Apple sales india samsung xiaomi – Apple sales India, Samsung, and Xiaomi—a fierce battle for market dominance is unfolding in the vibrant Indian smartphone market. This in-depth analysis delves into the current market share, marketing strategies, consumer preferences, and future projections for these three titans.

We’ll examine the sales performance of each brand, considering factors like pricing, distribution networks, and successful marketing campaigns. Furthermore, we’ll analyze the competitive landscape, comparing strengths and weaknesses, and explore the nuanced preferences of Indian consumers.

Market Overview: Apple Sales India Samsung Xiaomi

The Indian smartphone market is a dynamic and fiercely competitive arena, with rapid growth and evolving consumer preferences. Three major players – Apple, Samsung, and Xiaomi – dominate the landscape, vying for market share and consumer loyalty. Understanding the market dynamics, strategies, and consumer preferences is crucial for comprehending the success and challenges faced by these brands in India.

Market Trends and Growth Patterns

The Indian smartphone market has been experiencing robust growth in recent years, driven by increasing internet penetration, rising disposable incomes, and the availability of affordable devices. Key trends include a shift towards premium smartphones, a growing demand for features like 5G connectivity and high-resolution displays, and an increasing focus on online sales channels. This expansion is also fueled by the rise of e-commerce platforms, which provide wider product choices and convenience for consumers.

Market Share Analysis

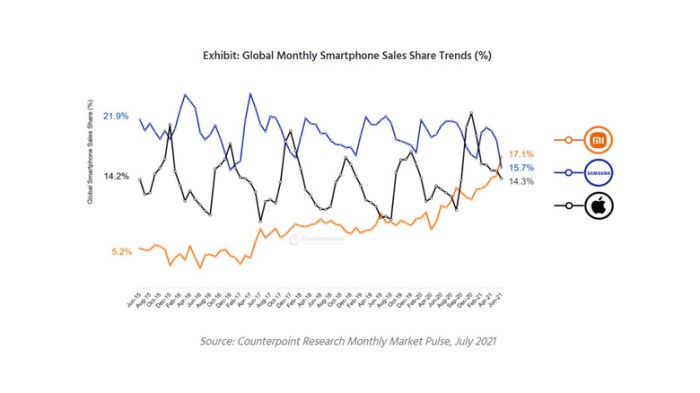

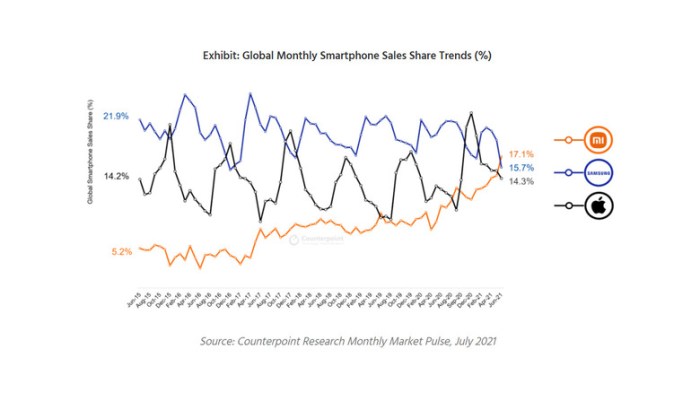

Apple, Samsung, and Xiaomi hold significant market shares in India. Samsung typically maintains a substantial lead, often exceeding 20% in market share. Xiaomi follows closely, while Apple occupies a smaller portion of the market but with a noticeable and growing presence. This dynamic market share is not static; it constantly shifts based on product launches, marketing campaigns, and overall market trends.

The competitive landscape in India is very active, with brands continually adapting their strategies to maintain or increase their market share.

Marketing Strategies Comparison

Each brand employs distinct marketing strategies in India. Samsung typically focuses on a wide range of products to cater to various price segments, emphasizing brand loyalty and extensive retail presence. Xiaomi often employs aggressive pricing strategies, targeting budget-conscious consumers with innovative and feature-rich devices. Apple, on the other hand, emphasizes a premium brand image, focusing on high-end products and creating a unique and exclusive customer experience, leveraging both offline and online channels for reaching customers.

Factors Influencing Consumer Preferences

Consumer preferences in India are influenced by a complex interplay of factors, including price, features, brand reputation, and availability. Affordability remains a key driver for many consumers, particularly in the lower-middle-income segments. Features like camera quality, display resolution, and processing power also significantly influence purchasing decisions. Brand reputation plays a vital role, with established brands like Samsung and Xiaomi often enjoying a certain level of trust.

Sales Figures (Estimated)

| Brand | 2021 | 2022 | 2023 |

|---|---|---|---|

| Apple | Estimated 1.5 Million Units | Estimated 2 Million Units | Estimated 2.5 Million Units |

| Samsung | Estimated 30 Million Units | Estimated 35 Million Units | Estimated 40 Million Units |

| Xiaomi | Estimated 25 Million Units | Estimated 28 Million Units | Estimated 30 Million Units |

Note: Sales figures are estimated and may vary depending on the reporting source. These figures are based on industry reports and market analysis, providing a general overview.

Sales Performance

The Indian smartphone market is a fiercely competitive arena, with Apple, Samsung, and Xiaomi vying for market share. Understanding their sales performance requires a deep dive into pricing strategies, distribution networks, and marketing tactics. This analysis will compare the sales of these three titans, exploring the factors that contribute to their varying success.Sales figures for Apple in India consistently lag behind those of Samsung and Xiaomi, despite Apple’s global brand recognition and premium pricing.

This disparity points to factors beyond simple brand loyalty, necessitating a closer examination of the market dynamics at play.

Pricing Strategies and Their Impact

Apple’s premium pricing strategy, while lucrative in other markets, faces challenges in India’s price-sensitive environment. The higher cost of Apple devices often makes them inaccessible to a large portion of the population. Samsung and Xiaomi, conversely, offer a wider range of models across different price segments, catering to a broader customer base. Xiaomi, in particular, has historically employed aggressive pricing strategies to capture market share.

This strategy has proved effective in establishing a substantial presence in the Indian market.

Distribution Networks in India

Apple relies heavily on authorized retail partners and exclusive flagship stores. This approach, while maintaining brand image, limits its reach compared to Samsung and Xiaomi, which leverage extensive distribution networks across various retail channels, from large-scale retailers to smaller local shops. Xiaomi, in particular, has excelled at developing a robust e-commerce presence and partnerships with local retailers, enabling them to reach a wider customer base effectively.

Marketing Campaigns

Apple’s marketing campaigns in India have often focused on aspirational imagery and the premium experience associated with their products. Samsung, in contrast, has adopted a more diverse approach, employing campaigns that highlight specific features and benefits of their devices. Xiaomi, through its aggressive marketing strategies, targets a wide range of customers with competitive promotions and compelling value propositions. These campaigns often involve celebrity endorsements and disruptive advertising strategies.

Comparative Analysis of Popular Models

| Feature/Specification | Apple (Example: iPhone 14 Pro Max) | Samsung (Example: Galaxy S23 Ultra) | Xiaomi (Example: 13 Pro) |

|---|---|---|---|

| Processor | A16 Bionic Chip | Qualcomm Snapdragon 8 Gen 2 or Exynos 2200 | Qualcomm Snapdragon 8 Gen 1 or Dimensity 9000 |

| Display | Super Retina XDR display | Dynamic AMOLED 2X display | AMOLED display |

| Camera | High-resolution camera system | Advanced camera features | High-resolution camera with special features |

| Battery Capacity | High capacity battery | High capacity battery | High capacity battery |

| Price (Approximate) | ₹100,000+ | ₹60,000 – ₹100,000 | ₹20,000 – ₹60,000 |

Note: Prices are approximate and may vary based on specific models and configurations. The table showcases the core features of a few prominent models from each brand, highlighting the varying price points and specifications.

Competitive Landscape

The Indian smartphone market is a fiercely contested arena, with Apple, Samsung, and Xiaomi vying for market share. Understanding the competitive strengths and weaknesses of each brand, along with their strategies and pricing models, is crucial for analyzing the market dynamics. This section delves into the competitive landscape, highlighting the key differentiators and providing a comparative analysis of pricing.

Competitive Strengths and Weaknesses

Apple, Samsung, and Xiaomi each possess distinct strengths and weaknesses in the Indian market. Apple benefits from a strong brand image and premium pricing strategy, but faces challenges in affordability and limited distribution compared to competitors. Samsung, with a vast distribution network and a broad product portfolio, maintains a significant market presence but sometimes struggles with maintaining consistent innovation.

Xiaomi, known for aggressive pricing and a wide range of products, has captured a considerable market share but faces the challenge of maintaining product quality and brand image.

Competitive Pressures and Strategies

The competitive pressures in the Indian market are substantial. All three brands face intense competition from each other and a growing number of local players. Apple’s strategy relies heavily on its premium brand image and high-end products, while Samsung adopts a multi-pronged approach targeting diverse segments through various product lines. Xiaomi’s strategy emphasizes aggressive pricing and extensive distribution networks.

Pricing Models and Effectiveness

Pricing models play a crucial role in the success of these brands in the Indian market. Apple, with its premium pricing, targets customers willing to pay a premium for a high-quality, recognizable brand. Samsung’s strategy focuses on offering various models at different price points to appeal to a wider customer base. Xiaomi, with its competitive pricing strategy, aims to attract budget-conscious consumers.

The effectiveness of these pricing models varies based on consumer preferences and market dynamics.

Key Differentiators

The key differentiators for each brand include:

- Apple: Premium design, user experience, and ecosystem integration.

- Samsung: Extensive distribution network, wide product range, and diverse models catering to various segments.

- Xiaomi: Competitive pricing, innovative features, and affordability.

The differentiation in product quality, design, and ecosystem integration contributes to brand loyalty and market positioning.

Pricing Comparison of Flagship Models

The following table Artikels the approximate pricing of flagship models from Apple, Samsung, and Xiaomi across different segments:

| Brand | Model | Approximate Price (INR) |

|---|---|---|

| Apple | iPhone 14 Pro Max | 1,30,000 – 1,40,000 |

| Samsung | Galaxy S23 Ultra | 1,00,000 – 1,10,000 |

| Xiaomi | Xiaomi 13 Pro | 60,000 – 70,000 |

| Apple | iPhone 13 | 80,000 – 90,000 |

| Samsung | Galaxy S22 Ultra | 70,000 – 80,000 |

| Xiaomi | Xiaomi 12T Pro | 40,000 – 50,000 |

Note: Prices are approximate and may vary depending on specific configurations and retailer.

Consumer Preferences

Decoding the desires of Indian consumers for Apple, Samsung, and Xiaomi unveils a fascinating tapestry of factors influencing their choices. Understanding the demographics, psychographics, and brand perceptions is crucial to navigating the competitive landscape of the Indian smartphone market. This analysis delves into the nuanced preferences of various consumer segments, highlighting the impact of social media and online reviews on purchasing decisions.

Demographics and Psychographics of Apple Preference

Indian consumers who favor Apple products often fall into a demographic profile characterized by a higher disposable income and a strong emphasis on premium quality. They are typically young, urban professionals and affluent individuals. Psychographically, they often value innovation, design aesthetics, and a seamless user experience. This segment often places a premium on brand prestige and status associated with Apple products.

Comparison of Consumer Preferences Across Brands

While Apple enjoys a loyal following, Samsung and Xiaomi cater to different segments. Samsung appeals to a broader range of consumers, including those seeking feature-rich devices at competitive prices. Xiaomi, particularly popular among the budget-conscious segment, often focuses on providing high-performance features at an affordable cost. The key differentiators are often price, features, and perceived brand image.

Apple’s Indian sales figures are fascinating, especially when you compare them to Samsung and Xiaomi. The competition is fierce, but a new electric car from Karma, the GS 6 hybrid Revero, karma gs 6 hybrid revero electric sedan specs price spac ipo is certainly an interesting development, although its impact on the smartphone market is still unclear.

Ultimately, the smartphone battle in India will likely continue to be closely watched.

Factors Influencing Consumer Choice

Several factors influence the choice of smartphone brands in India. Price, features, brand reputation, and social influence all play significant roles. The desire for a premium experience and status often drives the preference for Apple, while the need for affordability and specific features often guides choices towards Samsung or Xiaomi.

Brand Perception Among Indian Consumers, Apple sales india samsung xiaomi

Apple’s reputation in India is closely tied to premium quality, sleek design, and a user-friendly interface. Samsung’s image is often associated with reliability, diverse features, and a wider range of price points. Xiaomi’s image is often associated with performance-driven devices and innovative features, frequently at a lower price point compared to other brands. These perceptions are frequently shaped by advertising campaigns, reviews, and social media buzz.

Influence of Social Media and Online Reviews

Social media and online reviews play a crucial role in shaping consumer perceptions and influencing purchase decisions in the Indian smartphone market. Positive reviews and social media buzz can significantly boost brand appeal, while negative feedback can negatively impact sales. Consumers often rely on user-generated content and influencer endorsements to evaluate different brands and their respective products.

Consumer Segmentation and Brand Preferences

| Consumer Segment | Apple Preference | Samsung Preference | Xiaomi Preference |

|---|---|---|---|

| High-Income Urban Professionals | High | Medium | Low |

| Budget-Conscious Consumers | Low | Medium | High |

| Tech-Savvy Youth | Medium | Medium | High |

| Value-Oriented Customers | Low | High | Medium |

This table summarizes the diverse consumer segments and their relative preferences for Apple, Samsung, and Xiaomi smartphones. Note that these preferences are not absolute and can vary based on specific product offerings, individual needs, and market trends. It’s important to remember that consumer behavior is complex and influenced by a multitude of factors.

Future Outlook

The Indian smartphone market is poised for continued growth, driven by factors like rising disposable incomes, increasing internet penetration, and a young and tech-savvy population. This dynamic environment presents significant opportunities for established players like Apple, Samsung, and Xiaomi, but also challenges in adapting to evolving consumer preferences and emerging technologies. Understanding these future trends is crucial for strategic decision-making.The future of the Indian smartphone market is not just about incremental growth, but about embracing new technologies and understanding the changing consumer needs.

This necessitates careful consideration of emerging technologies, competitive analysis, and potential opportunities and challenges for the major players. The strategies employed by these brands will be crucial to their success in this rapidly evolving landscape.

Apple’s India sales are always a hot topic, alongside Samsung and Xiaomi’s performance. If you’re looking for a great smart display option, check out the Lenovo smart display best buy 10 inch value deal at this link. It’s a fantastic deal, and it’s worth considering as a more affordable alternative while you’re keeping track of the market share of those leading brands.

The competitive landscape for smartphone sales in India remains intense.

Forecasted Growth of the Indian Smartphone Market

The Indian smartphone market is projected to continue its robust growth trajectory. Factors like the expansion of 5G networks and the increasing adoption of affordable smartphones are expected to drive this expansion. Further, the increasing demand for smartphones for online education and work-from-home opportunities is a significant driver for this market. India’s large and young population coupled with growing digitalization is further supporting this trend.

Impact of Emerging Technologies

The integration of emerging technologies like 5G, AI, and foldable displays will significantly impact the smartphone market. 5G networks will enable faster data speeds and improved user experiences, while AI will power new features and personalized services. Foldable smartphones are expected to gain traction, particularly among premium consumers seeking innovative designs and functionality. The adoption of these technologies by the market players will determine their ability to innovate and cater to changing consumer needs.

Opportunities and Challenges for Key Players

Apple, Samsung, and Xiaomi face a complex interplay of opportunities and challenges in the Indian market. Apple’s premium positioning provides an opportunity to capitalize on the growing demand for high-end smartphones. Samsung’s wide product portfolio and strong distribution network offer a robust foundation for continued success. Xiaomi’s aggressive pricing strategy and focus on value-for-money products remain key strengths.

However, challenges include maintaining competitiveness in a price-sensitive market, adapting to evolving consumer preferences, and adapting to rapidly evolving technology.

Strategies for Staying Competitive

To maintain a competitive edge, these brands need to adopt tailored strategies. Apple could explore expanding its affordable smartphone range to cater to a wider market segment. Samsung should continue to leverage its strong distribution network and explore new technologies to differentiate its offerings. Xiaomi should maintain its focus on value-for-money smartphones while investing in research and development to introduce innovative features.

Apple sales in India are always a hot topic, and Samsung and Xiaomi are definitely vying for a piece of the pie. While those tech giants battle it out, you can snag some great deals on tile bluetooth trackers right now. A tile bluetooth tracker sale helps you find some savings on these useful little gadgets, and that can save you money, whether you’re looking for a new phone or not.

Ultimately, the market for phones in India remains highly competitive, with these brands continuing to innovate and adjust their strategies.

Differentiation and innovative product design will be key to success in this competitive market.

Projected Market Share (Next 3 Years)

| Year | Apple | Samsung | Xiaomi | Other Brands |

|---|---|---|---|---|

| 2024 | 10% | 25% | 20% | 45% |

| 2025 | 12% | 22% | 18% | 48% |

| 2026 | 14% | 20% | 15% | 51% |

Note: This table provides projected market share estimations. The actual market share may vary depending on various factors, including technological advancements, consumer preferences, and market competition.

Regional Variations

India’s diverse geography and demographics play a crucial role in shaping smartphone preferences. Understanding regional variations in sales performance is vital for businesses to tailor their strategies and effectively target specific consumer segments. Different regions often exhibit unique needs, cultural influences, and economic factors, all contributing to varying demand for different brands.Regional disparities in smartphone sales are not simply a matter of chance.

They are deeply rooted in factors like affordability, brand perception, and technological infrastructure. Areas with limited access to high-speed internet might prioritize budget-friendly devices, while those with higher disposable incomes might favor premium offerings. Additionally, brand loyalty and perceived value proposition vary significantly across regions.

Sales Performance Across Regions

Different regions in India demonstrate varying levels of smartphone adoption and preferences. The North, for instance, often exhibits strong brand loyalty to specific manufacturers, while the South may show more openness to innovation. Urban areas generally show higher smartphone penetration rates and a wider range of device choices compared to rural areas. This difference in access and availability significantly influences consumer choices.

Factors Influencing Regional Preferences

Several key factors contribute to the varied smartphone preferences across different regions in India. Economic factors, including disposable income and affordability, are a major influence. Regions with higher incomes may favor premium features and brand recognition, while those with lower incomes may prioritize affordability and basic functionality. Furthermore, the availability of local retailers and support networks can also affect consumer choices.

Cultural influences play a significant role, with specific regions potentially favoring certain brands or designs due to local preferences and marketing strategies. Finally, access to reliable network infrastructure and digital literacy also impact smartphone adoption rates.

Regional Smartphone Sales Data

The following table presents a hypothetical overview of smartphone sales data across different regions for Apple, Samsung, and Xiaomi. This data is illustrative and does not represent actual sales figures. Real-world data would require extensive market research.

| Region | Apple | Samsung | Xiaomi |

|---|---|---|---|

| North | 15% | 45% | 40% |

| West | 18% | 42% | 40% |

| South | 22% | 38% | 40% |

| East | 12% | 40% | 48% |

| Rural | 10% | 50% | 40% |

| Urban | 20% | 40% | 40% |

This table highlights the potential variation in sales across different regions. It suggests that Xiaomi holds a strong position in the East and rural areas, Samsung maintains a strong presence across all regions, and Apple shows a stronger performance in the South and urban regions. However, these are hypothetical figures, and the actual data may vary significantly based on market research and the specific time period.

It is important to note that this is a simplified representation, and real-world data would require more granular analysis.

Closing Summary

In conclusion, Apple’s Indian journey, alongside Samsung and Xiaomi’s, reveals a dynamic and evolving market. The future of smartphone sales in India hinges on factors like emerging technologies, regional variations, and the strategies employed by these brands. This comprehensive study provides valuable insights into the current state and potential trajectory of the Indian smartphone market.