balance. More frequent compounding results in more interest accruing over time.

- Fees: Certain credit cards include fees, such as annual fees, late payment fees, or cash advance fees. These fees can significantly impact the overall cost of borrowing, influencing the APR calculation.

Examples of APR Calculations

To illustrate how APR calculations work, let’s consider a few scenarios. These examples showcase different compounding frequencies and their impact on the total cost of borrowing.

- Scenario 1: A credit card with a 15% annual interest rate, compounded monthly. A $1000 balance will accrue interest at 1.25% per month (15% / 12 months). After one year, the total interest accrued will be more than $189. This is significantly more than simple interest calculation.

- Scenario 2: A credit card with a 12% annual interest rate, compounded daily. A $500 balance will accrue interest daily, resulting in a slightly higher overall cost compared to monthly compounding. The exact amount of interest will depend on the exact number of days in the year.

Interest Accrual Over Time

Interest accrual is a crucial aspect of understanding APRs. The more frequently interest is compounded, the faster your balance grows. To visualize this, consider the following example of a $1,000 balance with a 15% APR compounded monthly.

| Month | Balance | Interest Accrued |

|---|---|---|

| 1 | $1,000 | $12.50 |

| 2 | $1,012.50 | $12.66 |

| 3 | $1,025.16 | $12.81 |

As you can see, the balance grows incrementally each month, demonstrating how interest accrual works in a monthly compounding scenario. The more time that passes, the more the balance will grow, and the higher the total interest accrued will be.

Comparing APR Calculation Methods

Different credit cards use various methods to calculate APRs. Understanding these differences allows you to compare offers more effectively.

| APR Calculation Method | Description | Impact |

|---|---|---|

| Monthly Compounding | Interest is calculated and added to the balance monthly. | Results in slightly higher overall interest costs over the year compared to daily compounding. |

| Daily Compounding | Interest is calculated and added to the balance daily. | Results in higher overall interest costs over the year compared to monthly compounding. |

Types of Credit Card Interest Rates

Credit cards offer a variety of interest rates, each with its own characteristics and implications for your finances. Understanding these differences is crucial for making informed decisions about which card best suits your needs. Choosing a card with a favorable interest rate structure can significantly impact your overall cost of borrowing and help you avoid accumulating unnecessary debt.

Different Types of Interest Rates

Credit card interest rates are not a one-size-fits-all scenario. Various factors influence the specific rate you’ll pay, including your creditworthiness, the card issuer, and the terms of the card agreement. These factors often result in distinct interest rate categories, each designed to attract different types of consumers.

Introductory APRs

Introductory APRs are a common tactic used to entice new cardholders. These rates are typically lower than the standard APR and remain in effect for a specific period, often ranging from a few months to a year. This period of lower interest can be an attractive option for consumers who plan to pay off their balance quickly within that timeframe.

However, it’s essential to understand that introductory APRs are not permanent. Once the promotional period expires, your interest rate typically reverts to the standard APR, which is often significantly higher. This can lead to substantial increases in your monthly payments if you don’t pay off the balance before the promotional period ends.

Variable Interest Rates

Variable interest rates fluctuate based on market conditions and the issuer’s cost of borrowing. They are tied to a benchmark interest rate, such as the prime rate or the federal funds rate. When the benchmark rate changes, your credit card interest rate will also adjust accordingly. This means your monthly payments can change over time. This unpredictability can make budgeting and long-term financial planning more challenging.

Fixed Interest Rates

Fixed interest rates remain constant throughout the life of the credit card agreement. This stability provides a predictable payment structure, allowing consumers to budget their finances with greater certainty. The fixed rate is determined at the time of card issuance and doesn’t change regardless of market fluctuations.

Examples of Variable and Fixed Interest Rates

Variable Interest Rates Example:A credit card with a variable APR tied to the prime rate might start at 12.99% but could increase to 15.50% if the prime rate rises.Fixed Interest Rates Example:A credit card with a fixed APR of 14.99% will remain at 14.99% for the duration of the card agreement, regardless of changes in market conditions.

Comparison of Interest Rate Types

| Interest Rate Type | Description | Predictability | Potential for Change |

|---|---|---|---|

| Introductory APR | Lower APR for a limited time. | Low initially, then high. | High |

| Variable APR | Interest rate changes based on market conditions. | Low, but can increase significantly. | High |

| Fixed APR | Interest rate remains constant. | High | Low |

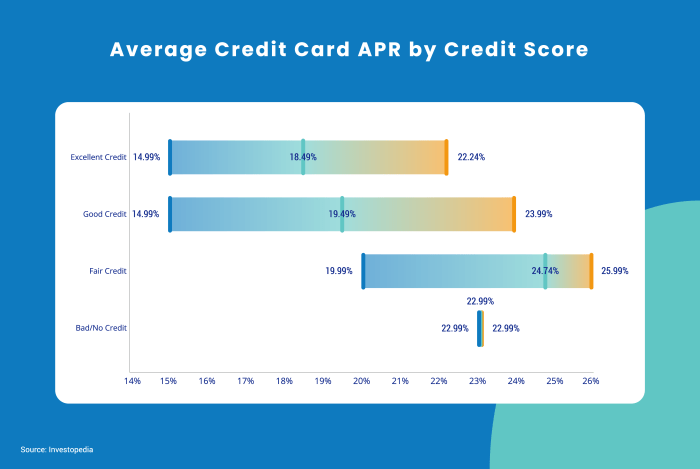

Impact of Credit Score on Interest Rates

Your credit score is a crucial factor in determining your credit card interest rate. Lenders use it to assess your creditworthiness and predict your likelihood of repaying the loan. A higher credit score generally translates to a lower interest rate, as it signifies a lower risk for the lender. This means you’ll pay less interest over the life of your loan.Credit scores are numerical representations of your credit history, reflecting your payment behavior, credit utilization, length of credit history, new credit, and types of credit.

A higher score indicates a better credit history, which lenders interpret as a lower risk. This, in turn, often leads to more favorable interest rates.

Correlation Between Credit Scores and Interest Rates

Credit scores and interest rates have a strong inverse correlation. The higher your credit score, the lower the interest rate you’re likely to receive. Lenders view higher scores as a reduced risk, justifying lower interest rates to attract customers. This is because a higher score suggests responsible financial habits and a lower probability of defaulting on a loan.

How Credit Scores Affect APRs

Your credit score directly impacts the Annual Percentage Rate (APR) you’re offered on a credit card. A higher credit score often results in a lower APR, while a lower score usually leads to a higher APR. This difference in APR can significantly impact the amount of interest you pay over the life of the loan. Lenders use sophisticated algorithms that take into account multiple factors, including your credit score, to determine the APR.

Understanding credit card interest rates and APRs is crucial for responsible spending. Knowing the details helps you avoid unnecessary debt. To keep your emails organized and accessible, you should definitely use Gmail. Its powerful search function and integrated tools make managing your inbox a breeze, freeing up time to focus on your finances. Ultimately, mastering your credit cards interest rates and APRs is key to smart financial decisions.

Examples of Different Credit Scores Affecting Interest Rates

Consider these examples:

- A borrower with a credit score of 750 might receive an APR of 15% on a credit card, while a borrower with a score of 650 might be offered an APR of 18%. The difference in interest rate translates to a substantial difference in the amount of interest paid over time, especially with larger balances.

- A borrower with a credit score of 780 might get an APR of 12%, whereas a borrower with a score of 680 could face an APR of 20%. This showcases the significant impact a higher credit score has on lowering interest rates.

- Someone with a credit score of 800+ might receive the lowest APR available for a specific credit card and loan type.

Importance of Maintaining a Good Credit Score

Maintaining a good credit score is vital for securing favorable interest rates on various financial products. It’s not just about credit cards; it affects loans, mortgages, and other types of credit. A high credit score reflects responsible financial behavior, indicating to lenders that you’re a low-risk borrower. This, in turn, allows you to access better financial opportunities and save money on interest payments.

Impact of Credit Scores on Interest Rates (Table)

| Credit Score Range | Estimated APR Range (Illustrative Example) |

|---|---|

| 750-850 | 10-15% |

| 700-749 | 12-18% |

| 650-699 | 15-22% |

| Below 650 | 20%+ |

Note: APR ranges are illustrative and may vary depending on other factors like the specific credit card issuer, credit card type, and economic conditions. These are not fixed values. A lender will use a complex algorithm that assesses multiple factors.

Factors Affecting Credit Card Interest Rates

Credit card interest rates aren’t arbitrary; they’re meticulously calculated based on a variety of factors. Understanding these factors is crucial for consumers to make informed decisions about their credit card choices and potentially negotiate better terms.

Creditworthiness

Lenders meticulously assess your creditworthiness before approving a credit card application. A key aspect of this evaluation is your credit score, a numerical representation of your credit history and borrowing habits. Higher credit scores typically indicate a lower risk for lenders, resulting in lower interest rates.

Credit History

A comprehensive credit history is vital for determining your creditworthiness. Lenders examine the length of your credit history, the types of credit accounts you hold (e.g., credit cards, loans), and the consistency of your repayment patterns. A longer, more diverse, and positive credit history often translates into more favorable interest rates.

Payment History

Consistent and timely payments are paramount in establishing a positive credit history and influencing interest rates. A flawless payment history demonstrates responsible borrowing, reducing risk for lenders and leading to more attractive interest rates. Conversely, late or missed payments can significantly increase interest rates, often drastically.

Understanding credit card interest rates and APRs is crucial for responsible financial management. While navigating the complexities of finance can be tricky, it’s also important to stay informed about other high-profile legal battles, like the Elon Musk Tesla SEC lawsuit loss consent decree Twitter situation. This case highlights the potential financial ramifications of certain business decisions.

Ultimately, knowing your credit card interest rates and APRs empowers you to make informed spending choices.

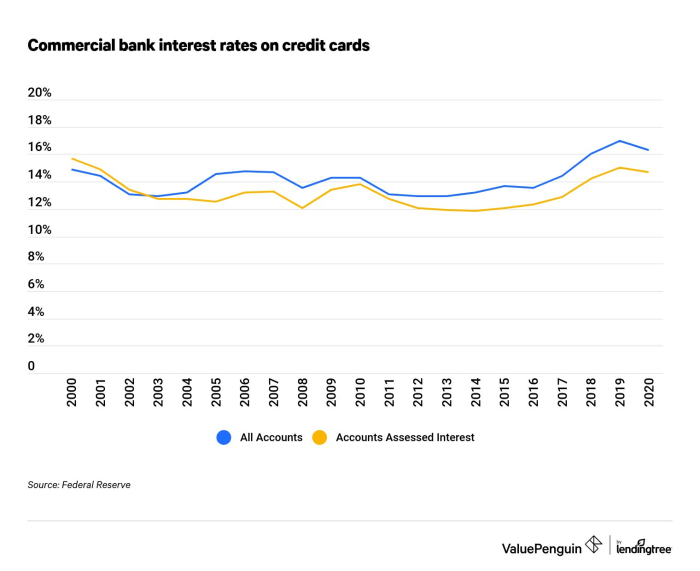

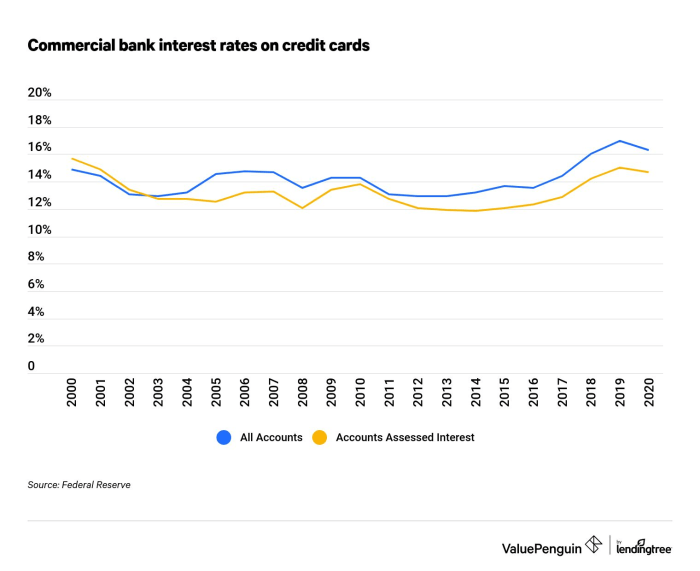

Economic Conditions and Market Trends

The broader economic climate significantly impacts credit card interest rates. Economic downturns, characterized by high unemployment and reduced consumer spending, often result in increased risk for lenders. In such situations, lenders may raise interest rates to mitigate their potential losses. Conversely, during periods of economic prosperity, rates might be lower.

Example: Economic Downturn Impact

During the 2008 financial crisis, many lenders raised credit card interest rates due to the increased risk associated with consumers’ financial instability. The fear of defaults and loan losses prompted a widespread rise in rates. Conversely, periods of strong economic growth, such as the late 1990s, often saw lower interest rates as the risk of defaults decreased.

Factors Influencing Interest Rates: A Summary

| Factor | Description |

|---|---|

| Creditworthiness | Evaluated through credit score and credit history; higher scores indicate lower risk. |

| Credit History | Length, types of credit accounts, and repayment patterns are scrutinized. |

| Payment History | Consistent timely payments demonstrate responsible borrowing. |

| Economic Conditions | Economic downturns often lead to higher interest rates due to increased risk. |

| Market Trends | Overall market conditions influence the demand for credit and lenders’ risk assessments. |

Managing Credit Card Interest Rates

Knowing your credit card interest rate and APR is crucial, but managing it effectively is equally important. A high interest rate can quickly turn a small purchase into a significant debt burden. Understanding strategies to control your rates empowers you to make informed financial decisions and keep your credit card debt manageable.

Strategies for Controlling Credit Card Interest Rates

Managing credit card interest rates involves proactive steps to keep them low and avoid unnecessary charges. These strategies are about responsible use and consistent financial discipline. It’s not about avoiding credit, but using it wisely.

Importance of On-Time Payments

Maintaining a flawless payment history is paramount for managing credit card interest rates. Consistent on-time payments demonstrate responsible financial behavior to credit card issuers. This positive record can lead to lower interest rates in the future and can improve your credit score. By making timely payments, you avoid late fees and interest charges that can significantly impact your financial health.

Late payments can negatively affect your credit score, making it harder to qualify for favorable interest rates in the future and potentially leading to a spiral of debt.

Balance Transfers: Benefits and Implications

Balance transfers can be a useful tool for managing credit card debt, but they come with specific implications. A balance transfer may temporarily lower your interest rate, offering a chance to pay down debt more quickly. However, it’s essential to carefully consider the transfer fees and the new interest rate on the transferred balance. Understanding these terms is crucial to avoiding a higher overall debt burden.

If a transfer doesn’t result in a significant reduction in interest payments or if you aren’t diligent about paying down the balance, it might be counterproductive.

Strategic Debt Repayment

Strategically paying off debt involves a calculated approach to reducing your overall interest burden. Different repayment methods can affect your interest expenses. Paying the minimum amount each month will likely lead to higher interest charges over time. Instead, consider the snowball or avalanche methods. The snowball method focuses on paying off smaller debts first, creating momentum.

The avalanche method prioritizes high-interest debts, potentially saving you more money in interest charges over the long run. Both strategies require careful planning and commitment to repayment schedules.

Tips for Managing Interest Rates Effectively

- Monitor your credit card statements closely: Regularly reviewing your statements ensures you are aware of any changes in your interest rates or fees.

- Pay more than the minimum payment: Paying more than the minimum payment reduces the total amount of interest you pay and shortens the time it takes to pay off your balance.

- Review your credit report regularly: Checking your credit report helps you identify any errors or inaccuracies that might be affecting your creditworthiness and interest rates.

- Negotiate your interest rates: Contacting your credit card issuer to negotiate a lower interest rate may be an option for those with a strong credit history and consistent payment history.

- Avoid accumulating new debt: Taking on new credit card debt when you already have existing debt can increase your overall interest burden.

Resources for Comparing Credit Card Interest Rates

Knowing your options is crucial when choosing a credit card. Comparing interest rates and annual percentage rates (APRs) across different cards is essential to finding the best deal. This empowers you to make informed decisions that save you money in the long run.

Reliable Sources for Comparing Credit Card Rates

Understanding where to find accurate and reliable information is vital for successful comparison. Numerous websites and tools specialize in providing detailed credit card comparisons. These resources often aggregate data from multiple issuers, simplifying the process of finding the best options.

Examples of Comparison Websites and Tools

Numerous websites and tools provide comprehensive credit card comparisons. These resources allow users to input their creditworthiness factors and see which cards best match their needs. Websites like NerdWallet, Bankrate, and Credit Karma frequently update their data to ensure accuracy. These sites also often offer additional insights into credit card features, rewards programs, and other factors beyond just interest rates.

Importance of Research and Comparison

Thorough research and comparison of credit card offers are vital for maximizing your financial benefits. This involves scrutinizing various aspects, including interest rates, fees, and rewards programs. By comparing different options, you can find the card that best aligns with your spending habits and financial goals.

Steps to Effectively Compare Interest Rates

Effectively comparing credit card interest rates involves a systematic approach. First, define your needs and preferences. Next, identify reputable comparison websites and use their filters to narrow your search based on criteria such as credit score, desired rewards, and spending habits. Finally, meticulously review the terms and conditions of each card to fully understand the implications of choosing a specific card.

Table of Reliable Comparison Resources

| Resource | Description |

|---|---|

| NerdWallet | A comprehensive financial website offering in-depth credit card comparisons, including interest rates, fees, and rewards. |

| Bankrate | A reputable financial resource providing comparative analysis of credit card offers, helping users find the best rates and terms. |

| Credit Karma | A popular personal finance platform that allows users to monitor their credit scores and compare credit card options based on interest rates and other factors. |

| Experian | A major credit reporting agency that offers tools and resources for comparing credit card offers, providing insights into credit scores and credit reports. |

Consequences of High-Interest Rates

High credit card interest rates can have a devastating impact on your financial well-being. These rates, often expressed as an Annual Percentage Rate (APR), significantly influence the amount you pay over the life of your debt. Understanding the consequences is crucial for making informed financial decisions and avoiding potential financial strain.High interest rates exponentially increase the total cost of borrowing.

This means that not only do you pay back the original amount borrowed, but you also pay a substantial fee for the privilege of borrowing. This extra cost can quickly spiral out of control, making it challenging to repay the debt and potentially leading to further financial difficulties.

Financial Implications of High Interest Rates

High-interest credit card rates directly translate into a larger overall debt burden. The more you owe, the more interest you accrue, creating a vicious cycle. This increased debt burden can impact your ability to save, invest, or handle unexpected expenses. The compounding effect of interest is significant; a small difference in interest rates can lead to a large difference in the total cost of borrowing over time.

Impact on Overall Debt Burden

High-interest rates exacerbate the overall debt burden. The added interest payments contribute substantially to the total amount you owe, making it harder to pay off the principal balance. This is especially true for those with already existing debts. For instance, if you have multiple debts, high-interest credit cards can make it nearly impossible to manage your financial obligations.

Effects of High-Interest Rates on Personal Finances

High-interest rates can negatively impact various aspects of your personal finances. Reduced savings, delayed investments, and a diminished ability to handle emergencies are all potential consequences. The stress of high credit card debt can also affect mental well-being and overall financial stability. Imagine having to choose between paying an urgent bill and making a minimum credit card payment.

This kind of decision can be emotionally taxing.

Scenarios of Financial Strain Due to High Interest Rates

High-interest rates can lead to financial strain in numerous scenarios. One example is when unexpected expenses arise. If a significant repair or medical bill comes up, individuals with high-interest credit cards may be forced to use their cards, which could further increase their debt burden and financial stress. Another example is when a person experiences job loss or a significant reduction in income.

Understanding credit card interest rates and APRs is crucial for responsible spending. But sometimes you’ve got gift cards lying around you’d rather turn into cash. Knowing how to sell or swap gift cards on platforms like Amazon or eBay can be a surprisingly easy way to recoup some value, especially if you’re looking for a quick way to cover your credit card bills or make extra money.

Ultimately, understanding your credit card interest rates and APRs is still paramount to smart financial management. how to sell or swap gift cards amazon ebay This knowledge empowers you to make informed decisions about your credit card use.

Without a plan to manage their debts, the high interest rates can lead to a rapid accumulation of debt and financial instability.

Table Illustrating Financial Burdens of High Interest Rates

| Scenario | Initial Loan Amount | Interest Rate (APR) | Total Interest Paid (over 5 years) | Total Amount Repaid (over 5 years) |

|---|---|---|---|---|

| Example 1 | $5,000 | 18% | $2,800 | $7,800 |

| Example 2 | $5,000 | 25% | $5,000 | $10,000 |

| Example 3 | $5,000 | 10% | $1,300 | $6,300 |

Note: These are illustrative examples and do not represent individual situations. The specific amounts will vary based on different factors such as the loan term, the interest rate, and the payment schedule. The table highlights how even a small difference in interest rates can lead to significant differences in the total cost of borrowing.

Credit Card Interest Rate FAQs

Navigating the world of credit cards can feel like deciphering a secret code, especially when it comes to interest rates. Understanding the nuances of APRs and how interest is calculated is key to making informed decisions about your spending and financial health. This section dives into frequently asked questions, common misconceptions, and practical strategies for grasping these often-confusing concepts.

Common Misconceptions About Interest Rates

Many consumers harbor misconceptions about credit card interest rates. A common myth is that a high interest rate automatically means a bad credit card. This isn’t always the case; factors beyond the rate itself, like rewards programs or fees, play a significant role in the overall value of a card. Another misconception is that interest rates are fixed.

While some cards offer fixed rates, many are variable, adjusting based on market conditions.

Strategies for Understanding Interest Rate Terms

Deciphering credit card interest rate language can be challenging. Understanding terms like Annual Percentage Rate (APR), introductory APR, and variable APR is crucial. The APR is the annual rate you’ll pay on outstanding balances. Introductory APRs are often lower rates for a limited time, but these can change after the introductory period ends. Variable APRs adjust based on external factors like the prime interest rate.

Understanding these terms empowers you to compare offers accurately and make informed decisions. A critical aspect is comprehending the difference between the stated APR and the actual interest cost. Some cards have hidden fees that contribute to the overall interest burden.

Strategies to Understand Interest Rate Calculations

Comprehending the mechanics of credit card interest calculation is vital. Interest rates aren’t just numbers; they represent a cost for borrowing. Interest accrues on the outstanding balance, and understanding the compounding nature of interest is crucial. The more you carry a balance, the more interest you accumulate. Paying off your balance as quickly as possible is a key strategy for minimizing interest charges.

Interest calculations are typically daily, and the interest rate is applied to the daily balance.

Consumer Concerns Regarding Credit Card Interest

High-interest rates can significantly impact consumers’ financial well-being. The fear of accumulating substantial debt and the difficulty of repaying it are common concerns. High interest rates can make it challenging to meet financial goals, such as saving for a down payment or paying off other debts. It’s essential to be aware of the potential consequences of high interest rates and develop strategies to mitigate the risks.

Frequently Asked Questions and Answers

| Question | Answer |

|---|---|

| What is the difference between APR and interest rate? | While often used interchangeably, APR is the annual percentage rate, encompassing all interest charges, fees, and other costs. The interest rate is the percentage applied to the outstanding balance. |

| How do I find the best credit card for my needs? | Compare various cards, considering not just the APR, but also rewards programs, fees, and other benefits. Utilize online comparison tools and read reviews. |

| Can I negotiate my credit card interest rate? | In some cases, contacting your credit card issuer might lead to a rate reduction, particularly if you have a strong credit history and demonstrate responsible credit management. |

| What are the factors that influence credit card interest rates? | Credit score, credit utilization ratio, the type of card, and economic conditions all play a part in determining your interest rate. |

| How can I lower my credit card interest rate? | Improving your credit score, reducing your credit utilization, and making consistent on-time payments are key steps. |

Closing Summary

In conclusion, understanding credit card interest rates and APRs is paramount for responsible financial management. We’ve covered everything from the fundamental definitions to the practical implications of high-interest rates. By understanding the calculations, different types, and factors influencing your rate, you’re well-equipped to make informed decisions and manage your credit card debt effectively. Armed with this knowledge, you can take control of your finances and work towards a healthier financial future.