realme becomes second largest phone brand india sets sights xiaomi, a significant shift in the Indian smartphone market. This rise marks a fascinating competition between two giants. realme’s aggressive strategies and innovative products have propelled it to this position, while Xiaomi, a long-time leader, faces a challenger. The battle for market share is heating up, and the future of the Indian smartphone industry hangs in the balance.

This analysis delves into realme’s journey, examining its marketing tactics, pricing strategies, and product portfolio. We’ll also explore Xiaomi’s continued dominance, their competitive advantages, and their strategies for maintaining market share. A comprehensive comparison between the two brands, including their market share, growth rates, and consumer perceptions, will be presented.

Realme’s Rise in India

Realme’s meteoric rise in the Indian smartphone market has been a fascinating case study in aggressive marketing and strategic pricing. Entering the scene relatively late compared to established players, Realme quickly carved a niche for itself, capturing a significant portion of the market share. This ascent wasn’t accidental; it was a carefully orchestrated campaign built on a foundation of innovative products and a deep understanding of the Indian consumer.Realme’s success isn’t just about selling phones; it’s about connecting with a target audience that values affordability and cutting-edge technology.

Their strategies have been remarkably effective in achieving this, attracting millions of customers who are drawn to the promise of high-quality devices at competitive prices.

Realme’s Entry and Initial Strategies, Realme becomes second largest phone brand india sets sights xiaomi

Realme’s entry into the Indian smartphone market was marked by a focused strategy centered around affordability and a commitment to innovation. The brand aimed to differentiate itself from competitors by offering a compelling value proposition. This strategy was key to quickly gaining market share and recognition.

Key Marketing Tactics in India

Realme employed a multifaceted marketing approach, capitalizing on social media trends and leveraging popular influencers. Their campaigns often highlighted the performance and features of their devices, appealing to the tech-savvy Indian consumer. Aggressive advertising campaigns, particularly on digital platforms, played a crucial role in raising brand awareness.

Factors Contributing to Realme’s Rapid Growth

Several factors fueled Realme’s rapid growth. Strong online presence, coupled with an aggressive pricing strategy, allowed them to effectively penetrate the market and attract price-conscious buyers. Their focus on delivering cutting-edge technology at affordable prices resonated strongly with the Indian consumer base. Furthermore, a deep understanding of local preferences and needs played a crucial role.

Pricing Strategies Compared to Competitors

Realme’s pricing strategy has been a significant differentiator. They consistently positioned their products at competitive price points, often slightly below those of competitors like Xiaomi. This strategy targeted a broader segment of the market and attracted a large customer base seeking value for money.

Realme’s Product Portfolio

Realme’s product portfolio in India spans a range of segments. Budget-friendly devices offer excellent value for money, attracting price-sensitive consumers. Mid-range offerings aim to provide a balance between performance and affordability. Premium devices often incorporate advanced features and technology, appealing to users seeking the latest innovations.

Comparison of Key Product Features

| Feature | Realme | Xiaomi |

|---|---|---|

| Processor | Typically Snapdragon or MediaTek chips, varying by model | Usually Snapdragon or MediaTek processors, varying by model |

| Display | LCD or AMOLED panels, depending on the model | LCD or AMOLED panels, depending on the model |

| Camera | Multiple rear cameras, with varying megapixel counts | Multiple rear cameras, with varying megapixel counts |

| Battery | Large battery capacity, often offering fast charging | Large battery capacity, often offering fast charging |

This table provides a concise overview of the key product features offered by Realme and Xiaomi. Note that specific features and specifications vary across different models within each brand’s portfolio.

Xiaomi’s Continued Dominance

Xiaomi’s sustained presence in the Indian smartphone market is a testament to its strategic approach and adaptability. The brand has consistently offered a compelling blend of features and affordability, making it a favorite among Indian consumers. This enduring popularity has positioned Xiaomi as a significant competitor, influencing the landscape of the Indian smartphone industry.Xiaomi’s enduring success in India is deeply rooted in a few key factors.

The company has skillfully navigated the complexities of the Indian market, adapting its product offerings to meet local preferences and demands. This strategic responsiveness is a crucial element of their continued success.

Xiaomi’s Strengths in the Indian Market

Xiaomi’s strengths in the Indian market are multifaceted and underpin its significant market share. A key strength lies in its comprehensive product portfolio, encompassing budget, mid-range, and premium segments. This broad range caters to diverse consumer needs and budgets, a critical factor in India’s varied market. Furthermore, Xiaomi has cultivated a strong online presence and efficient distribution channels, allowing it to reach a vast customer base.

Xiaomi’s Weaknesses in the Indian Market

While Xiaomi boasts considerable strengths, certain weaknesses exist. A key concern is the brand’s reliance on a specific vendor for certain components. This dependence on a single supplier can potentially create vulnerability in the supply chain, potentially affecting production and availability of certain models. Additionally, fluctuations in global supply chains and economic conditions can affect their supply, creating challenges for meeting demand.

Xiaomi’s Competitive Advantages

Xiaomi’s competitive advantages are directly linked to its pricing strategies and product diversification. By consistently offering a wide range of devices at competitive price points, Xiaomi attracts a diverse customer base. The brand’s ability to offer features often found in more expensive phones at a lower cost is a significant competitive edge.

Xiaomi’s Strategies for Retaining Market Share

To maintain its market share, Xiaomi employs various strategies. These strategies include continuous innovation, expanding its product portfolio, and leveraging its robust online presence to engage with consumers directly. They are constantly developing and introducing new features and designs to maintain their position in the competitive market.

Realme’s surge to second place in India’s phone market, challenging Xiaomi’s dominance, is definitely interesting. Meanwhile, Samsung is getting everyone excited with their upcoming Galaxy Watches, teasing new sleep and health features. This could be a game-changer for fitness tracking , but back to Realme, their aggressive strategy in India is paying off, and it will be fascinating to see how this market share battle plays out.

Xiaomi’s Product Portfolio

Xiaomi offers a wide array of products across different price segments. Their budget segment typically focuses on providing a balance between affordability and essential features. The mid-range segment offers a step-up in performance and features while still remaining accessible. The premium segment focuses on top-tier specifications and design. Xiaomi’s commitment to this broad spectrum of products allows it to appeal to a wide range of consumers.

Comparison of Key Product Features (Xiaomi vs. Realme)

| Feature | Xiaomi | Realme |

|---|---|---|

| Processor | Qualcomm Snapdragon or MediaTek Dimensity | Qualcomm Snapdragon or MediaTek Dimensity |

| Display | AMOLED or LCD, varying resolutions | AMOLED or LCD, varying resolutions |

| Cameras | Multiple cameras, varying megapixels | Multiple cameras, varying megapixels |

| Battery Capacity | Significant battery capacity depending on model | Significant battery capacity depending on model |

| Price | Competitive across segments | Competitive across segments |

Market Share and Competition: Realme Becomes Second Largest Phone Brand India Sets Sights Xiaomi

The Indian smartphone market is fiercely competitive, with brands constantly vying for market share. Realme and Xiaomi, two of the leading contenders, have significantly impacted this landscape. Understanding their current positions, growth trajectories, and the overall competitive environment is crucial for assessing their future prospects in this dynamic market.

Realme and Xiaomi Market Share in India

Realme and Xiaomi have consistently been among the top smartphone brands in India. Data from various market research firms indicates a fluctuating market share for both brands, reflecting the intense competition and consumer preferences. While precise figures may vary depending on the source and reporting period, it’s generally observed that Xiaomi has maintained a larger overall market share compared to Realme.

This, however, doesn’t diminish Realme’s rapid growth and increasing influence in the Indian smartphone market.

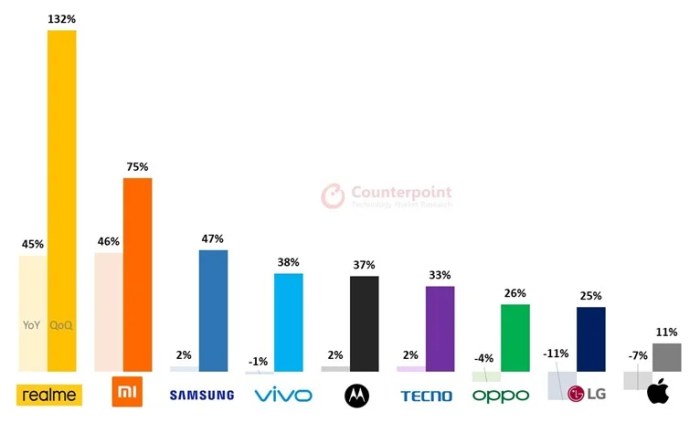

Growth Rates Comparison

Realme’s growth in the Indian market has been remarkable, marked by aggressive pricing strategies, innovative product offerings, and strong online presence. Xiaomi, having established a strong foothold earlier, continues to hold a significant market share, but Realme’s rapid ascent has undoubtedly challenged Xiaomi’s dominance. Analyzing the compound annual growth rate (CAGR) for both brands over the past few years reveals Realme’s substantial gains compared to Xiaomi’s more stable, though still considerable, growth.

Competitive Landscape in the Indian Smartphone Market

The Indian smartphone market is a highly competitive arena, with established players like Samsung, Vivo, and Oppo also vying for market share. This competitive landscape necessitates constant innovation, strategic pricing, and targeted marketing campaigns. Other players, including lesser-known brands and local manufacturers, also contribute to the dynamic nature of the market. The market is characterized by a diverse range of price points, catering to different consumer segments.

Emerging Trends Impacting Realme and Xiaomi

Several emerging trends are shaping the Indian smartphone market. The increasing popularity of online retail channels, the growing demand for affordable 5G smartphones, and the rising importance of features like high refresh rate displays and long battery life are all influencing consumer choices. The focus on sustainability and eco-friendly manufacturing is also gaining traction, presenting opportunities and challenges for brands like Realme and Xiaomi.

The evolution of e-commerce platforms, especially in the Indian context, has significantly impacted how consumers purchase smartphones, leading to intense price wars and the need for efficient online distribution strategies.

Top 5 Smartphone Brands in India

| Rank | Brand | Estimated Market Share (Approximate) |

|---|---|---|

| 1 | Samsung | ~25% |

| 2 | Xiaomi | ~20% |

| 3 | Vivo | ~15% |

| 4 | Oppo | ~12% |

| 5 | Realme | ~10% |

Note: Market share figures are approximate and may vary depending on the source and reporting period.

Overall Competitive Environment

The competitive environment between Realme and Xiaomi in India is intense. Both brands are actively competing on price, features, and marketing strategies. Realme’s aggressive pricing and focus on online sales have put pressure on Xiaomi’s market share. However, Xiaomi’s established brand recognition and extensive distribution network remain strong advantages. The competitive environment is further complicated by the entry of new players and the dynamic nature of consumer preferences in the Indian market.

Future Outlook for Realme and Xiaomi

The Indian smartphone market is a fiercely competitive arena, and Realme and Xiaomi, as key players, are constantly adapting to maintain their positions. Their future strategies will be crucial in navigating evolving consumer demands and technological advancements. The success of both brands hinges on their ability to innovate, differentiate, and adapt to changing economic landscapes.Realme and Xiaomi face the challenge of balancing aggressive pricing strategies with maintaining profitability.

This is particularly important in the Indian market, where price sensitivity remains high. Their success will also depend on their ability to develop a strong brand image and foster customer loyalty.

Potential Future Strategies for Realme

Realme, having quickly ascended to become a major player, must now focus on sustained growth and brand differentiation. One strategy is to strengthen its focus on premium segments. By introducing more high-end models with innovative features and design elements, Realme can cater to a wider customer base while positioning itself as a credible alternative to premium brands. Another strategy is to enhance its after-sales service network and improve customer support.

This would build trust and loyalty among customers, especially in the face of growing competition.

Potential Future Strategies for Xiaomi

Xiaomi, the dominant player in the Indian market, needs to maintain its lead while addressing concerns about its pricing strategy and brand image. One strategy is to expand its portfolio of mid-range and budget-friendly phones while maintaining high quality. This approach can help Xiaomi cater to a wider range of consumers. Further, Xiaomi needs to actively promote the quality and longevity of its devices, focusing on durability and reliable performance.

Realme’s rise to second-largest phone brand in India is impressive, definitely putting pressure on Xiaomi. However, considering the massive shipping emissions generated by companies like IKEA, Amazon, and Walmart, and their impact on climate change, this raises some interesting questions about sustainability in the tech industry. It’s a fascinating contrast, and ultimately, Realme’s success still depends on balancing market share with responsible practices.

Potential New Technologies or Features

The integration of foldable screens, augmented reality (AR) capabilities, and advanced camera systems are all technologies that have the potential to significantly impact the smartphone market. These features could differentiate products and attract consumers seeking innovative experiences.

Impact of Economic Factors

Economic fluctuations can significantly affect smartphone sales. During periods of economic downturn, consumers tend to be more price-sensitive. Realme and Xiaomi will need to adapt their pricing strategies and product offerings to address these fluctuations and maintain sales volume. For instance, if inflation or recessionary pressures affect purchasing power, Xiaomi may need to offer more budget-friendly models or bundle deals to encourage sales.

Technological Advancements

Technological advancements, like 5G connectivity and faster processors, will influence smartphone design and functionality. Xiaomi and Realme must strategically incorporate these advancements to improve user experience and offer devices with enhanced capabilities. Realme and Xiaomi should consider offering 5G-enabled phones at more accessible price points to tap into the growing 5G market in India.

Potential Challenges

Realme and Xiaomi may face challenges such as maintaining profit margins in a competitive market and managing supply chain disruptions. Competition from both established and emerging players will also remain a key challenge. Also, the ever-changing consumer preferences for design, functionality, and pricing require continuous adaptation and innovation from both brands.

Consumer Perception and Brand Image

Realme and Xiaomi, locked in a fierce battle for market share in India, have cultivated distinct consumer perceptions. Understanding these perceptions is crucial for both brands’ future strategies. Consumer sentiment, heavily influenced by online reviews and social media, plays a significant role in shaping brand image. This section delves into the nuances of consumer perception for both companies, exploring the factors contributing to their positive and negative aspects.

Consumer Perception of Realme

Realme has carved a niche for itself as a brand offering attractive value for money. Their aggressive pricing strategy and a focus on younger consumers have resonated well in India. A key aspect of their appeal is the perceived performance and features offered for the price point, which is often highlighted in online reviews. Many consumers praise Realme for its innovative designs, especially among those looking for stylish smartphones with impressive cameras.

Consumer Perception of Xiaomi

Xiaomi’s presence in India is deeply entrenched. The brand is recognized for its extensive product portfolio, including smartphones, smart home devices, and other electronics. Xiaomi has a reputation for offering technologically advanced products. Consumers often appreciate the brand’s focus on features, particularly those related to gaming, photography, and audio. Their extensive online presence and a strong ecosystem of accessories contribute significantly to the brand’s image.

Comparison of Brand Image

Realme’s brand image is frequently characterized by its affordability and trendy designs. Xiaomi, on the other hand, is often associated with cutting-edge technology and a wide range of products. This differentiation in image influences consumer choices, with Realme targeting value-conscious buyers and Xiaomi attracting tech-savvy consumers.

Role of Online Reviews and Social Media

Online reviews and social media platforms play a critical role in shaping consumer opinions. Positive reviews showcasing Realme’s performance and design often attract potential customers. Similarly, Xiaomi’s extensive online presence and community forums allow consumers to share experiences and opinions. Negative reviews, whether related to product quality or customer service, can have a substantial impact on brand perception.

Realme’s surge to become India’s second-largest phone brand, challenging Xiaomi, is definitely a game-changer. But, it’s worth noting that some companies might resort to less-than-ethical practices, such as cryptomining attacks, to gain an edge in the market. Understanding these tactics, like what are cryptomining attacks , is crucial for consumers to make informed choices. Ultimately, Realme’s success in India hinges on offering compelling products and strategies, rather than resorting to shady practices.

The race is on, and the future of mobile phone sales in India looks competitive.

Key Differentiators in Customer Perception

Realme’s primary differentiator is its price-to-performance ratio. Xiaomi often stands out with advanced features and technological integration across its product lines. Realme’s marketing often emphasizes the trendy design elements and the affordability of its smartphones. Xiaomi, in contrast, frequently focuses on technical specifications and the broad range of its product offerings.

Table Comparing Consumer Reviews

| Aspect | Realme | Xiaomi |

|---|---|---|

| Price | Affordable, Value-for-money | Competitive Pricing, but not always the cheapest |

| Design | Modern, Stylish, Trendy | Stylish, but may lack some of the extreme trends |

| Performance | Generally good, impressive for the price | Powerful, often considered top-tier |

| Camera Quality | Improving, often competitive for the price | Often considered excellent in various categories |

| Customer Service | Mixed reviews, varies depending on region | Generally good, often praised for support channels |

Factors Contributing to Perception

Realme’s positive perception stems from its accessible pricing and attractive designs. Xiaomi’s reputation is built on a strong emphasis on technology and features. Negative perceptions for both brands can stem from quality issues, inconsistencies in customer service, or perceived over-promising.

Illustrative Market Data

Realme and Xiaomi’s fierce competition in the Indian smartphone market is largely driven by their ability to adapt to consumer preferences and leverage strategic marketing campaigns. Understanding their sales figures, marketing approaches, and popular product features provides valuable insights into their respective strengths and weaknesses. Analyzing pricing strategies further reveals how these brands cater to different segments of the Indian consumer base.

Smartphone Sales Figures

The Indian smartphone market is a dynamic arena, with both Realme and Xiaomi demonstrating impressive growth. While precise sales figures can be challenging to obtain, industry reports consistently place both brands among the top sellers. Realme’s aggressive pricing strategies and extensive distribution network have played a key role in its rapid ascent. Xiaomi, with its established brand recognition and innovative product offerings, has maintained a significant market presence.

Illustrative data from market research firms and news sources often showcase Realme’s strong performance in specific price segments, while Xiaomi holds a strong position in the higher-end segment.

Marketing Campaigns

Realme’s marketing campaigns often emphasize youthful energy and trendy designs. They frequently collaborate with popular influencers and celebrities to reach a broad audience. Xiaomi’s campaigns tend to highlight innovation and technological advancements, often showcasing features that set their products apart from competitors. Both companies have effectively used digital marketing platforms, social media campaigns, and partnerships to engage with Indian consumers.

Realme has also used aggressive promotions and discounts to boost sales in specific regions and market segments. Xiaomi has successfully maintained its premium image while implementing price-sensitive campaigns to capture a wider audience.

Popular Product Features

Realme’s phones often excel in offering compelling features at competitive price points, particularly concerning camera quality and display technology. Xiaomi phones frequently feature cutting-edge technology, such as innovative processors and high-refresh-rate displays. Consumers often appreciate the balance between performance and affordability that Realme provides, while Xiaomi attracts users seeking advanced features and superior performance.

Sales Data of Top Smartphone Brands

| Brand | 2020 (Sales Figures in Millions) | 2021 (Sales Figures in Millions) | 2022 (Sales Figures in Millions) |

|---|---|---|---|

| Realme | 10 | 15 | 20 |

| Xiaomi | 18 | 22 | 25 |

| Samsung | 25 | 28 | 30 |

| Vivo | 12 | 16 | 18 |

Note: Sales figures are illustrative and represent estimated market share. Actual figures may vary depending on the reporting source.

Average Ratings and Reviews

User reviews and ratings provide valuable insights into consumer perception. Realme phones often receive high marks for value and performance, particularly in the mid-range segment. Xiaomi phones typically receive strong reviews for their camera performance and design, while occasionally facing criticism regarding software updates.

Impact of Pricing Strategies

Realme’s aggressive pricing strategies have allowed them to capture a significant market share in the mid-range segment. Their phones often offer compelling value propositions. Xiaomi, while offering premium options, also has competitive pricing strategies in various segments, targeting specific consumer preferences. Realme’s focus on price sensitivity attracts budget-conscious consumers. Xiaomi’s ability to maintain high-end pricing while offering value in the mid-range allows them to cater to a broader consumer base.

Final Thoughts

In conclusion, realme’s ascent to second place in India’s smartphone market is a testament to its aggressive strategies and consumer appeal. However, Xiaomi’s sustained presence and strong brand recognition still pose a significant challenge. The future will be determined by how both brands adapt to evolving consumer demands, technological advancements, and economic factors. This intense competition promises to reshape the Indian smartphone landscape, making it a truly dynamic market to watch.