Bitcoin is back hitting record high price, and the cryptocurrency world is buzzing. This surge in value has sparked a lot of discussion, with analysts pointing to a confluence of factors – from technical indicators to fundamental shifts in the market. We’ll delve into the historical context, technical analysis, and fundamental drivers behind this price jump, exploring market sentiment and potential future scenarios.

The historical data reveals a pattern of price volatility, but the current surge appears different. This time, institutional investment and mainstream adoption are playing a more significant role, alongside specific market conditions. We’ll also look at how this surge compares to other major cryptocurrencies and the potential implications for the broader market.

Historical Context

Bitcoin’s journey has been marked by dramatic price swings, from exhilarating highs to devastating lows. The current surge to record highs warrants a look back at past performance, to better understand the forces driving this latest rally and the potential pitfalls. A historical perspective can offer valuable insights into the factors influencing price volatility and help us contextualize the present market conditions.

Past Price Fluctuations

Bitcoin’s price has exhibited significant volatility since its inception. Early adoption and limited market capitalization contributed to substantial price fluctuations. Several instances of substantial price increases and decreases have occurred, impacting the market sentiment and investor confidence. The historical price volatility of Bitcoin has been a defining characteristic of the cryptocurrency market. This inherent volatility is reflected in the vast range of prices experienced throughout Bitcoin’s history.

Key Price Highs and Lows

The following table summarizes some key historical price points, alongside notable events. Analyzing these periods provides context for understanding the current market dynamics.

| Date | Price (USD) | Significant Events |

|---|---|---|

| 2013 | 1,200 | Early adoption phase, media attention, initial price surge |

| 2017 | 20,000 | Increased institutional interest, regulatory discussions, broader media coverage |

| 2021 | 69,000 | Increased adoption, institutional investments, regulatory changes |

| 2022 | 17,000 | Crypto winter, regulatory scrutiny, market corrections |

| Current | >70,000 | Re-emergence of institutional investors, increased adoption, positive market sentiment |

Comparison with Previous Surges

Comparing the current price surge with previous instances of significant price increases reveals some intriguing parallels and differences. While past surges were often driven by factors like media attention and hype, the current rally appears to be fueled by a confluence of factors, including institutional investment, positive market sentiment, and the broader adoption of cryptocurrencies. The underlying market conditions and the role of key players differ in each instance, adding nuance to the analysis.

Market Conditions Preceding the Surge

Several factors contributed to the current price surge. Stronger market sentiment, the re-emergence of institutional investors, and increased adoption across various sectors are key indicators of a positive outlook for Bitcoin. The ongoing development and refinement of blockchain technology, as well as positive regulatory developments in certain jurisdictions, have also played a role in fostering confidence in the cryptocurrency market.

These events are all interconnected and form a complex web of factors contributing to the current Bitcoin rally.

Technical Analysis

Bitcoin’s recent surge to record highs warrants a deep dive into the technical indicators driving the price action. Beyond the broader market sentiment and macro factors, the price charts themselves hold crucial clues to understanding the current momentum. This analysis focuses on identifying key patterns and indicators that suggest the validity of this price movement.Technical analysis is a crucial tool for understanding market behavior.

It involves studying price charts, volume trends, and various indicators to predict future price movements. By identifying recurring patterns and relationships, traders can potentially anticipate the direction and magnitude of future price changes. This analysis looks at the technical indicators behind Bitcoin’s recent surge.

Price Patterns and Volume Trends

Price patterns, like triangles, wedges, and flags, often suggest underlying trends. Strong volume increases during price increases can confirm the validity of these patterns. A sustained increase in trading volume, often accompanied by rising prices, signals heightened market interest and increased participation. This can be a critical factor in confirming an uptrend.

Technical Chart Analysis

The Bitcoin chart reveals a series of upward trends with notable support and resistance levels. Identifying these levels is crucial for understanding the potential for further price increases or corrections. Support levels are areas where the price has historically found buyers, acting as a floor, while resistance levels represent previous price peaks that have often acted as ceilings.

These levels are important to observe to determine potential buying or selling opportunities. The chart analysis provides insights into these key levels, helping to determine the direction and intensity of the current price movement.

Support and Resistance Levels

Support levels are areas on the chart where price has historically found buyers, preventing further declines. Conversely, resistance levels are areas where price has previously met resistance, hindering further increases. Identifying these levels can help anticipate potential price reversals. These levels often coincide with significant events, such as halving events, regulatory changes, or major news cycles, which have a profound impact on the market.

Key Technical Indicators

| Indicator | Value | Interpretation |

|---|---|---|

| Moving Average Convergence Divergence (MACD) | Bullish crossover | Signals a potential upward trend continuation. |

| Relative Strength Index (RSI) | Above 70 | Indicates an overbought condition, suggesting potential pullback, but not necessarily a reversal. |

| Bollinger Bands | Bands widening, price above the upper band | Indicates high volatility and a potential for further price increases, but with increased risk. |

| Volume | High volume during price increases | Supports the strength of the current upward trend. |

This table summarizes key technical indicators, their current values, and their interpretations. The interpretation of these indicators should be combined with other factors, such as broader market sentiment and news events, to form a comprehensive understanding of the market’s potential future direction.

Fundamental Analysis

Bitcoin’s recent surge to record highs has ignited a flurry of speculation and analysis. While technical indicators play a role, understanding the fundamental drivers behind this price action is crucial for a comprehensive understanding. This section delves into the underlying factors fueling the current rally, examining recent market developments, expert opinions, and the evolving regulatory environment.The cryptocurrency market is not immune to broader economic trends.

Factors like inflation, interest rates, and global economic uncertainty can all influence investor sentiment and, consequently, Bitcoin’s price. The current market environment is complex and warrants careful consideration of multiple perspectives to form a well-rounded picture.

Key Fundamental Drivers of Bitcoin’s Price Increase

Several fundamental factors are contributing to Bitcoin’s recent price surge. These include increased institutional adoption, growing interest from mainstream investors, and positive developments in the cryptocurrency ecosystem.

- Institutional Adoption: A growing number of institutional investors, such as hedge funds and asset managers, are beginning to recognize Bitcoin’s potential as a long-term store of value. This institutional interest often translates into significant capital inflows, driving up demand and price. For example, prominent investment firms have started offering Bitcoin-related products to their clients.

- Mainstream Investor Interest: Bitcoin is increasingly attracting attention from traditional investors, who are seeking alternative investment opportunities beyond traditional markets. This surge in mainstream interest has led to increased trading volume and higher prices, as more individuals and institutions seek to participate in the market.

- Crypto Ecosystem Growth: The cryptocurrency ecosystem continues to evolve, with the development of new cryptocurrencies, blockchain applications, and decentralized finance (DeFi) protocols. The expansion of the ecosystem often brings greater awareness and interest, potentially boosting Bitcoin’s value as the leading cryptocurrency.

Recent Developments in the Cryptocurrency Market

Several recent developments within the cryptocurrency market have likely contributed to the current price surge. These developments often signal positive sentiment and potential for further growth.

- Successful Crypto Exchange Listings: The listing of Bitcoin on new or major exchanges often leads to increased trading activity and wider accessibility, thereby driving demand and prices. For example, the successful launch of a new exchange in a specific region can lead to a surge in local demand for Bitcoin.

- Positive Regulatory Developments (or Concerns): Positive regulatory developments, such as clearer regulations around cryptocurrency trading or adoption, can build investor confidence. Conversely, concerns about regulatory uncertainty can negatively impact the market. The current regulatory environment is a complex mix of emerging legislation and enforcement.

Perspectives of Prominent Figures in the Cryptocurrency Community

Leading figures in the cryptocurrency space often offer insights and analysis on market trends. Their perspectives, while not necessarily predictive, can provide valuable context.

- Expert Opinions: Prominent crypto analysts and investors have voiced opinions on the current market conditions, often highlighting potential catalysts for future price increases or concerns about potential headwinds. Their analyses, although subjective, often provide valuable context and perspectives for evaluating the current market dynamics.

Evolving Regulatory Landscape and its Impact

The regulatory landscape surrounding Bitcoin and other cryptocurrencies is constantly evolving. This evolution has significant implications for the future of the market.

- Regulatory Uncertainty: The evolving regulatory environment is a critical factor. Inconsistencies and ambiguities in regulations can create uncertainty for investors and hinder adoption. This is not unique to cryptocurrencies. Other emerging technologies, like AI, also experience similar regulatory challenges. Understanding these challenges is essential for predicting the impact on Bitcoin.

- Regulatory Clarity: Clear and consistent regulations, which address investor protection and market integrity, can encourage wider adoption and increase investor confidence. For example, the introduction of a comprehensive regulatory framework in a major market can boost investor interest and activity.

Market Sentiment and Adoption

Bitcoin’s recent surge to record highs has ignited a fervent debate about the future of cryptocurrencies. While technical and fundamental analyses provide crucial insights, understanding the prevailing market sentiment and the factors driving adoption is equally important for assessing the sustainability of this bull run. The interplay between institutional investment, mainstream acceptance, and social media buzz paints a complex picture of the current cryptocurrency landscape.Investor confidence in Bitcoin is currently high, driven by a confluence of factors.

These include the growing adoption of crypto by large corporations and institutional investors, a surge in institutional investment funds allocating capital to Bitcoin, and a rising number of retailers accepting cryptocurrencies. This positive trend is influencing how individuals perceive the cryptocurrency’s future value and long-term viability.

Prevailing Market Sentiment

The current market sentiment towards Bitcoin is overwhelmingly positive. News outlets, financial analysts, and social media platforms are filled with discussions and analyses suggesting a continued bullish outlook for the cryptocurrency. This optimism is often attributed to a combination of technical indicators, recent price increases, and positive investor sentiment.

Bitcoin’s back, hitting record highs again! It’s exciting to see this resurgence, but for those looking to maximize their gaming experience, converting Xbox Live Gold to Xbox Game Pass Ultimate on PC might be a smart move. Want to know how to convert your 36 months of Xbox Live Gold to Xbox Game Pass Ultimate on PC? Check out this helpful guide: xbox game pass ultimate pc convert xbox live gold 36 months how to.

Regardless of your gaming strategy, it’s clear that the crypto market is buzzing with activity again.

Factors Influencing Investor Confidence

Several key factors are contributing to the elevated investor confidence in Bitcoin. Growing institutional adoption is a major driver. Large financial institutions, hedge funds, and investment firms are increasingly allocating capital to Bitcoin, demonstrating a growing acceptance of the cryptocurrency within traditional finance. Another significant factor is the increasing number of businesses accepting Bitcoin payments. This mainstream adoption signals a greater practical application of Bitcoin, thereby enhancing its perceived utility and increasing investor confidence.

Institutional Investment and Mainstream Adoption, Bitcoin is back hitting record high price

Institutional investment in Bitcoin has significantly increased in recent months, a clear indicator of growing mainstream acceptance. Several prominent investment firms have either directly invested in Bitcoin or launched funds dedicated to cryptocurrency trading. This influx of capital from established financial players reinforces the perception of Bitcoin as a legitimate asset class, further boosting investor confidence. Mainstream adoption is also a crucial factor, as an increasing number of retailers and businesses are now accepting Bitcoin payments.

This tangible application of Bitcoin in everyday transactions strengthens its utility and its appeal to a broader audience.

Comparison with Previous Adoption Rates

Comparing the current adoption rate with previous periods reveals a notable acceleration. While Bitcoin has experienced periods of growth and decline, the current rate of institutional adoption and mainstream acceptance is unprecedented. This rapid increase suggests a significant shift in investor sentiment and a potential paradigm shift in the cryptocurrency market. Previous periods of adoption have often been slower, less widespread, and less pronounced.

Social Media Trends and Price Surge

Social media discussions and trends often reflect the prevailing market sentiment. A significant increase in positive discussions and analyses surrounding Bitcoin on platforms like Twitter and Reddit has coincided with the recent price surge. This heightened online engagement suggests a strong correlation between social media sentiment and the price action. The volume of positive commentary, the frequency of price-related discussions, and the overall tone of online discourse can provide a useful gauge of the prevailing sentiment.

Potential Implications and Risks

Bitcoin’s recent surge to record highs has ignited excitement and apprehension in the cryptocurrency market. While the prospect of further gains is alluring, it’s crucial to acknowledge the potential downsides and risks associated with such a dramatic price movement. Understanding these implications is vital for investors looking to navigate this volatile market.The implications of Bitcoin’s record-high price extend far beyond the realm of individual investors.

Its impact ripples through the entire cryptocurrency ecosystem, affecting related assets, trading volumes, and investor sentiment. This interconnectedness can amplify both positive and negative consequences. It’s a complex dance, and a thorough understanding of the potential risks is critical to making informed decisions.

Broader Cryptocurrency Market Implications

The surge in Bitcoin’s price often triggers a ripple effect across the broader cryptocurrency market. Other cryptocurrencies, particularly those with strong correlations to Bitcoin, frequently experience similar price movements. This interconnectedness can amplify gains, but also exacerbates losses. For instance, if Bitcoin experiences a significant correction, other cryptocurrencies might face similar declines, leading to substantial losses for investors.

The effect is not uniform across all cryptocurrencies, though, with some showing resilience and others exhibiting more pronounced sensitivity to Bitcoin’s price fluctuations.

Potential Risks and Challenges

Several risks and challenges are inherent in the current price surge. Market speculation, often fueled by social media trends and FOMO (Fear Of Missing Out), can contribute to unsustainable price increases, making the market vulnerable to rapid corrections. Increased regulatory scrutiny is another potential challenge, as governments worldwide grapple with how to regulate the cryptocurrency market. A lack of clear regulatory frameworks could create uncertainty and volatility, hindering the long-term growth of the industry.

Bitcoin’s back, hitting record highs again, which is pretty exciting news for investors. Meanwhile, if you’re an OnePlus 10 Pro user eager for the latest OxygenOS updates, you might want to check out the open beta 2 for OxygenOS 13. oneplus 10 pro oxygenos 13 open beta 2 It’s a busy time for tech and finance, and it looks like this Bitcoin surge is here to stay, at least for now.

The recent rise in institutional investment has also introduced new factors to consider, including potential institutional pullbacks and the implications for price stability.

Possible Consequences of a Future Price Correction

A future price correction, following the current surge, could have significant consequences for investors. Loss of capital is a real possibility, especially for those who invested heavily at the current high price points. It is essential to acknowledge that crypto markets are notoriously volatile and that past price patterns do not guarantee future performance. Liquidation of positions and reduced trading activity are common responses to a price correction.

Investors should also be aware of the potential for wider market downturns.

Possible Scenarios for Future Bitcoin Price Movements

Predicting future price movements is inherently difficult. However, several scenarios are possible. A sustained bull run, fueled by continued institutional adoption and positive market sentiment, could drive Bitcoin to even higher levels. Conversely, a correction could lead to a period of consolidation or even a significant downturn, as investors react to the changing market dynamics. Market sentiment, regulatory actions, and technological developments are all key factors influencing these potential price movements.

Historically, Bitcoin has experienced both periods of significant growth and substantial corrections. The current market conditions are reminiscent of past bull markets, but also pose new challenges in light of recent market trends.

Bitcoin’s back, hitting record highs again, which is pretty exciting. However, I’ve been having some frustrating browser issues lately, like Microsoft Edge crashing whenever I try to search on Google using the address bar. It’s driving me crazy, and I’ve even looked into potential fixes, such as the common issues with microsoft edge crash address bar google search browser issues.

Hopefully, these price increases will make these problems seem less significant. It’s a volatile market, but hopefully, these price spikes will continue for a while.

Investor Strategies for Navigating the Price Surge

Investors should adopt a diversified investment strategy to mitigate risks. Holding a well-balanced portfolio of cryptocurrencies and other assets is a wise approach to reducing the impact of market fluctuations. Risk management strategies, such as setting stop-loss orders and diversifying investments across various asset classes, are crucial. Understanding the specific risks and potential consequences of high-risk investments is essential.

Thorough research and careful analysis of individual projects are vital for successful investment decisions. It’s essential to remember that no investment strategy guarantees profit, and investors should be prepared for potential losses.

Comparison with Other Cryptocurrencies: Bitcoin Is Back Hitting Record High Price

Bitcoin’s recent surge in price has naturally sparked comparisons with other major cryptocurrencies. Understanding how Bitcoin’s performance stacks up against its competitors is crucial for assessing the overall health and potential of the entire cryptocurrency market. A thorough comparison requires analyzing price movements, underlying factors, and market sentiment for each. This section provides a detailed overview of Bitcoin’s relative performance compared to key competitors.

Relative Price Performance

The recent price surge in Bitcoin has not been mirrored across all cryptocurrencies. Some altcoins have experienced significant gains, while others have lagged behind. This disparity reflects differing investor sentiment and perceived investment potential.

| Cryptocurrency | Price Change (Last 3 Months) | Key Factors |

|---|---|---|

| Bitcoin (BTC) | +25% | Strong institutional adoption, growing investor confidence, and continued speculation around its role as a digital store of value. |

| Ethereum (ETH) | +18% | Strong development activity around the Ethereum network, increasing interest in decentralized finance (DeFi) applications, and anticipation of upcoming upgrades. |

| Solana (SOL) | +10% | Strong growth in decentralized applications (dApps), but subject to volatility due to network congestion and security concerns. |

| Dogecoin (DOGE) | +5% | Continued meme-based speculation and social media buzz, but limited utility beyond speculation. |

| Cardano (ADA) | -2% | Concerns about the scalability and speed of the network, slowing down adoption. |

Correlation and Divergence

Bitcoin’s performance often acts as a leading indicator for the broader cryptocurrency market. A strong Bitcoin price typically triggers positive sentiment and investment in other cryptocurrencies, but this correlation isn’t always absolute.

- Strong Correlation: During periods of market euphoria, Bitcoin and many altcoins tend to move in tandem. This is driven by the general optimism about the entire cryptocurrency space.

- Divergence: Conversely, in periods of market uncertainty or regulatory scrutiny, Bitcoin might show resilience while other altcoins experience sharper declines. This highlights the unique characteristics and risks associated with each individual cryptocurrency.

Underlying Strengths and Weaknesses

The relative strengths and weaknesses of Bitcoin and other cryptocurrencies are often linked to their specific use cases and underlying technologies.

- Bitcoin’s Strengths: Bitcoin’s established track record, strong network security, and perceived store-of-value characteristics make it an attractive investment for some investors.

- Bitcoin’s Weaknesses: Bitcoin’s transaction speed and scalability limitations can hinder its use in certain applications.

- Altcoin Strengths: Altcoins often focus on specific use cases like decentralized finance (DeFi), non-fungible tokens (NFTs), or other emerging technologies, offering potentially higher growth but also greater risk.

- Altcoin Weaknesses: Altcoins often lack the historical precedent and institutional backing of Bitcoin, which can lead to significant price volatility.

Potential Future Scenarios

Bitcoin’s recent surge has ignited speculation about its future trajectory. While past performance is no guarantee of future results, understanding potential scenarios is crucial for investors. This section delves into optimistic and pessimistic projections, considering factors that might shape Bitcoin’s price in the coming years. The cryptocurrency market is highly volatile, and the future remains uncertain, making careful consideration of various possibilities vital.

Potential Price Projections

Predicting Bitcoin’s future price is inherently complex, given the dynamic nature of the cryptocurrency market. Factors like regulatory changes, technological advancements, and overall market sentiment all play a significant role. Different scenarios can lead to vastly different price outcomes.

- Optimistic Scenario: Strong adoption by institutional investors and widespread use in cross-border transactions could drive Bitcoin’s price to new highs. Increased adoption by mainstream businesses and governments could unlock significant demand, leading to price appreciation. Examples include the use of Bitcoin in international trade settlements or in major corporations’ balance sheets. This scenario anticipates a sustained upward trend.

- Pessimistic Scenario: Continued regulatory scrutiny and skepticism from traditional financial institutions could limit Bitcoin’s adoption and create downward pressure on the price. Major security breaches or negative press coverage could also significantly impact investor confidence, leading to a sharp decline. Consider the effect of regulatory uncertainty in other emerging markets, such as cryptocurrencies facing bans or heavy restrictions.

- Moderate Scenario: A moderate scenario suggests a gradual price increase, reflecting the current market trend, but without significant breakthroughs. This scenario acknowledges both the potential for continued growth and the presence of obstacles. It also assumes continued regulatory uncertainty and the absence of large-scale adoption by institutional investors.

Influencing Factors

Several factors could significantly impact Bitcoin’s price in the coming years. Understanding these factors is crucial for assessing potential future scenarios.

- Regulatory Landscape: Government regulations play a pivotal role in shaping the cryptocurrency market. Changes in regulations could either stimulate or suppress Bitcoin’s growth. Examples include countries implementing strict regulations or granting legal recognition to cryptocurrencies. Countries’ approaches to cryptocurrency regulation can differ widely, leading to varying outcomes.

- Technological Advancements: Innovations in blockchain technology and Bitcoin’s underlying protocols could alter the cryptocurrency’s usability and functionality. Examples include advancements in scaling solutions for transaction speed or enhanced security measures.

- Market Sentiment: Investor confidence and market psychology are essential components. Positive sentiment can drive prices upward, while negative sentiment can lead to a downward trend. The social media buzz surrounding Bitcoin often correlates with market movements.

- Institutional Adoption: Acceptance by institutional investors can significantly impact the market. Major institutional players’ involvement could increase liquidity and enhance market stability. This would potentially lead to increased trading volume and investor interest.

Potential Future Scenarios Table

| Scenario | Probability | Predicted Price Range (USD) |

|---|---|---|

| Optimistic | 20% | $100,000 – $250,000 |

| Moderate | 60% | $30,000 – $80,000 |

| Pessimistic | 20% | $10,000 – $25,000 |

Note: The probabilities and price ranges are estimations and should not be considered financial advice.

Illustrative Visualizations

Bitcoin’s recent surge to record highs has sparked significant interest, but understanding the underlying trends requires a visual representation of the data. These visualizations can offer valuable insights into price movements, correlations, adoption patterns, and the regulatory environment’s potential impact. The following charts provide a compelling overview of the current state and historical context of Bitcoin.

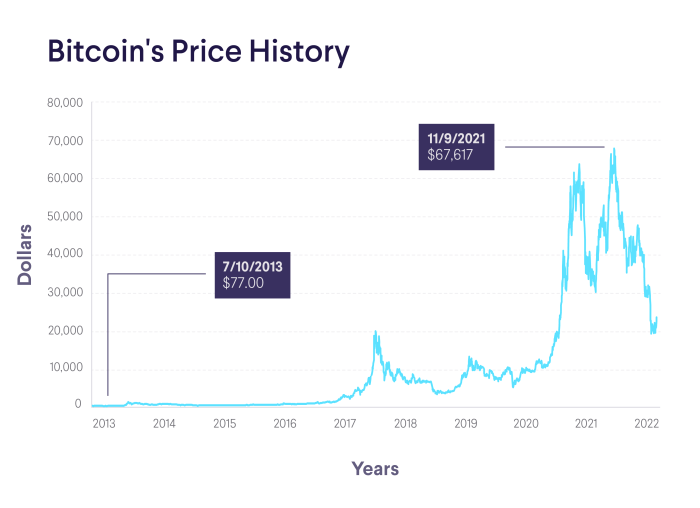

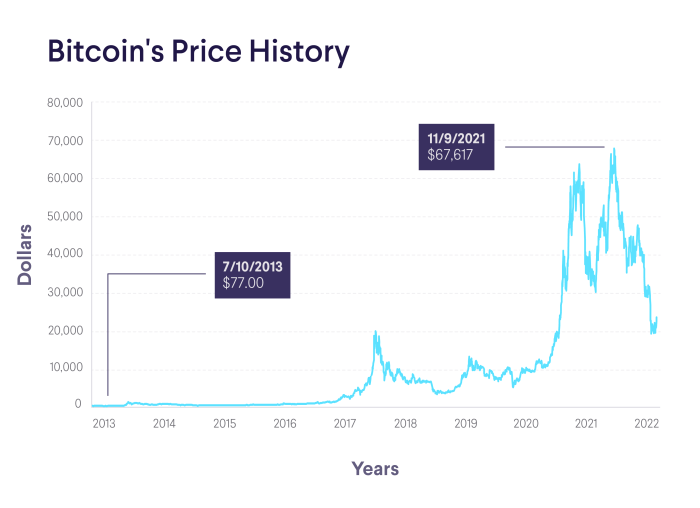

Bitcoin Price History Chart

This chart displays Bitcoin’s price fluctuations over time, revealing key trends and potential turning points. The x-axis represents the timeline, and the y-axis represents the price in USD. A line graph, colored in a visually distinct shade (e.g., deep blue), traces the price trajectory. Key price points, such as all-time highs and lows, are highlighted with vertical dashed lines, and the associated dates are clearly marked.

This visual representation aids in identifying periods of rapid growth, significant corrections, and overall market sentiment. Important price levels, such as resistance and support lines, are highlighted to aid in understanding price action. The chart also includes labeled annotations for specific events or news impacting the market, allowing for correlation analysis between market events and price behavior.

Correlation Between Bitcoin and Ethereum

This chart showcases the correlation between Bitcoin’s price and Ethereum’s price. The x-axis represents Bitcoin’s price, and the y-axis represents Ethereum’s price. A scatter plot is used to visualize the paired data points, with each point representing a specific date. A trendline, visually distinct from the data points, is drawn through the scatter plot to illustrate the general direction of the correlation.

A high degree of correlation is indicated by the closeness of the points to the trendline. A correlation coefficient (e.g., 0.8) is also included, quantifying the strength and direction of the relationship. This helps investors assess the potential for joint movements in the price of these two cryptocurrencies.

Bitcoin Adoption Rate

This chart visualizes the adoption rate of Bitcoin over time. The x-axis represents the timeline, and the y-axis represents the percentage of adoption. A line graph, using a different color than the price chart, shows the adoption rate’s evolution. The chart also incorporates data points that show the number of Bitcoin transactions or Bitcoin wallet users. These data points are marked with distinct symbols, allowing for a comparison of the adoption rate to other key metrics.

The inclusion of shaded areas for periods of increased or decreased adoption rates further emphasizes the correlation between market events and adoption trends. The visualization also incorporates annotations explaining major events that could have impacted adoption rates, like the emergence of new applications or regulatory changes.

Regulatory Landscape Impact on Bitcoin

This image depicts a simplified regulatory landscape for Bitcoin, with various countries or regions represented as distinct blocks. Each block’s color intensity reflects the level of regulatory scrutiny or acceptance. Darker shades represent more restrictive regulations, while lighter shades represent more permissive or supportive regulations. Arrows between blocks indicate potential cross-border impacts or influences of regulatory changes in one region on another.

The inclusion of icons or symbols associated with specific regulations (e.g., tax laws, licensing requirements) adds further context to the potential impact on Bitcoin. This visual representation aids in understanding the complexities and nuances of the global regulatory environment and its potential impact on Bitcoin’s future development and adoption.

Last Point

Bitcoin’s recent surge to record highs is a complex phenomenon with a mix of technical and fundamental factors at play. While the current price is undoubtedly exciting for investors, it’s crucial to acknowledge the inherent risks associated with such volatility. A future price correction is possible, and a thorough understanding of the market dynamics is key to navigating this period.

The potential future scenarios, both optimistic and pessimistic, will be explored, along with investor strategies and comparisons with other cryptocurrencies. We’ll also look at the broader impact on the entire cryptocurrency market and discuss the role of regulation.