The CFPB Data Brokers Fair Credit Reporting Act is a crucial piece of legislation impacting how data brokers operate and how consumers are affected. This act seeks to ensure fairness and transparency in the collection and use of consumer data, bridging the gap between outdated regulations and modern data broker practices. The Act aims to protect consumers from potential harm while simultaneously allowing responsible data brokers to function effectively.

The Consumer Financial Protection Bureau (CFPB) plays a key role in enforcing this act, regulating data brokers’ activities and scrutinizing their compliance with the Fair Credit Reporting Act (FCRA). The FCRA, while established to protect credit reports, requires adaptation to accommodate the ever-evolving landscape of data broker practices. This article delves into the complexities of this interplay, exploring the potential conflicts, and highlighting the CFPB’s efforts to ensure responsible data broker practices.

Overview of CFPB Data Brokers

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in safeguarding consumers’ financial well-being in the United States. Established in response to the 2008 financial crisis, the CFPB is tasked with overseeing various financial institutions and products, including those offered by data brokers. This oversight aims to protect consumers from unfair, deceptive, or abusive practices.Data brokers collect and compile vast amounts of personal information from diverse sources, often without consumers’ explicit knowledge or consent.

This data encompasses a wide range of details, including financial history, credit scores, employment details, and even lifestyle preferences. Data brokers then sell or share this aggregated consumer data to businesses for marketing, advertising, and other commercial purposes. This practice raises concerns about privacy and potential misuse of sensitive information.

CFPB Jurisdiction over Data Brokers

The CFPB’s authority over data brokers is rooted in its mandate to prevent unfair, deceptive, or abusive practices in consumer financial products or services. While not explicitly targeting data brokers in a dedicated section of its statutes, the CFPB can leverage existing consumer protection laws to address issues related to data collection, use, and disclosure practices by these entities.

The CFPB’s data brokers and the Fair Credit Reporting Act are all about protecting your personal information. But what happens when your internet connection suddenly slows down? Understanding when carriers start throttling you and what you can do about it is crucial. This article will help you understand those tricky situations. Ultimately, knowing your rights concerning data brokers and fair credit reporting is key to avoiding those throttled connections and protecting your digital life.

This means that the CFPB can potentially use its authority to investigate and take action against data brokers if their practices violate these existing laws.

Data Broker Practices and Data Collection

Data brokers employ various methods to amass consumer data. These methods include purchasing information from other companies, scraping data from public sources, and collecting information directly from consumers through surveys or online forms. The sheer volume and variety of data collected raise concerns about potential inaccuracies, biases, and misuse of sensitive personal information. Furthermore, consumers often lack transparency into how their data is being used and shared.

Historical Context of Data Broker Regulation

Data broker regulation in the US has evolved gradually. Early efforts focused on specific aspects of consumer protection, such as credit reporting. Over time, the increasing volume and sophistication of data broker practices have prompted a growing awareness of the need for comprehensive regulations. This evolving understanding of the potential risks associated with data broker activities has led to a call for stricter rules.

Examples include regulations that require greater transparency in how companies collect and use consumer data.

Potential Impacts on Consumers

The activities of data brokers can have significant impacts on consumers. These impacts range from targeted advertising and pricing discrimination to the potential for identity theft and fraud. For instance, inaccurate or outdated data held by data brokers could lead to consumers being denied credit or insurance, or being charged higher premiums due to misrepresented information. The lack of clear oversight or effective regulations can result in substantial risks to consumers’ financial well-being.

Fair Credit Reporting Act (FCRA) and its Relevance

The Fair Credit Reporting Act (FCRA) is a cornerstone of consumer protection in the United States, designed to safeguard individuals’ credit information and ensure responsible use by businesses. Understanding its provisions is crucial in assessing the impact of data brokers on consumers’ rights. The FCRA aims to balance the need for businesses to access information with the need to protect consumers from inaccurate or misleading data.The FCRA’s regulations significantly affect how companies collect, use, and share consumer credit information.

Its provisions are critical in evaluating how data brokers, with their unique data aggregation and sharing practices, interact with existing consumer protections. This analysis delves into the key aspects of the FCRA, comparing its current protections with the realities of modern data broker activities, and identifying potential conflicts.

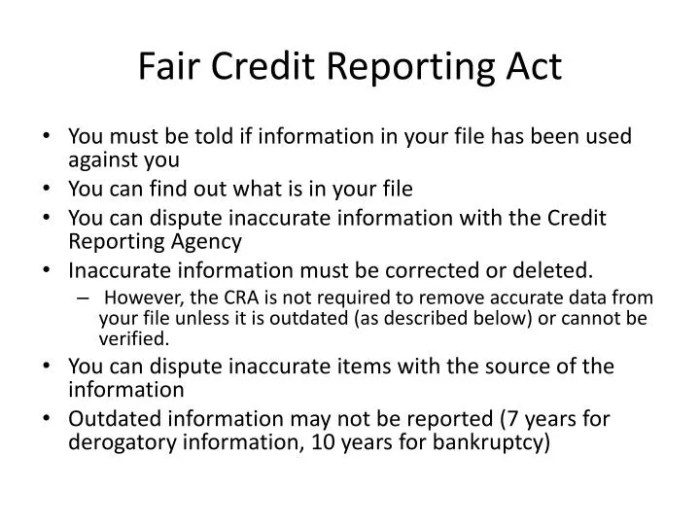

Key Provisions of the FCRA

The FCRA Artikels specific rights for consumers regarding their credit reports. These rights include access to their reports, the right to dispute inaccuracies, and the right to limit the use of their information for certain purposes. These fundamental protections are essential for ensuring consumers have control over their credit information.

- Access and Correction: Consumers have the right to obtain a copy of their credit report from each of the three major credit bureaus. This allows them to review the information and identify any inaccuracies. They can also dispute any errors, and the bureaus are obligated to investigate and correct those errors. This fundamental right is crucial in maintaining accurate credit records.

- Restrictions on Information Sharing: The FCRA places limitations on who can access a consumer’s credit report. Only authorized users, such as creditors, landlords, or employers, can obtain the report for specific purposes related to a business transaction. This protects consumers from unauthorized access and misuse of their credit information.

- Consumer Disputes: The FCRA establishes procedures for consumers to dispute inaccurate information on their credit reports. This involves notifying the credit reporting agency, providing supporting documentation, and allowing the agency time to investigate. This mechanism is vital for ensuring the accuracy and reliability of consumer credit information.

Comparison of FCRA Protections and Data Broker Practices

Modern data brokers collect and aggregate information from various sources, including public records, social media, and even consumer behavior patterns. These practices, while potentially useful for certain applications, raise concerns about the accuracy and scope of the information used and shared. This comparison assesses how well the FCRA addresses the unique data collection and sharing methods employed by modern data brokers.

- Scope of Information: The FCRA primarily focuses on traditional credit reporting, while data brokers often collect broader datasets. This difference in scope raises questions about the adequacy of the FCRA’s protections in the context of data brokers’ more extensive information gathering practices.

- Transparency and Consent: The FCRA’s focus on credit reports does not always extend to the broader information collection practices employed by data brokers. Data brokers may not always be transparent about how they collect and use consumer information, raising concerns about informed consent.

- Consumer Control: The FCRA provides mechanisms for consumers to access and dispute information on their credit reports. However, the methods for consumers to challenge or limit the use of their data collected by data brokers are often less clear and less straightforward.

Potential Conflicts and Gaps

The FCRA’s existing protections might not fully encompass the multifaceted data collection and sharing practices employed by modern data brokers. This creates potential conflicts and gaps in the legislation. The following points highlight the potential issues.

- Data Aggregation and Use: Data brokers frequently aggregate data from multiple sources, creating a complex picture of a consumer. The FCRA’s focus on individual credit reports may not adequately address the potential for misuse or misinterpretation of this aggregated information.

- Data Accuracy and Reliability: The FCRA mandates accuracy in credit reports. However, data brokers often gather information from diverse sources, potentially including inaccurate or incomplete data. The legislation may not adequately address the complexities of ensuring data accuracy in these more comprehensive datasets.

- Consumer Access to Data: The FCRA allows consumers to access their credit reports. Data brokers often do not offer a comparable mechanism for consumers to access or control the broader datasets they compile.

Addressing Consumer Rights

The FCRA addresses consumer rights by providing mechanisms for accessing, correcting, and disputing information on their credit reports. This empowers consumers to ensure the accuracy and responsible use of their credit information. These provisions aim to protect individuals from inaccurate or misleading credit information.

- Consumer Rights in the Digital Age: The FCRA’s provisions for credit reports do not directly address the broader collection and use of consumer data by data brokers. This poses a challenge in protecting consumers in the digital age where data collection practices are increasingly sophisticated.

Data Broker Practices and FCRA Compliance

Data brokers play a crucial role in the modern economy, collecting and sharing vast amounts of consumer data. However, this power comes with significant responsibilities, particularly under the Fair Credit Reporting Act (FCRA). Understanding how data brokers handle consumer information is essential for ensuring compliance and preventing harm to individuals. The FCRA mandates accuracy, fairness, and transparency in the use of consumer data.

Breaches in these areas can have serious consequences, impacting credit scores, insurance premiums, and other aspects of daily life.Data brokers must diligently ensure the accuracy and fairness of the information they collect and disseminate. Inaccurate or outdated data can lead to misrepresentation and harm, particularly in contexts where this data influences financial decisions or insurance rates. Additionally, the FCRA requires data brokers to provide consumers with access to their data and the opportunity to dispute inaccurate information.

Common Data Broker Practices and Potential FCRA Implications, Cfpb data brokers fair credit reporting act

Data brokers employ various practices to collect and analyze consumer data. These practices can raise potential FCRA compliance issues if not carefully managed. A key concern is the potential for inaccurate or outdated data, which violates the FCRA’s accuracy provisions. Another area of concern is the potential for unfair discrimination, particularly in the context of insurance information providers.

Data brokers should ensure that their data collection and analysis practices are not biased and do not result in discriminatory outcomes.

FCRA Violations by Data Brokers: Examples

Data brokers can violate the FCRA in several ways. For example, a credit reporting agency might include inaccurate information about a consumer’s credit history, leading to an incorrect credit score and potentially impacting their ability to secure loans or rent an apartment. An insurance information provider might use data to unfairly deny coverage or charge higher premiums to certain demographic groups, violating the FCRA’s nondiscrimination provisions.

Another potential violation occurs when a consumer data aggregator fails to provide consumers with access to their data or fails to resolve disputes promptly.

The CFPB’s efforts regarding data brokers and the Fair Credit Reporting Act are fascinating, especially considering the broader societal impact of data collection. It’s intriguing to see how these issues intersect with other global concerns, like celebrating World Oceans Day, and even with the innovative storytelling in current futures sci fi anthology short series world oceans day.

Ultimately, these diverse discussions all point back to the importance of responsible data handling and the need for regulations to protect consumers’ rights.

Table of Data Broker Types and Potential FCRA Implications

| Data Broker Type | Data Collected | Potential FCRA Violations | Mitigation Strategies |

|---|---|---|---|

| Credit Reporting Agency | Credit history, payment information, and public records | Inaccurate or outdated information, failure to provide access to information, unfair or discriminatory practices | Implementing robust verification procedures, employing dispute resolution mechanisms, and ensuring compliance with nondiscrimination guidelines. |

| Insurance Information Providers | Insurance claims data, medical records, and driving records | Unfair discrimination in pricing or coverage based on protected characteristics, inaccurate information leading to inappropriate risk assessment | Adhering strictly to nondiscrimination laws, verifying the accuracy of information, and using data for appropriate risk assessment |

| Consumer data aggregators | Various consumer data points from diverse sources (e.g., social media, purchase history, online activity) | Privacy violations, misuse of data, failure to provide access or correct inaccurate information, potential for unfair discrimination due to biased algorithms or incomplete data sets | Data anonymization, encryption, and secure storage practices, clear data usage policies, robust dispute resolution processes, ensuring fairness in data analysis. |

CFPB’s Approach to Data Broker Regulation

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in overseeing the activities of data brokers, ensuring fair practices and protecting consumers from potential harm. This involves monitoring compliance with the Fair Credit Reporting Act (FCRA), investigating complaints, and taking appropriate enforcement actions when necessary. Their approach reflects a commitment to safeguarding consumer data and promoting transparency in the data brokerage industry.The CFPB’s actions are not simply reactive; they aim to proactively shape the industry towards ethical and responsible data practices.

This proactive stance is vital in maintaining consumer trust and fostering a healthier financial ecosystem.

CFPB Enforcement Actions

The CFPB has taken various enforcement actions against data brokers who have violated the FCRA. These actions vary in severity and nature, reflecting the different types of violations. Understanding these actions provides valuable insight into the CFPB’s enforcement strategy and the potential consequences for non-compliance.

The CFPB’s focus on data brokers and the Fair Credit Reporting Act is crucial for consumer protection. It’s fascinating to see how these regulations impact our daily lives, and, similarly, the innovative space exploration, like the new NASA mission finalists, particularly the New Frontiers missions to Saturn’s moon Titan, and the Caesar Comet mission new nasa mission finalists new frontiers saturn titan caesar comet.

Ultimately, the responsible use of data and the future of space exploration are interconnected, and both deserve attention. The CFPB’s work in regulating data brokers will hopefully protect consumers as we explore the cosmos.

| CFPB Action | Violation Type | Impact on Data Broker | Resolution |

|---|---|---|---|

| Formal complaint | False advertising regarding the accuracy and completeness of consumer information | Negative publicity and potential loss of consumer trust, leading to decreased business opportunities. | Corrective actions, including revised marketing materials, and public disclosures of the violations. |

| Civil penalty | Unfair or deceptive acts or practices, such as failing to provide consumers with adequate notice of how their information is being collected or used. | Financial penalties that can significantly impact the data broker’s profitability. | Complying with CFPB’s directives, and often implementing improved internal policies and procedures to prevent future violations. |

| Cease and desist order | Engaging in practices that violate the FCRA, like unauthorized sharing of sensitive personal information or failing to comply with consumer rights to access and correct their information. | Prohibition from engaging in specific activities, which can cripple the data broker’s operations. | Stopping the unlawful practices and adhering to the FCRA’s provisions. |

Proposed Regulations and Guidelines

The CFPB has not publicly released formal proposed regulations specifically targeting data brokers. However, the agency has expressed intent to develop guidelines, or implement more robust enforcement, regarding data broker practices in line with the FCRA. This signifies a commitment to clarifying the rules for data brokers and setting clear expectations.

Potential Future CFPB Actions

Given the ever-evolving nature of data brokerage and the ongoing need to address consumer protection concerns, the CFPB might take future actions such as requiring more comprehensive disclosures of data collection practices or mandating stronger data security measures. The specific actions would depend on emerging trends in the data brokerage industry and the nature of any new violations or issues that come to light.

For instance, a rise in identity theft linked to data broker practices could prompt a new round of enforcement actions.

Data Broker FCRA Compliance Process

A data broker ensuring FCRA compliance must follow a multi-pronged approach. Firstly, a thorough understanding of the FCRA is essential. This involves familiarizing with the act’s provisions, particularly those related to consumer rights, and the limitations on data collection and usage.Secondly, the broker must establish internal policies and procedures that align with the FCRA. These policies should cover data collection, storage, usage, and security.

This includes outlining how the broker obtains consent, handles requests for access or correction, and safeguards consumer data from unauthorized access. A comprehensive data security program is paramount.Thirdly, regular audits and reviews of data broker operations are crucial. These reviews should evaluate the broker’s compliance with the FCRA and identify areas for improvement. This ongoing monitoring ensures that compliance efforts remain up to date and address emerging risks.Finally, a robust system for addressing consumer complaints is vital.

This involves establishing a clear process for handling complaints, ensuring prompt responses, and diligently addressing consumer concerns. A commitment to resolving issues promptly and fairly is crucial for maintaining a positive reputation and customer relationships.

Consumer Impacts and Implications

Data brokers, by collecting and sharing vast amounts of consumer information, wield significant power. Understanding the potential harms and benefits of their activities, along with the consequences of inadequate regulation, is crucial for creating a balanced and fair marketplace. This section delves into the multifaceted impact data brokers have on individual consumers.Data brokers, in their capacity to amass and utilize consumer data, can exert considerable influence on various aspects of consumers’ lives.

This includes influencing financial decisions, impacting creditworthiness, and potentially exacerbating existing inequalities. Conversely, responsible data broker practices could contribute to a more efficient and transparent marketplace.

Potential Harms of Data Broker Activities

Data brokers’ practices can create several risks for consumers. Unvetted or inaccurate information, if incorporated into credit reports or lending decisions, can lead to unfair and discriminatory outcomes. Consumers may face difficulty obtaining loans, higher interest rates, or even denial of credit opportunities.

Examples of Data Broker Influence on Lending Decisions

Data brokers compile information from various sources, such as public records, online activities, and credit history. This compiled data can influence lending decisions. For instance, if a data broker reports that a consumer frequently uses payday loans, this might be interpreted by a lender as a sign of high risk, resulting in higher interest rates or denial of a loan application.

Data Broker Practices and Credit Scores

Data brokers’ activities can impact credit scores, even if the consumer has a pristine credit history. If a data broker inaccurately reports information, such as an incorrect address or an unpaid bill, it can negatively affect a consumer’s credit score, leading to difficulty in securing loans or renting housing. Conversely, accurate and verified data could potentially strengthen a consumer’s credit profile.

Consequences of Inadequate Data Broker Regulation

Insufficient regulation of data brokers can result in the widespread misuse of consumer data, potentially leading to discrimination, financial hardship, and diminished consumer trust. The lack of transparency and accountability could further entrench existing economic disparities.

Benefits of Responsible Data Broker Practices

Responsible data broker practices can potentially offer benefits to consumers. For example, accurate and timely information from data brokers could help lenders assess risk more accurately, potentially leading to more favorable terms for qualified borrowers. A robust system for verification and correction of errors would enhance the accuracy of consumer information, preventing unfair or inaccurate judgments.

Last Point: Cfpb Data Brokers Fair Credit Reporting Act

In conclusion, the CFPB Data Brokers Fair Credit Reporting Act is a significant step toward protecting consumers from the potential harms of irresponsible data broker practices. The Act seeks to balance the needs of consumers with the legitimate operations of data brokers, and the CFPB’s ongoing efforts are critical in shaping a future where data collection and use are conducted ethically and transparently.

Understanding the potential violations and mitigation strategies is essential for both data brokers and consumers alike.