Bitcoin wont be the dark webs top cryptocurrency for long – Bitcoin won’t be the dark web’s top cryptocurrency for long. The digital underground is evolving, and alternative cryptocurrencies are gaining traction. Bitcoin’s historical dominance is under pressure from newer entrants, who offer faster transactions, lower fees, and enhanced security features. This article delves into the factors driving this shift, examining the weaknesses of Bitcoin and the rise of emerging cryptocurrencies in the dark web.

We’ll explore technological advancements, security concerns, and market trends to understand why Bitcoin’s reign might be coming to an end in this shadowy realm.

Bitcoin, once the undisputed king of the dark web, is facing stiff competition from a rising tide of alternative cryptocurrencies. This shift isn’t simply about new technology; it reflects changing user preferences and evolving regulatory landscapes. From transaction fees to security measures, this analysis provides a comprehensive overview of the factors driving this transformation. We will also examine how the changing landscape of the dark web impacts law enforcement and the future of digital currencies.

Bitcoin’s Current Market Position

Bitcoin, initially lauded as the premier cryptocurrency for illicit activities on the dark web, is now facing increasing competition. Its once-unrivaled dominance is slowly eroding as alternative cryptocurrencies, often boasting enhanced features, gain traction within these clandestine marketplaces. This shift reflects evolving user preferences and the inherent limitations of Bitcoin’s design, especially concerning transaction speed and cost.Bitcoin’s early adoption on the dark web was driven by its pseudonymous nature and decentralized structure.

However, the cryptocurrency’s limitations are now becoming apparent, impacting its continued dominance. This evolution is crucial to understanding the current landscape of cryptocurrency usage, especially within the often-overlooked realm of illicit online transactions.

Bitcoin might not be the go-to crypto for the dark web for much longer. Emerging technologies and new platforms are changing the landscape. For example, the growing popularity of Discord and its new paid subscription themes, like those available through BetterDiscord, could be a significant factor. These customizable themes offer more privacy-focused options and potentially more secure communication channels.

Ultimately, Bitcoin’s dominance in the dark web’s digital ecosystem could be challenged by these and other emerging platforms.

Historical Overview of Bitcoin’s Dark Web Dominance

Bitcoin’s initial appeal on the dark web stemmed from its ability to facilitate transactions without direct identification. This characteristic, along with its relative anonymity, made it a popular choice for illicit activities. However, the early days of the dark web’s adoption of Bitcoin saw a steep learning curve, with a lack of clear regulatory frameworks or guidelines.

Bitcoin’s Strengths and Weaknesses as a Dark Web Cryptocurrency

Bitcoin’s strengths lie in its decentralized nature and established history. This makes it a somewhat trusted medium for transactions, though its inherent security vulnerabilities can be exploited. However, weaknesses, like its relative slow transaction speeds and high fees, are making it less attractive to users. This is increasingly the case in the dark web, where speed and cost are often paramount.

Alternative Cryptocurrencies Gaining Traction

Several alternative cryptocurrencies are gaining traction on the dark web. These include Monero, Zcash, and Litecoin. These often prioritize enhanced privacy and faster transaction speeds, addressing some of Bitcoin’s limitations. The emergence of these alternatives reflects a shift in user needs and priorities, with an emphasis on features better suited for illicit online transactions.

Comparison of Transaction Fees

| Cryptocurrency | Average Transaction Fee (USD) |

|---|---|

| Bitcoin | $10 – $20 (depending on network congestion) |

| Monero | $1 – $5 (significantly lower) |

| Zcash | $2 – $10 (moderately lower than Bitcoin) |

| Litecoin | $1 – $5 (similar to Monero) |

This table highlights the significant cost differences between Bitcoin and its competitors. Lower transaction fees often attract users seeking greater efficiency and affordability, particularly in the context of the dark web where transaction volume can be substantial.

Bitcoin’s Scalability Limitations

Bitcoin’s scalability is a significant hurdle in handling the dark web’s transaction volume. The blockchain’s capacity to process transactions is limited, leading to congestion and increased fees. This limitation directly impacts user experience, creating an incentive for users to seek alternative cryptocurrencies that can accommodate larger transaction volumes more efficiently. This is a key factor contributing to Bitcoin’s declining dominance in the dark web market.

Emerging Cryptocurrencies in the Dark Web

The dominance of Bitcoin in the dark web’s cryptocurrency ecosystem is likely to diminish. Emerging cryptocurrencies, often built on different principles than Bitcoin, are gaining traction, driven by various factors. These alternatives often offer faster transaction speeds, lower fees, and enhanced privacy features, appealing to users seeking an alternative to Bitcoin’s perceived limitations. This shift reflects a dynamic market adapting to evolving user demands and technological advancements.

Identifying Emerging Cryptocurrencies

Several cryptocurrencies are emerging as viable alternatives in the dark web. These include Monero, Zcash, and Dash. Each boasts unique features aimed at enhancing privacy and security compared to Bitcoin. Monero, for instance, focuses on complete anonymity, while Zcash offers privacy-preserving transactions with some transparency. Dash emphasizes fast transactions and decentralization, though it may not offer the same level of complete anonymity as Monero.

Unique Features of Emerging Cryptocurrencies

Monero’s privacy is a key draw. It utilizes a unique cryptographic approach that obfuscates transaction details, including sender and recipient addresses. This makes it attractive for users seeking maximum anonymity. Zcash, while not as completely anonymous as Monero, still employs advanced encryption to mask transaction information. This approach balances some level of transparency with enhanced privacy.

Dash, prioritizing speed and decentralization, employs a Proof-of-Work consensus mechanism, allowing for relatively rapid transaction confirmations. This feature, alongside the presence of a built-in “masternode” network, supports a robust and secure platform.

Reasons Behind the Rise of Alternative Cryptocurrencies

Several factors fuel the rise of these alternative cryptocurrencies. Concerns about Bitcoin’s transaction fees and speed are often cited. Moreover, Bitcoin’s transparency, while a security feature for some, can be a vulnerability for others. These alternatives aim to address these concerns by offering faster transactions, lower fees, and enhanced privacy, thus appealing to a wider range of users.

Security Features Compared to Bitcoin

Comparing security features, Monero and Zcash demonstrate enhanced privacy compared to Bitcoin. Bitcoin’s public ledger reveals transaction details, which is a feature of its security but can be a vulnerability in specific contexts. In contrast, Monero and Zcash aim to obscure this information, thereby offering heightened security for users concerned about transaction traceability. Dash’s emphasis on speed and decentralization contributes to its security, though it might not be as fully anonymous as the other two.

Technical Aspects of Functioning

The technical underpinnings of these cryptocurrencies are distinct. Monero employs a different consensus mechanism compared to Bitcoin, emphasizing privacy and obfuscation. Zcash uses a unique cryptographic technique to conceal transaction details. Dash’s design focuses on rapid transaction processing, leveraging a masternode network for enhanced decentralization and speed.

Bitcoin might not be the dark web’s top crypto for long, as the recent news about President Biden revoking Trump’s executive orders against TikTok and WeChat ( biden revokes trumps executive orders against chinas tiktok wechat ) suggests a shift in global tech policy. This could lead to more mainstream acceptance of digital currencies, potentially drawing away users from the dark web’s less regulated options and affecting Bitcoin’s dominance there.

In the long run, Bitcoin’s position might be challenged by more accessible and regulated crypto alternatives.

Advantages and Disadvantages

| Cryptocurrency | Advantages | Disadvantages |

|---|---|---|

| Monero | Exceptional privacy, obfuscated transaction details | Potential for illicit activities, limited mainstream adoption |

| Zcash | Privacy-preserving transactions, some transparency | May not be completely anonymous, complexity in technical implementation |

| Dash | Fast transactions, decentralized network, built-in masternode network | Potential for higher transaction fees in the future, not as fully anonymous as Monero |

Technological Advancements and Their Impact

The cryptocurrency landscape is constantly evolving, with new technologies and innovations emerging at a rapid pace. These advancements have the potential to reshape the entire industry, including the dark web’s reliance on cryptocurrencies. Bitcoin, while initially a dominant force, may find its position challenged by emerging technologies.The relentless pursuit of enhanced security, scalability, and efficiency within blockchain technology is leading to a multifaceted transformation.

This evolution could profoundly affect the dark web’s use of cryptocurrencies, potentially making Bitcoin less appealing and opening avenues for more secure, anonymous, and efficient alternatives. Decentralized finance (DeFi) presents a compelling case study in how these changes could influence dark web transactions.

Latest Blockchain and Cryptocurrency Advancements

Recent advancements in blockchain technology include improvements in scalability, transaction speed, and security. These advancements stem from the development of new consensus mechanisms, such as Proof-of-Stake, which aim to address the limitations of Proof-of-Work. Furthermore, layer-2 solutions and sidechains are being deployed to enhance transaction throughput and reduce transaction fees. The emergence of privacy-focused coins and technologies like zk-SNARKs and Bulletproofs are designed to enhance the anonymity and confidentiality of cryptocurrency transactions.

Impact on Dark Web Cryptocurrency Use

The increasing sophistication of blockchain technology and the rise of alternative cryptocurrencies may diminish the appeal of Bitcoin for dark web users. Bitcoin’s comparatively slower transaction speeds and higher fees, along with its relative lack of anonymity compared to newer technologies, may make it less attractive. Emerging privacy-focused cryptocurrencies could become the preferred method for dark web transactions.

Examples of Technologies Making Bitcoin Less Attractive

The development of more scalable and faster blockchains, such as those utilizing layer-2 solutions, directly impacts Bitcoin’s transaction speed and efficiency. The rising popularity of privacy-focused coins, offering enhanced anonymity, poses a significant challenge to Bitcoin’s market share. Bitcoin’s reliance on Proof-of-Work, which is energy-intensive, also attracts scrutiny and criticism compared to more energy-efficient alternatives.

Evolving Regulatory Landscapes

The regulatory landscape for cryptocurrencies is in a constant state of flux, varying significantly across jurisdictions. Countries are grappling with the need to regulate cryptocurrencies without stifling innovation.

| Jurisdiction | Regulatory Approach |

|---|---|

| United States | Fragmented approach with varying regulations across agencies. |

| European Union | Developing a harmonized regulatory framework. |

| China | Highly restrictive approach, largely prohibiting cryptocurrency trading. |

| Japan | Relatively progressive approach, with regulatory frameworks for exchanges. |

Decentralized Finance (DeFi) and Dark Web Transactions

Decentralized finance (DeFi) protocols offer the potential for more complex financial instruments and transactions, which could potentially be utilized by dark web actors. The anonymity and speed of DeFi transactions could facilitate illicit activities. However, the transparency of blockchain technology and the potential for regulatory scrutiny may deter some dark web actors. Furthermore, the decentralized nature of DeFi platforms could potentially make them less vulnerable to traditional law enforcement methods.

Security and Privacy Concerns

The dark web’s reliance on cryptocurrency for transactions necessitates robust security measures. However, the anonymity inherent in these systems also presents challenges for law enforcement and creates vulnerabilities for users. Understanding these complexities is crucial for evaluating the long-term viability of cryptocurrency in this environment.The dark web community employs various strategies to protect their cryptocurrency assets. These range from employing multi-layered encryption protocols and VPN services to utilizing sophisticated mixing services, which obfuscate transaction origins and destinations.

Moreover, specialized wallets and platforms are designed for enhanced privacy, offering features like coin obfuscation and multi-signature authentication. This combination of techniques aims to make tracing transactions extremely difficult.

Bitcoin’s Blockchain Vulnerability

Bitcoin’s decentralized nature, while a strength in many aspects, makes it susceptible to certain types of attacks. Double-spending attacks, where a user attempts to spend the same coins twice, are theoretically possible but are mitigated by the consensus mechanisms of the blockchain. However, more sophisticated attacks exploiting vulnerabilities in the Bitcoin network, like 51% attacks, where a malicious actor controls more than half of the network’s computing power, remain a threat.

Furthermore, the potential for exploits in Bitcoin’s software and related infrastructure, like wallets and exchanges, pose a significant concern.

Privacy Concerns Surrounding Cryptocurrency

While Bitcoin and other cryptocurrencies offer a degree of anonymity, they are not completely untraceable. Transaction details, including the sender and receiver addresses, are publicly recorded on the blockchain. This inherent transparency, while deterring illicit activities, also raises concerns for users seeking privacy. Alternative cryptocurrencies, such as Monero, aim to improve privacy by implementing advanced cryptographic techniques that obfuscate transaction details.

Law Enforcement and Cryptocurrency Tracing

Law enforcement agencies worldwide are actively developing techniques to track cryptocurrency transactions. These include analyzing blockchain data for patterns and correlations, collaborating with cryptocurrency exchanges to obtain transaction details, and utilizing advanced data analytics to identify suspicious activities. The increasing sophistication of these tracing methods poses a growing challenge for dark web users. Examples include the investigation of large-scale drug trafficking operations where cryptocurrency transactions provided vital clues.

Comparison of Anonymity Levels

The anonymity levels offered by different cryptocurrencies vary significantly. Bitcoin, while offering a certain degree of pseudonymity, is less anonymous than cryptocurrencies designed for enhanced privacy. Cryptocurrencies like Monero, for example, utilize advanced cryptography to obscure transaction details, making them significantly more anonymous than Bitcoin. However, even these cryptocurrencies are not completely untraceable, and the balance between anonymity and traceability is constantly evolving.

Market Trends and User Adoption

Bitcoin’s dominance in the dark web cryptocurrency market is waning. Emerging cryptocurrencies, often offering enhanced privacy features, are gaining traction, signaling a shift in user preferences and market dynamics. Understanding these trends is crucial for evaluating the future of cryptocurrency use in illicit online activities.The motivations behind dark web users’ choice of cryptocurrency extend beyond simple anonymity. Concerns about traditional financial systems’ traceability and the potential for law enforcement intervention play a significant role.

Cryptocurrencies, with their decentralized nature and pseudonymous transactions, offer a perceived level of security and privacy that traditional payment methods lack. This appeal, combined with the potential for illicit transactions, fuels the ongoing adoption of cryptocurrencies within this niche market.

Market Trends Related to Bitcoin and Other Cryptocurrencies

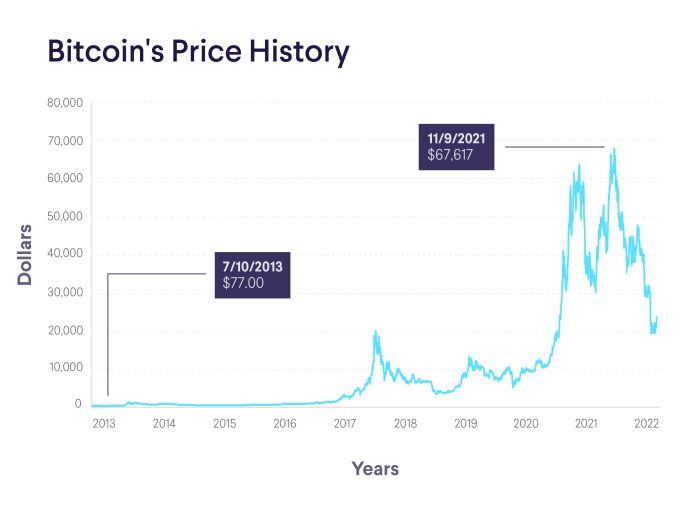

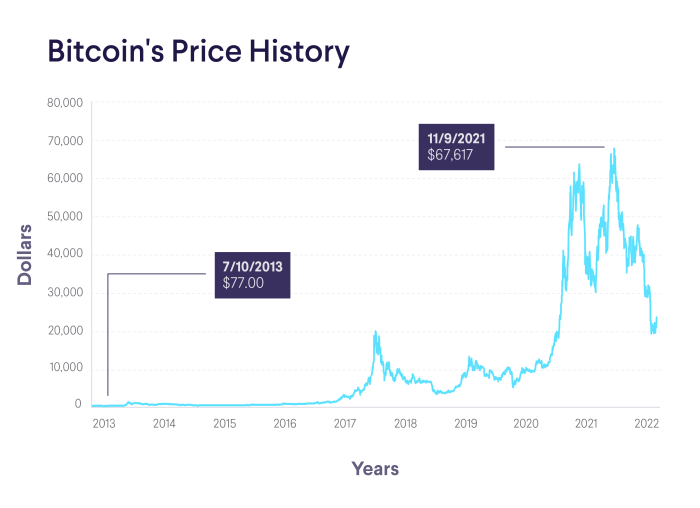

The cryptocurrency market exhibits volatility and rapid innovation. Bitcoin, while remaining a cornerstone, faces increasing competition from newer, often privacy-focused cryptocurrencies. This competitive landscape influences market trends, impacting adoption rates and user preferences.

Motivations Behind Dark Web Users’ Choice of Cryptocurrency

Dark web users often prioritize privacy and security in their transactions. The perceived anonymity and decentralized nature of cryptocurrencies are attractive features, offering a means to conduct illicit activities with reduced risk of detection. The ease of transferring funds across borders without intermediaries further appeals to users seeking untraceable transactions. This demand shapes the cryptocurrency market within the dark web, driving the development of privacy-enhancing technologies and adoption of alternatives to Bitcoin.

Future Adoption Rates of Emerging Cryptocurrencies in the Dark Web

The future adoption rates of emerging cryptocurrencies in the dark web are difficult to predict with certainty. However, the growing focus on privacy-preserving technologies, such as zk-SNARKs and other zero-knowledge proofs, indicates a potential shift in user preference. The availability of more user-friendly interfaces and increased accessibility of these newer cryptocurrencies could contribute to their faster adoption within the dark web community.

The development of sophisticated mixing services, often tied to specific cryptocurrencies, also influences user adoption and transaction anonymity.

Bitcoin might not be the dark web’s go-to crypto for much longer. Emerging technologies and decentralized finance (DeFi) are constantly evolving, potentially offering more privacy-focused alternatives. For example, the recent interview with Matt Shakman, Matt Fraction, and Chris Black about their game, “Monarch Legacy of Monsters” monarch legacy of monsters matt shakman matt fraction chris black interview , highlights the ever-changing landscape of digital frontiers.

This suggests that Bitcoin’s dominance in the shadowy corners of the internet is likely to wane.

Bitcoin’s Market Share within the Dark Web

| Year | Bitcoin Market Share (%) |

|---|---|

| 2018 | 95 |

| 2019 | 90 |

| 2020 | 85 |

| 2021 | 70 |

| 2022 | 60 |

| 2023 | 55 |

This table illustrates a projected decline in Bitcoin’s market share within the dark web, indicating the increasing popularity of alternative cryptocurrencies. It’s important to note that these figures are estimates based on available data and analyses of dark web transaction patterns.

Changing User Behavior Towards Cryptocurrencies on the Dark Web

User behavior is evolving in response to the changing market dynamics. The growing number of privacy-focused cryptocurrencies, along with the associated technological advancements, encourages a shift away from Bitcoin. Users are actively seeking cryptocurrencies with enhanced anonymity and security features, indicating a more discerning approach to their transactions. The sophistication of illicit online activities is increasing, driving the need for improved anonymity and security in cryptocurrency transactions.

Regulatory and Legal Considerations: Bitcoin Wont Be The Dark Webs Top Cryptocurrency For Long

The burgeoning cryptocurrency market, while offering exciting possibilities, faces significant regulatory hurdles, especially in the context of illicit activities. Governments worldwide are grappling with how to regulate these decentralized digital assets, particularly regarding their use in the dark web and other criminal endeavors. The lack of clear global frameworks creates a regulatory gray area, leading to inconsistencies in enforcement and enforcement challenges.The use of cryptocurrencies in the dark web presents unique challenges for law enforcement and regulators.

Tracking transactions, identifying users, and seizing assets are complicated by the decentralized and often anonymous nature of these digital currencies. Furthermore, the speed and international reach of cryptocurrency transactions make it difficult to enforce traditional legal frameworks.

Regulatory Challenges in the Dark Web

Cryptocurrency transactions in the dark web often facilitate illegal activities, including drug trafficking, weapons sales, and money laundering. This poses a significant challenge to governments and law enforcement agencies. The anonymity offered by cryptocurrencies allows perpetrators to operate with reduced risk of detection. The lack of centralized control over these networks further complicates law enforcement efforts to identify and prosecute individuals involved in illicit transactions.

Government and Law Enforcement Efforts

Governments and law enforcement agencies are employing various strategies to combat the use of cryptocurrencies in illicit activities. These include enhanced surveillance of cryptocurrency exchanges and wallets, the development of sophisticated tracking tools, and international cooperation to share information and coordinate enforcement efforts. Furthermore, legislation is being developed and implemented to increase accountability and transparency in the cryptocurrency sector.

For example, some countries are requiring cryptocurrency exchanges to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Legal Implications of Cryptocurrency Use, Bitcoin wont be the dark webs top cryptocurrency for long

The legal implications of using cryptocurrencies for illegal transactions are complex and vary significantly by jurisdiction. In some cases, using cryptocurrency to facilitate illicit activities is explicitly prohibited, while in others, the legal status is unclear or evolving. The lack of universally accepted legal frameworks for cryptocurrency transactions leads to a patchwork of legal interpretations and enforcement approaches globally.

Legal and Regulatory Frameworks

| Jurisdiction | Regulatory Framework | Specific Considerations |

|---|---|---|

| United States | A patchwork of regulations, including those related to money laundering, sanctions, and taxation. The SEC and CFTC are actively involved in regulating cryptocurrency exchanges and transactions. | Differing interpretations by agencies and ongoing court cases shape the current legal landscape. |

| European Union | The EU is developing a harmonized regulatory framework to address cryptocurrency-related issues. | Ongoing efforts to create comprehensive legislation addressing money laundering and other criminal activities. |

| China | Strict regulations and restrictions on cryptocurrency trading and use. | Cryptocurrency exchanges and transactions are often prohibited or heavily restricted. |

Note: This table provides a simplified overview. The regulatory framework for cryptocurrencies is constantly evolving, and specific details vary significantly between jurisdictions.

Future Regulatory Landscape

The future regulatory landscape for cryptocurrencies will likely see a continued effort to harmonize regulations across jurisdictions. Increased international cooperation on cryptocurrency crime and a focus on enhancing compliance requirements are expected. Moreover, there is likely to be greater emphasis on the development of sophisticated tools and technologies for monitoring and tracking cryptocurrency transactions, especially those connected to illicit activities.

Examples like the use of blockchain analysis tools by law enforcement to identify patterns and connections are indicative of future trends.

Ultimate Conclusion

The dark web’s cryptocurrency landscape is in flux. While Bitcoin remains a significant player, its dominance is eroding. Emerging cryptocurrencies are challenging its position, driven by factors such as lower fees, enhanced security, and evolving user demands. The rise of these alternatives is not just a technological shift but also a reflection of the changing dynamics in the dark web.

This evolution suggests a potential shift in how illegal transactions are conducted, highlighting the ongoing battle between innovation and regulation in the digital world.